Hanesbrands Inc (HBI) Surpasses Key Financial Targets Amidst Sales Headwinds

Net Sales: $1.3 billion in Q4, a 12% decrease compared to the previous year.

Gross Margin: Improved by 400 basis points to 38.1% in Q4, reflecting inventory and cost savings initiatives.

Inventory Levels: Year-end inventory below $1.4 billion, a 31% improvement year-over-year.

Operating Cash Flow: Generated $562 million in 2023, surpassing the $500 million target.

Debt Reduction: Accelerated paydown of over $500 million in 2023, exceeding expectations.

Earnings Per Share: GAAP EPS of $0.22 and adjusted EPS of $0.03 in Q4 from continuing operations.

2024 Outlook: Anticipates strong profit and EPS growth, with plans to pay down over $300 million of debt.

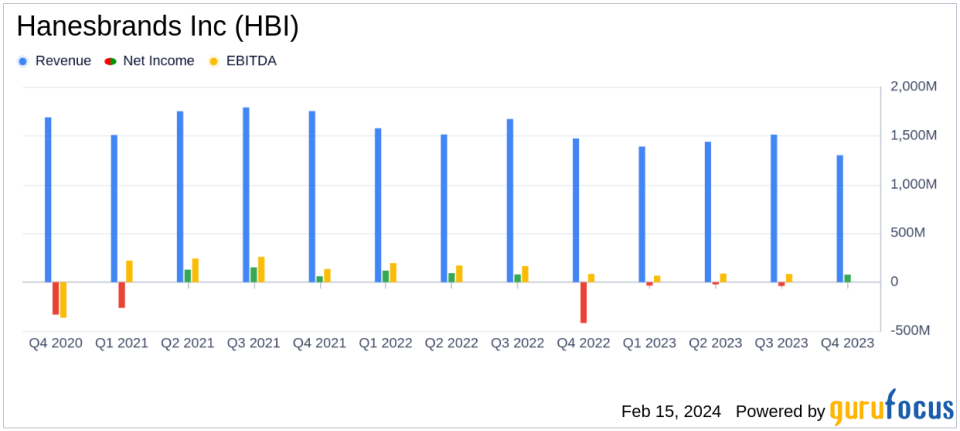

On February 15, 2024, Hanesbrands Inc (NYSE:HBI), a global leader in iconic apparel brands, released its 8-K filing, announcing its fourth-quarter and full-year 2023 results. Despite a challenging sales environment, the company exceeded its year-end goals for its four key performance metrics, including gross margin, inventory, operating cash flow, and debt reduction.

Hanesbrands, known for its portfolio of brands such as Hanes, Champion, Playtex, Maidenform, Bali, Berlei, and Bonds, operates a vertically integrated business model, producing over 70% of its goods in company-controlled factories across the globe. The company's distribution spans the Americas, Europe, and Asia-Pacific, leveraging both wholesale channels and direct-to-consumer sales through retail stores and e-commerce platforms.

Financial Performance and Challenges

Hanesbrands reported a decrease in net sales to $1.3 billion in the fourth quarter, a 12% decline from the previous year. The global Champion brand sales fell by 23% on a reported basis, with U.S. sales down by 30% due to challenging activewear market dynamics. Despite these headwinds, the company's gross margin saw a significant increase, reaching 38.1%, a 400 basis point improvement over the prior year. This margin expansion was attributed to the company's inventory and cost savings initiatives, as well as lower input costs from commodities and ocean freight.

The company's inventory management capabilities, including SKU discipline and lifecycle management, contributed to a year-end inventory level below $1.4 billion, a 31% improvement from the previous year. This inventory reduction, along with lower input costs, helped generate $562 million of operating cash flow for the full year, exceeding the $500 million target.

With a stronger-than-expected operating cash flow, Hanesbrands accelerated its debt paydown to more than $500 million in 2023, reducing its year-end leverage to 5.2 times net debt-to-adjusted EBITDA. The company ended the year with more than $1.3 billion in liquidity.

Financial Achievements and Importance

The company's financial achievements are particularly important as they demonstrate resilience in a challenging market. The improved gross margin indicates effective cost control and operational efficiency, which are critical for a company in the Manufacturing - Apparel & Accessories industry. The reduction in inventory levels and accelerated debt paydown reflect a strong balance sheet and liquidity position, positioning the company for future growth and investment.

Key Financial Metrics and Commentary

CEO Steve Bratspies commented on the results, stating:

"Our fourth quarter performance did not meet our expectations as the sales environment proved to be more challenging than expected. However, we saw several positive indicators that give us confidence margins and leverage have reached a positive inflection point and demonstrate progress on our strategy to simplify our business, reduce inventory, cut costs, and reignite Innerwear."

Bratspies also highlighted the company's market share gains in U.S. Innerwear and a robust pipeline of innovation launches planned for 2024.

Analysis of Company's Performance

The company's ability to exceed its financial targets in a difficult sales environment suggests a strong focus on operational efficiency and cost management. The significant improvement in gross margin and operating cash flow, coupled with debt reduction, indicates a solid financial foundation that can support Hanesbrands' strategic initiatives and investments in innovation and marketing to drive future growth.

For 2024, Hanesbrands provides guidance that includes expectations for strong profit and EPS growth, despite a cautious view of consumer demand. The company plans to continue its debt reduction efforts, with a target of paying down more than $300 million in debt during the year.

For value investors and potential GuruFocus.com members, Hanesbrands Inc (NYSE:HBI) presents a case study of a company that is navigating market challenges with strategic financial management, setting the stage for potential value appreciation and investment opportunities.

Explore the complete 8-K earnings release (here) from Hanesbrands Inc for further details.

This article first appeared on GuruFocus.