Hanesbrands (HBI) Reviews Strategic Options for Champion Brand

Hanesbrands Inc. HBI is on track to evaluate strategic options for the global Champion business, a renowned global lifestyle brand. Management will look into various alternatives to boost shareholders’ value in this regard. The options include a potential sale or other strategic transaction and continuing to operate the business as part of the company, among others.

Hanesbrands is committed to leveraging its iconic brands and competitive advantages to accelerate growth and profits while simplifying its operations. On these grounds, the company continues to take action to ensure its innerwear and activewear brands are on track to achieve long-term growth. Well, Hanesbrands is working with advisors to recognize the correct path for Champion and HanesBrands to maximize value.

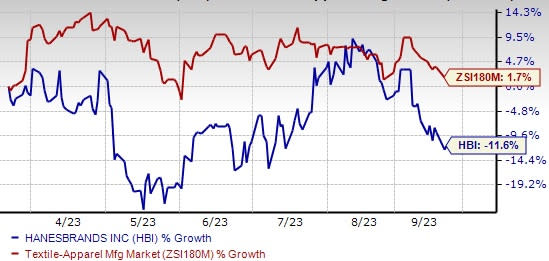

Image Source: Zacks Investment Research

What’s More?

Hanesbrands is progressing well with its Full Potential plan. The plan includes growing the global Champion brand, reigniting innerwear growth, driving consumer-centricity and focusing on the portfolio. The company is on track to execute its full potential supply chain strategies to remain competitive and balance speed, cost and flexibility to boost top-line growth and increase margins over time. Management has been streamlining the portfolio, shedding non-core, lower-margin businesses and lowering skews for business simplification.

Hanesbrands is investing in the business to unlock growth, enhance consumer’s brand experience, reduce costs by exiting non-strategic businesses and improve efficiencies. Management is investing in data analytics and supply chain improvements to fuel growth. Hanesbrands’ supply chain segmentation work has resulted in a focus on lower inventory, profitable SKUs, increased efficiencies in the distribution centers and lesser product delivery times from Asia.

Efforts to bolster brands via robust innovations are likely to keep supporting Hanesbrands. In its second-quarter 2023 earnings call, management highlighted that consumer-focused innovation grew 30% year over year. The company’s innovation pipeline is full, which will aid in new product launches during 2025, which includes the launch of M by Maidenform this fall.

Lowered View

Considering the challenging apparel market, mainly in Australia, along with softness in the U.S. activewear category, management lowered its view for the back half of the year. For 2023, net sales from continuing operations are now anticipated to be $5.80-$5.90 billion, including an anticipated currency headwind of nearly $37 million. The midpoint of the guidance suggests a nearly 6% year-over-year decline on a reported basis and cc basis. The metric was expected to be $6.05-$6.20 billion earlier. Adjusted earnings per share (EPS) from continuing operations is envisioned to be in the 16-30 cents range compared with the 31-42 cents projected earlier.

Shares of the Zacks Rank #4 (Sell) company have declined 11.6% in the past six months against the industry’s 1.7% growth.

Eye These Solid Picks

Some better-ranked companies are Royal Caribbean RCL, Guess?, Inc. GES and Live Nation Entertainment, Inc. LYV.

Royal Caribbean sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RCL has a trailing four-quarter earnings surprise of 28.5% on average. The Zacks Consensus Estimate for Royal Caribbean’s 2023 sales and EPS indicates increases of 55.1% and 182.1%, respectively, from the year-ago period’s reported levels.

Guess?, which designs, markets, distributes and licenses lifestyle collections of apparel and accessories currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for GES’ current financial-year revenues and earnings suggests growth of 3.7% and 9.9%, respectively, from the year-ago reported figure. Guess? has a trailing four-quarter earnings surprise of 43.4%, on average.

Live Nation presently sports a Zacks Rank of 1. LYV has a trailing four-quarter earnings surprise of 34.6%, on average.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests rises of nearly 21% and 57.8%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Hanesbrands Inc. (HBI) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report