Harmony Biosciences Holdings Inc (HRMY) Reports Robust Revenue Growth in Q4 and Full Year 2023

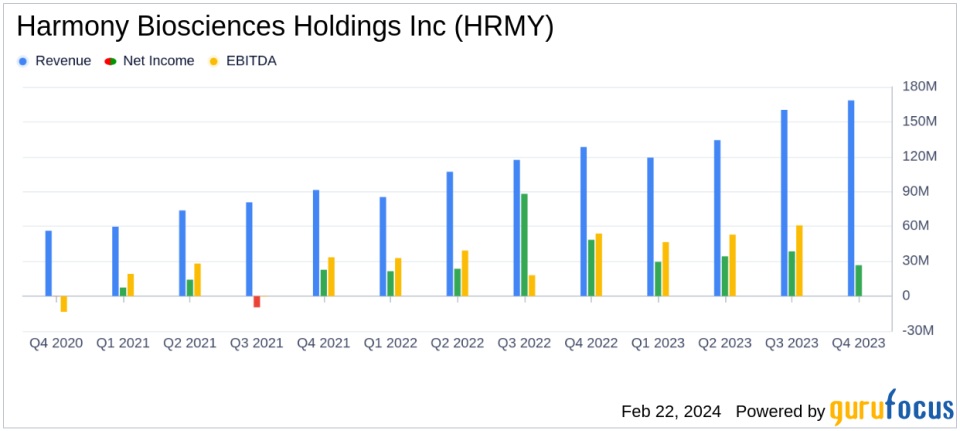

Net Revenue: Q4 net revenue increased by 31% to $168.4 million; full-year net revenue rose by 33% to $582.0 million.

GAAP Net Income: Q4 GAAP net income was $26.6 million; full-year GAAP net income reached $128.9 million.

Earnings Per Share (EPS): Q4 EPS stood at $0.45; full-year EPS was $2.13.

Operating Expenses: Research and development, sales and marketing, and general and administrative expenses totaled $268.8 million for the full year.

2024 Revenue Guidance: Projected net product revenue between $700 million to $720 million.

Cash Position: As of December 31, 2023, Harmony had cash, cash equivalents, and investment securities of $425.6 million.

On February 22, 2024, Harmony Biosciences Holdings Inc (NASDAQ:HRMY) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a commercial-stage pharmaceutical entity dedicated to developing therapies for rare neurological diseases, reported a significant increase in net revenue, primarily driven by the strong commercial performance of its flagship product, WAKIX (pitolisant).

Harmony Biosciences' President and CEO, Jeffrey M. Dayno, M.D., highlighted the company's exceptional year, marked by the continued growth of WAKIX and advancements in clinical development programs. The company's focus on rare neurological diseases and its robust pipeline, including the anticipated FDA priority review for WAKIX in pediatric narcolepsy, positions Harmony for sustained growth.

Financial Performance and Challenges

Harmony's net product revenue for Q4 2023 was $168.4 million, a 31% increase compared to the same period in 2022. The full-year net revenue saw a 33% rise to $582.0 million. This growth is attributed to the organic demand for WAKIX, tapping into a significant market opportunity with approximately 80,000 diagnosed narcolepsy patients in the U.S.

Despite the revenue growth, GAAP net income for Q4 decreased to $26.6 million from $48.5 million in the same quarter of the previous year. The full-year GAAP net income also saw a decline to $128.9 million from $181.5 million in 2022. The decrease in GAAP net income was primarily due to the release of the valuation allowance on deferred tax assets in the previous year, which resulted in a significant income tax benefit.

Financial Achievements and Industry Significance

The company's financial achievements, particularly the growth in net revenue, underscore the successful commercialization of WAKIX and Harmony's ability to penetrate a large market with unmet medical needs. In the biotechnology industry, where product success is critical, Harmony's performance demonstrates the potential of WAKIX and the company's strategy in addressing rare neurological disorders.

Harmony's strong cash position, with $425.6 million in cash, cash equivalents, and investment securities, provides the company with the financial flexibility to pursue further growth opportunities and invest in its pipeline. The projected net product revenue for 2024 between $700 million to $720 million reflects the company's confidence in its continued commercial success.

Key Financial Metrics and Commentary

Important metrics from the financial statements include a 31% increase in Q4 net product revenue and a 33% increase for the full year. The company's operating expenses for the full year were $268.8 million, with significant investments in research and development, sales and marketing, and general and administrative functions.

Harmony delivered another year of outstanding performance in 2023, with continued strong growth for WAKIX, demonstrating its durability going into year five on the market, stated Jeffrey M. Dayno, M.D., President and CEO of Harmony.

Harmony's commitment to innovation and commercial excellence is evident in its financial results and strategic initiatives. The company's focus on rare neurological diseases and its robust product pipeline, including the anticipated FDA priority review for WAKIX in pediatric narcolepsy, positions Harmony for sustained growth and success in the biotechnology sector.

For a detailed understanding of Harmony Biosciences Holdings Inc (NASDAQ:HRMY)'s financial performance, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Harmony Biosciences Holdings Inc for further details.

This article first appeared on GuruFocus.