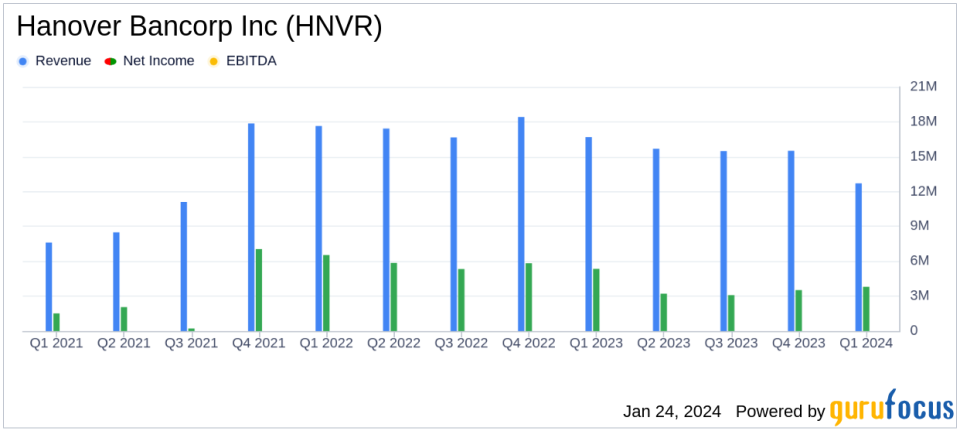

Hanover Bancorp Inc (HNVR) Reports Mixed Fourth Quarter Results Amidst Rising Interest Rates

Net Income: Reported $3.8 million for Q4 2023, down from $5.3 million in Q4 2022.

Earnings Per Share: Diluted EPS at $0.51, compared to $0.72 in the same quarter last year.

Net Interest Income: Decreased by 17.1% year-over-year to $12.7 million.

Non-Interest Income: Increased, contributing positively to the earnings.

Balance Sheet: Total assets grew to $2.27 billion, up from $2.15 billion in the previous quarter.

Dividend: Declared a $0.10 per share cash dividend payable in February 2024.

On January 24, 2024, Hanover Bancorp Inc (NASDAQ:HNVR) released its 8-K filing, detailing the financial results for the fourth quarter ended December 31, 2023. The United States-based banking company, which offers a full range of financial services including consumer and commercial banking products, faced a challenging quarter as net income and net interest income decreased, while non-interest income showed strength.

Financial Performance and Challenges

Hanover Bancorp Inc (NASDAQ:HNVR) reported a decrease in net income to $3.8 million for the fourth quarter of 2023, down from $5.3 million in the same period a year ago. This decline was primarily due to a decrease in net interest income, which fell by 17.1% to $12.7 million, as the net interest margin compressed to 2.40% from 3.49% in the previous year. The rapid rise in interest rates, driven by Federal Reserve policy, was a significant factor, causing the cost of interest-bearing deposits to rise faster than the yield on interest-earning assets.

The bank also experienced an increase in non-interest expense, largely due to growth-related increases in compensation and benefits, occupancy and equipment, federal deposit insurance premiums, and other operating expenses. These challenges were partially offset by a decrease in the provision for credit losses and an increase in non-interest income.

Financial Achievements

Despite the headwinds, Hanover Bancorp Inc (NASDAQ:HNVR) achieved notable financial successes. Non-interest income increased, contributing positively to the overall earnings. The bank also declared a $0.10 per share cash dividend, underscoring its commitment to returning value to shareholders. Total assets grew to $2.27 billion, up from $2.15 billion in the previous quarter, indicating a solid balance sheet position.

Key Financial Metrics

Important financial metrics from the earnings report include:

"The yield on interest earning assets increased to 5.91% in the 2023 quarter from 5.17% in the comparable 2022 quarter, an increase of 74 basis points, offset by a 211 basis point increase in the cost of interest-bearing liabilities to 4.19% in 2023 from 2.08% in the fourth calendar quarter of 2022."

This metric is crucial as it reflects the bank's ability to generate earnings from its assets, which is a key indicator of financial health for investors.

Analysis of Company's Performance

Michael P. Puorro, Chairman and Chief Executive Officer, commented on the quarterly results:

"We are extremely pleased with our fourth calendar quarter results highlighted by a 42% increase in adjusted diluted EPS, driven by margin expansion and increasing returns from our investments in SBA and C&I Banking. Together with our sustained focus on cost management, these new initiatives will enhance earnings and capital growth into the future."

The bank's strategic focus on cost management and investment in Small Business Administration (SBA) and Commercial & Industrial (C&I) Banking has helped to mitigate some of the negative impacts of the rising interest rate environment.

Overall, Hanover Bancorp Inc (NASDAQ:HNVR) has navigated a challenging interest rate landscape with a mix of strategic initiatives and cost management. While net income has decreased, the bank's efforts to diversify income streams and manage expenses have provided some counterbalance, positioning it to potentially benefit from the anticipated favorable interest rate environment in 2024.

For a detailed view of Hanover Bancorp Inc (NASDAQ:HNVR)'s financials and to stay updated on the latest investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Hanover Bancorp Inc for further details.

This article first appeared on GuruFocus.