Harmony Gold Mining Co Ltd's Meteoric Rise: Unpacking the 11% Surge in Just 3 Months

Harmony Gold Mining Co Ltd (NYSE:HMY) has been making waves in the stock market with a significant 21.71% gain over the past week and an impressive 11.27% gain over the past three months. The company's current market cap stands at $3 billion, with its stock price at $4.55. The company's current GF Value is $4.27, a slight decrease from its past GF Value of $4.74 three months ago. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Despite this decrease, the company's current GF Valuation is 'Fairly Valued', a step up from its past GF Valuation as 'Modestly Undervalued' three months ago.

Company Overview

Harmony Gold Mining Co Ltd is a gold mining and exploration company operating in South Africa and Papua New Guinea (PNG). The company's projects include Bambanani, Joel, Masimong, Phakisa, Target 1, Tshepong, Unisel, Doornkop, and Kusasalethu. These operations have positioned the company as a key player in the Metals & Mining industry.

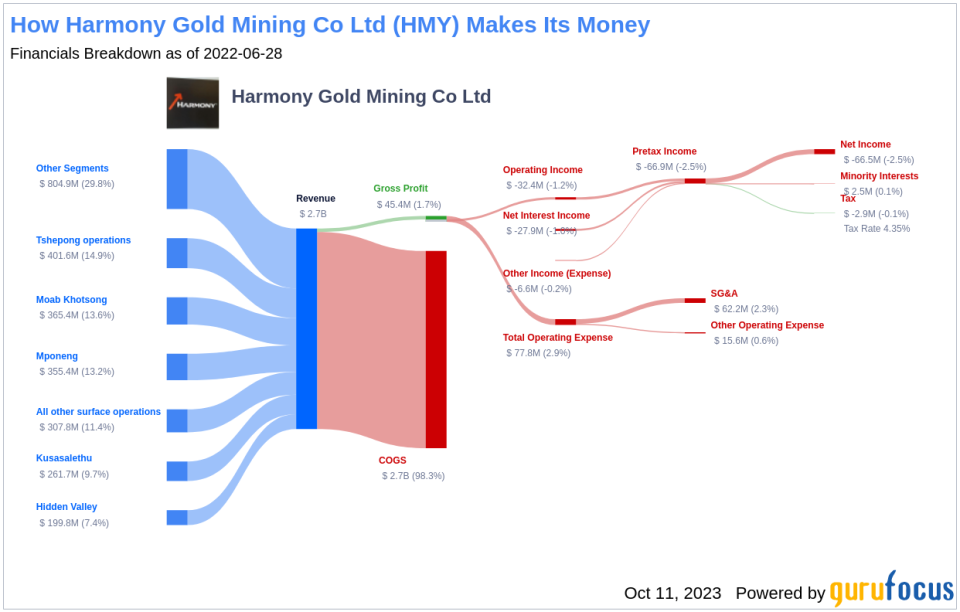

Profitability Analysis

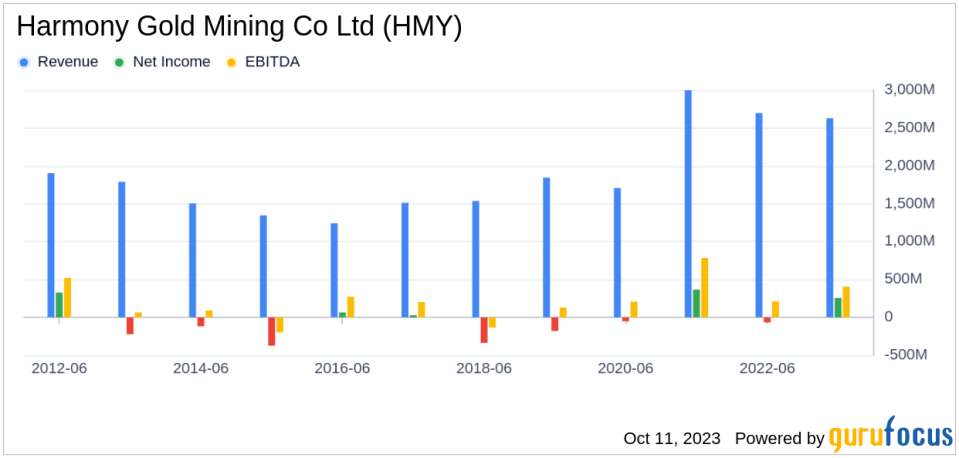

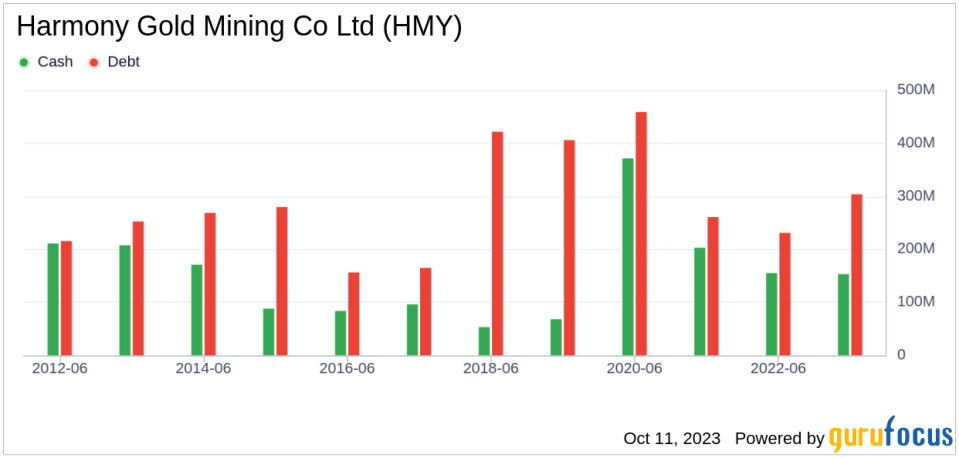

Harmony Gold Mining Co Ltd has a Profitability Rank of 5/10, indicating its relative profitability within the industry. The company's operating margin stands at 16.08%, better than 78.35% of 873 companies in the same industry. This is calculated as Operating Income divided by its Revenue. The company's ROE, ROA, and ROIC are 14.98%, 9.19%, and 12.74% respectively, all of which are better than the majority of companies in the industry. Over the past 10 years, the company has had 4 years of profitability, better than 64.87% of 1207 companies.

Growth Prospects

The company's Growth Rank is 5/10, indicating its relative growth within the industry. The company's 3-year and 5-year revenue growth rates per share stand at 14.10% and 12.60% respectively, better than the majority of companies in the industry. These figures suggest that Harmony Gold Mining Co Ltd has a solid growth trajectory.

Major Shareholders

Jim Simons (Trades, Portfolio) is the company's major shareholder, holding 0.32% of shares. Steven Cohen (Trades, Portfolio) also holds a stake in the company, albeit a negligible share percentage.

Competitive Landscape

Harmony Gold Mining Co Ltd faces competition from Sibanye Stillwater Ltd, Randgold & Exploration Co Ltd, and Anglogold Ashanti PLC. These companies have market capitalizations of $4.16 billion, $2.275 million, and $7.74 billion respectively.

Conclusion

In conclusion, Harmony Gold Mining Co Ltd has shown impressive stock performance, profitability, and growth. Despite facing competition within the Metals & Mining industry, the company's solid financials and growth prospects suggest a promising future. Investors should keep a close eye on this stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.