The Hanover Insurance Group Inc Reports Strong Q4 and Full Year 2023 Results

Net Income: Q4 net income of $107.9 million, a significant rebound from a net loss in the prior-year quarter.

Operating Income: Q4 operating income of $113.1 million, with a per diluted share value of $3.13.

Combined Ratio: Q4 combined ratio improved to 94.2%, with a full-year combined ratio of 103.5%.

Net Premiums Written: Increase of 1.5% in Q4 and 6.1% for the full year, reaching $5.8 billion.

Investment Income: Net investment income rose by 7.5% in Q4 and 12.1% for the full year.

Book Value Per Share: Increased to $68.93, up 16.4% from the end of Q3 2023.

Dividend: Board approved a 5% increase to the regular quarterly dividend.

The Hanover Insurance Group Inc (NYSE:THG) released its 8-K filing on January 31, 2024, detailing a strong finish to the year with substantial improvements in both quarterly and annual financial metrics. The company, a prominent provider of property and casualty insurance products and services, operates through independent agents and brokers in the U.S. and internationally through Chaucer Holdings Limited. THG operates across three segments: Commercial Lines, Personal Lines, and Other, with a primary investment portfolio in fixed-income securities.

Financial Performance and Challenges

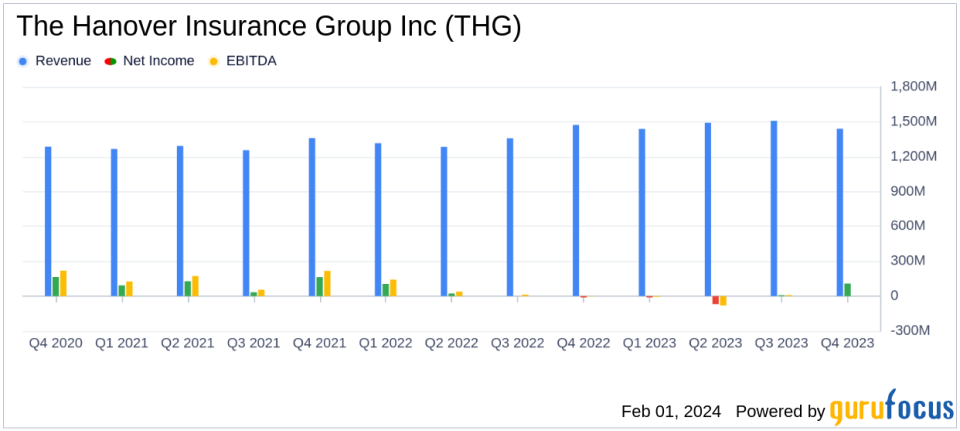

THG's fourth quarter was marked by a robust net income of $107.9 million, a significant turnaround from the net loss of $12.1 million in the same quarter of the previous year. Operating income also saw a dramatic increase to $113.1 million, or $3.13 per diluted share, compared to an operating loss in the prior-year quarter. This performance underscores the company's resilience and the effectiveness of its strategic initiatives, particularly in the face of challenges such as severe convective storms that led to elevated catastrophe losses earlier in the year.

The company's combined ratioa key measure of underwriting profitabilityimproved to 94.2% for the quarter, reflecting disciplined underwriting and favorable loss trends. Excluding catastrophes, the combined ratio for the quarter was an impressive 90.2%. For the full year, despite higher catastrophe losses, the combined ratio stood at 103.5%, with the ex-catastrophe combined ratio at 91.3%. These figures are crucial as they demonstrate THG's ability to manage claims and expenses effectively, which is vital for profitability in the insurance industry.

Financial Achievements and Importance

THG's financial achievements in the fourth quarter and full year are significant. The growth in net premiums written, which increased by 1.5% in the quarter and 6.1% for the full year to $5.8 billion, indicates the company's ability to expand its business while maintaining underwriting discipline. Net investment income also grew, up 7.5% in the quarter and 12.1% for the full year, driven by higher bond reinvestment rates and the continued investment of operational cashflows. This growth in investment income is particularly important as it helps to offset underwriting risks and contributes to overall profitability.

Furthermore, the increase in book value per share to $68.93, up 16.4% from the end of the third quarter, reflects the company's strong earnings and an increase in the fair value of fixed maturity investments. The board's approval of a 5% increase to the regular quarterly dividend also signals confidence in the company's financial health and its commitment to returning value to shareholders.

Key Financial Metrics and Commentary

THG's financial statements reveal several key metrics that are vital to understanding the company's performance. The net income and operating income figures highlight the company's profitability, while the combined ratio provides insight into underwriting effectiveness. Net premiums written and net investment income are indicative of growth and investment performance, respectively. President and CEO John C. Roche commented on the results:

"The fourth quarter represented a strong finish to a very productive year, as we delivered operating return on equity of 15.7% and a combined ratio of 94.2%, demonstrating meaningful improvement in each of our business segments and validating the strong execution of our margin recapture program."

Executive Vice President and CFO Jeffrey M. Farber also provided insights:

"Our fourth quarter current accident year loss and LAE ratio, excluding catastrophes, of approximately 60% improved over 3 points compared to the prior-year quarter... We are very optimistic about our position and confident in our strong outlook for 2024."

Analysis of Company's Performance

THG's performance in the fourth quarter and full year of 2023 reflects a company that has effectively navigated challenges and capitalized on opportunities. The significant rate increases across all business segments, coupled with underwriting initiatives and product changes, have positioned THG for a strong 2024. The company's proactive measures to address inflation and changing weather patterns have paid off, as evidenced by the improved combined ratios and robust rate increases.

Overall, THG's financial results demonstrate a company that is not only growing but also improving its profitability and operational efficiency. This performance is likely to appeal to value investors looking for companies with strong fundamentals and a clear path to sustained growth and profitability.

For more detailed information and to access the full earnings report, please visit The Hanover Insurance Group Inc's 8-K filing.

Explore the complete 8-K earnings release (here) from The Hanover Insurance Group Inc for further details.

This article first appeared on GuruFocus.