Harley-Davidson Inc (HOG) Navigates Challenging Environment with Mixed 2023 Financial Results

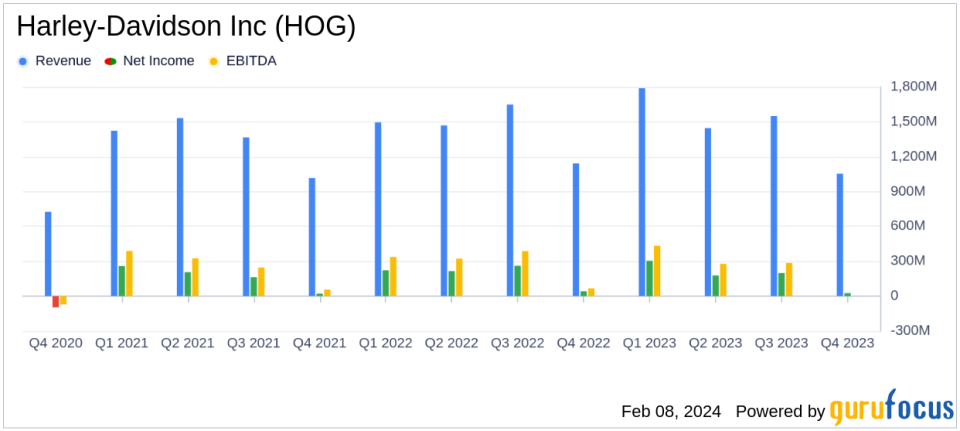

Revenue: Full-year revenue slightly up by 1% to $5.836 billion, despite a 14% drop in Q4.

Net Income: 2023 net income decreased by 5% to $707 million, with Q4 down 38%.

Diluted EPS: Earnings per share for the year at $4.87, a slight decrease from $4.96 in 2022.

Operating Margin: HDMC's operating margin for the year remained strong at 13.6%.

Global Shipments: Motorcycle shipments fell by 7% year-over-year to 179,984 units.

LiveWire Performance: LiveWire's operating loss widened, with electric motorcycle shipments up 11%.

Financial Outlook: For 2024, HDMC expects flat to 9% lower revenue and a 12.6% to 13.6% operating margin.

On February 8, 2024, Harley-Davidson Inc (NYSE:HOG) released its 8-K filing, detailing the financial outcomes of the fourth quarter and the full year of 2023. The company, a global leader in heavyweight motorcycles, has been executing its Hardwire strategic plan, focusing on profitable products and markets. Despite a challenging industry environment, Harley-Davidson has made strides in product development and market positioning, particularly with its Grand American Touring experience.

Performance and Challenges

Harley-Davidson's 2023 performance reflects a mixed outcome, with a slight increase in annual revenue to $5.836 billion, up 1% from the previous year. However, the fourth quarter saw a revenue decline of 14% at HDMC, which was somewhat offset by a 15% growth at HDFS. The company's net income for the year fell by 5% to $707 million, and diluted EPS decreased by 2% to $4.87. The operating margin at HDMC remained robust at 13.6%, though global motorcycle shipments declined by 7% year-over-year.

The challenges faced by Harley-Davidson are indicative of broader industry trends, including higher interest rates, economic uncertainty, and shifts in consumer demand. These factors have led to a decrease in motorcycle shipments and retail sales, particularly in North America and EMEA. The company's strategic focus on its most profitable segments and markets is crucial as it navigates these headwinds.

Financial Achievements and Industry Significance

Despite the challenges, Harley-Davidson's financial achievements in 2023 are noteworthy. The company's operating margin reflects a strong focus on profitability, and the slight revenue increase signifies resilience in a tough market. These achievements are significant for the Vehicles & Parts industry, where margins can be tight, and competition is fierce. Harley-Davidson's ability to maintain profitability in such an environment is a testament to its brand strength and strategic execution.

Key Financial Metrics

Important metrics from Harley-Davidson's financial statements include a 1% increase in gross margin year-over-year, indicating improved profitability per unit sold. The company also generated $755 million in cash from operating activities, highlighting its operational efficiency. Additionally, Harley-Davidson returned value to shareholders by repurchasing $350 million of shares and paying out $96 million in dividends.

"In the third year of our Hardwire strategy we have made progress in key elements of our strategic plan - focusing on our most profitable products and markets, which we believe will continue to yield benefits to the business and have set us up for long-term value creation despite the current challenging environment for the industry," said Jochen Zeitz, Chairman, President, and CEO, Harley-Davidson.

Analysis of Company Performance

Harley-Davidson's performance in 2023 reflects a company in transition, focusing on long-term value creation through strategic product development and market positioning. The company's ability to maintain a strong operating margin amidst declining shipments and retail sales is commendable. However, the challenges ahead, including economic uncertainty and changing consumer preferences, will require continued strategic focus and agility.

Looking ahead to 2024, Harley-Davidson anticipates flat to slightly lower revenue and a stable operating margin. The company's investment in electric motorcycles through its LiveWire brand, despite the current operating loss, positions it at the forefront of industry innovation. As Harley-Davidson continues to adapt to market conditions and consumer trends, its strategic focus on profitability and product development will be critical to its success.

For a more detailed analysis and to stay updated on Harley-Davidson Inc (NYSE:HOG) and other financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Harley-Davidson Inc for further details.

This article first appeared on GuruFocus.