Hanmi Financial Corp (HAFC) Reports Mixed 2023 Earnings Amid Economic Challenges

Net Income: Q4 net income was $18.6 million, a slight decrease from Q3's $18.8 million, and a significant drop from $28.5 million in the same quarter last year.

Earnings Per Share (EPS): Q4 EPS stood at $0.61, down from $0.62 in Q3 and down from $0.93 year-over-year.

Loan Growth: Loans receivable reached $6.18 billion, marking a 2.7% increase from Q3 and a 3.6% increase from the end of 2022.

Deposits: Total deposits slightly increased to $6.28 billion, with noninterest-bearing deposits making up 31.9% of the portfolio.

Net Interest Margin: Experienced a decline to 2.92%, an 11 basis point decrease from the previous quarter.

Asset Quality: Nonperforming assets improved to 0.21% of total assets, with a decrease in criticized loans and nonperforming loans.

Capital Ratios: Maintained strong capital ratios, with a common equity tier 1 capital ratio of 11.86% and a total capital ratio of 14.95%.

Hanmi Financial Corp (NASDAQ:HAFC) released its 8-K filing on January 23, 2024, detailing its financial results for the fourth quarter and full year of 2023. The Los Angeles-based bank, serving multi-ethnic communities with a focus on small businesses and commercial and real estate loans, faced a challenging economic environment characterized by rising interest rates and uncertainty.

Financial Performance and Challenges

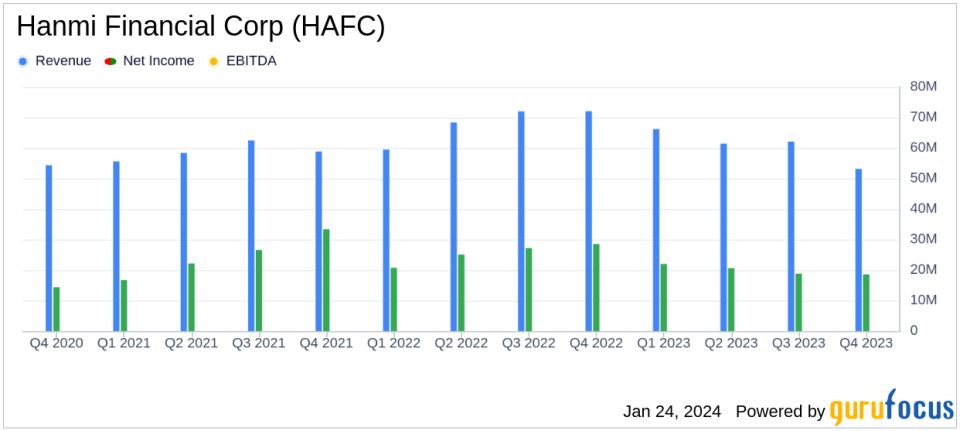

Hanmi's net income for the fourth quarter was $18.6 million, or $0.61 per diluted share, a slight decrease from the third quarter's $18.8 million, or $0.62 per diluted share. The bank's annualized return on average assets was 0.99%, and the return on average equity was 9.70%. The full-year net income saw a more pronounced decline to $80.0 million, or $2.62 per diluted share, from $101.4 million, or $3.32 per diluted share, in the previous year. This year-over-year decrease was attributed to a decline in net interest income, increased noninterest expense, and a rise in credit loss expense.

Despite these challenges, Hanmi's CEO Bonnie Lee expressed optimism, citing the bank's positive momentum, strong credit administration, and disciplined expense management. Lee highlighted the opening of two new branch locations in the fourth quarter and the bank's strategies that continued to drive growth and diversification in the loan portfolio.

"Looking ahead, Hanmi is moving forward with a strong balance sheet, excellent asset quality, a diverse and expanding base of loyal customers and an outstanding team that has repeatedly demonstrated the ability to navigate a variety of economic cycles," said Bonnie Lee.

Financial Highlights and Achievements

Hanmi's loan portfolio expanded to $6.18 billion, with loan production for the fourth quarter totaling $389.5 million at a weighted average interest rate of 8.10%. The bank's deposit base also grew modestly to $6.28 billion. However, net interest income for the fourth quarter decreased to $53.1 million, down 3.1% from the third quarter, and the net interest margin contracted to 2.92%, reflecting the challenging interest rate environment.

Noninterest income for the fourth quarter was $6.7 million, a decrease from the previous quarter's $11.2 million, primarily due to the absence of a significant gain from a sale-leaseback transaction. Noninterest expenses increased to $35.2 million for the fourth quarter, up 2.8% from the third quarter, with the efficiency ratio rising to 58.86%.

The bank's asset quality remained strong, with nonperforming assets declining to 0.21% of total assets. Hanmi also maintained robust capital ratios, with a tangible common equity to tangible assets ratio of 9.14% and a common equity tier 1 capital ratio of 11.86%.

Analysis of Hanmi's Performance

While Hanmi's year-over-year earnings reflect the impact of a challenging economic landscape, the bank's quarter-over-quarter performance demonstrates resilience. The bank's strategic focus on relationship-driven banking and disciplined growth positions it well for future success. However, the current interest rate environment and economic uncertainty may continue to pose challenges for the banking sector.

Hanmi's strong capital ratios and asset quality are indicative of a solid foundation, which is critical for weathering potential economic headwinds. The bank's ability to maintain a healthy loan-to-deposit ratio and its strategic branch expansion also suggest a forward-looking approach to growth and customer service.

Investors and stakeholders will likely monitor Hanmi's performance closely in the coming quarters, looking for signs of sustained profitability and strategic adaptability in an evolving economic climate.

For a detailed analysis of Hanmi Financial Corp's earnings and to stay updated on the latest financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Hanmi Financial Corp for further details.

This article first appeared on GuruFocus.