Hanesbrands (HBI) Down More Than 15% in 6 Months: Here's Why

Hanesbrands Inc. HBI is grappling with inflationary pressure, hurting its margins. The persistent macro-driven slowdown in consumer spending threatens the basic apparel company’s performance.

These factors hurt the company’s second-quarter 2023 results, with the top and the bottom line declining year over year. At the time of its quarterly results, management lowered its 2023 view.

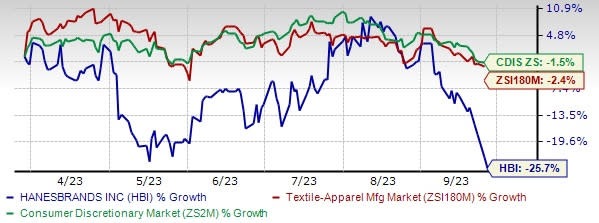

Shares of the Zacks Rank #4 (Sell) company have slumped 25.7% in the past six months compared with the industry’s 2.4% decline. The stock has underperformed the Zacks Consumer Discretionary sector’s decline of 1.5% during this time.

Let’s delve deeper.

Image Source: Zacks Investment Research

Macroeconomic Challenges Hurt Q2 Results

Hanesbrands is witnessing persistent macroeconomic hurdles, which hurt its second-quarter results. The company’s adjusted loss from continuing operations of 1 cent a share deteriorated from 28 cents per share in the year-ago quarter. Net sales from continuing operations decreased 4.9% to $1,439 million, which includes $18 million negative impact from foreign exchange rates. The downside was caused by declines in U.S. Activewear and a persistent macro-driven slowdown in consumer spending affecting Australia.

Global Champion brand sales tumbled 16%, with a decline of 25% in the United States and a 1% decrease internationally. Global Champion brand sales fell 15% at cc, while international brand sales aligned with the year-ago quarter’s levels. Management recently announced that it is evaluating strategic options for the Champion business, including a potential sale.

Cost Woes Stay

Hanesbrands is grappling with a rising inflationary environment, which continued in the second quarter. The adjusted gross margin was 33.6%, down nearly 425 basis points (bps). The downside was caused by commodity and ocean freight inflation, which represented almost 245 bps of margin headwind as it continued to sell through higher-cost inventory. Also, unfavorable business mix and increased labor rates were hurdles.

Lowered View

Considering the challenging apparel market, mainly in Australia, along with softness in the U.S. activewear category, management lowered its view for the back half of the year. For 2023, net sales from continuing operations are now anticipated to be $5.80-$5.90 billion, including an anticipated currency headwind of nearly $37 million. The midpoint of the guidance suggests a nearly 6% year-over-year decline on a reported basis and cc basis. The metric was expected to be $6.05-$6.20 billion earlier.

For 2023, adjusted earnings per share (EPS) from continuing operations is envisioned to be in the 16-30 cents range compared with the 31-42 cents projected earlier.

Wrapping Up

Hanesbrands is progressing well with its Full Potential plan, which includes consumer-centricity and focusing on the portfolio. Hanesbrands’ supply chain segmentation work has focused on lower inventory, profitable SKUs and increased efficiencies in the distribution centers. Efforts to bolster brands via robust innovations are noteworthy.

Whether these upsides can help Hanesbrands counter the downsides above is yet to be seen.

3 Solid Bets

Some better-ranked companies are Guess? Inc. GES, Live Nation Entertainment, Inc. LYV and GIII Apparel Group GIII.

Guess?, which designs, markets, distributes and licenses lifestyle collections of apparel and accessories, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GES’ current financial-year revenues and earnings suggests growth of 3.7% and 9.9%, respectively, from the year-ago reported figure. Guess? has a trailing four-quarter earnings surprise of 43.4%, on average.

Live Nation presently sports a Zacks Rank of 1. LYV has a trailing four-quarter earnings surprise of 34.6% on average.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests rises of nearly 21% and 57.8%, respectively, from the year-ago period’s levels.

GIII Apparel sports a Zacks Rank #1. GIII is a manufacturer, designer and distributor of apparel and accessories

The Zacks Consensus Estimate for GIII Apparel’s current financial year’s sales and EPS suggests growth of 8% and 14.7%, respectively, from the year-ago period’s reported figures. GIII has a trailing four-quarter earnings surprise of 526.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hanesbrands Inc. (HBI) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report