Hancock Whitney (HWC) Rides on Loan Demand Amid Rising Costs

Hancock Whitney Corp. HWC is well-positioned for revenue growth due to steady loan demand, high interest rates and strategic expansion. A strong balance sheet keeps capital distribution sustainable. However, an elevated expense base and subdued mortgage banking business remain headwinds.

Hancock Whitney’s growth strategy is reflected in its revenue trajectory. The company completed the acquisition of MidSouth Bancorp in 2019, which continues to aid its financials. Revenues (tax-equivalent basis) witnessed a five-year compound annual growth rate (CAGR) of 4%. Concurrently, total loans experienced a CAGR of 3.6%.

Top-line growth is likely to be bolstered by high interest rates, decent loan demand and strategic initiatives to improve fee income. We project revenues and total loans to witness a CAGR of 2.7% and 2.1% over the three years ending 2026, respectively.

Amid high rates, HWC’s net interest margin (NIM) witnessed a rise in 2023 to 3.34% from 3.26% in 2022. However, rising funding costs weighed on NIM, and its pace of expansion came down. With the Federal Reserve expected to keep rates high in the near term, high funding costs are likely to weigh on NIM.

Nonetheless, strategic initiatives in terms of bond restructuring and balance sheet deleveraging are expected to boost NIM in the upcoming quarters. Management expects NIM to experience a modest improvement in 2024, assuming three-rate cuts, stabilizing deposit costs and growth in loan yields. We project NIM to be 3.36%, 3.40% and 3.44% in 2024, 2025 and 2026, respectively.

As of Dec 31, 2023, Hancock Whitney’s total debt stood at $1.39 billion (majorly consisting of short-term borrowings). It enjoys investment grade ratings of BBB/Baa3 and a stable outlook from Standard and Poor and Moody’s Investor Service, respectively. Hence, decent liquidity and earnings strength make the company capable of meeting its near-term debt obligations in the event of an economic downturn.

HWC’s capital distribution plans are encouraging. It announced an 11% hike in the quarterly dividend to 30 cents per share in January 2023. Prior to this, it increased its quarterly dividend by 12.5% in 2018.

Moreover, the company has an existing share repurchase plan. The plan was announced in 2023, authorizing Hancock Whitney to repurchase up to 4.3 million shares through Dec 31, 2024. As of Dec 31, 2023, the whole authorization remained available. A strong liquidity position and earnings strength are likely to help the company sustain its capital distribution plans going forward.

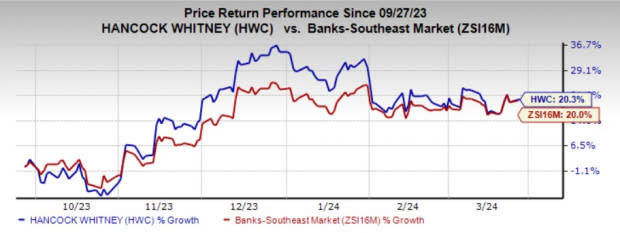

Currently, HWC carries a Zacks Rank #2 (Buy). Over the past six months, shares of Hancock Whitney have rallied 20.3%, marginally ahead of the industry’s growth of 20%.

Image Source: Zacks Investment Research

However, an uncertain outlook regarding the company’s mortgage banking business is a concern. With low mortgage rates, the company’s secondary mortgage income witnessed significant growth till 2020. Nonetheless, increased rates in 2021 resulted in the slowing down of mortgage activity, leading to a reduced mortgage income. HWC’s secondary mortgage market income recorded a negative CAGR of 38.9% over the last three years (2020-2023).

Given the delayed rate cuts signaled by the Fed, mortgage rates are expected to remain high in the near-term, in turn putting a drag on the mortgage income. We estimate secondary mortgage market income to increase only 10.9% over the next three years.

Further, Hancock Whitney’s elevated expense base remains a concern. Though expenses decreased in 2022, it witnessed a five-year CAGR of 3.2% ended 2023. While the MidSouth Bancorp acquisition led to significant cost savings, HWC’s inorganic expansion efforts, inflationary pressures and technological investments are likely to keep costs elevated. While we project total expenses to witness a decline of 1.8% this year, the metric is anticipated to rise by 4.3% in 2025.

Other Stocks Worth Considering

Some other top-ranked bank stocks are Bank7 Corp. BSVN and Popular Inc. BPOP. Each of them sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for BSVN’s current year earnings have been revised upward by 5.8% in the past 60 days. The company’s shares have rallied 22.9% over the past six months.

Estimates for BPOP’s 2024 earnings have moved 6.8% north in the past 60 days. The stock has risen 41.4% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Popular, Inc. (BPOP) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

Bank7 Corp. (BSVN) : Free Stock Analysis Report