Harmony's (HMY) Earnings and Revenues Increase Y/Y in H124

Harmony Gold Mining Company Limited HMY logged adjusted earnings of 51 cents per share in the first half of fiscal 2024 (ended Dec 31, 2023), up 200% from adjusted earnings of 17 cents recorded a year ago.

For the first half of fiscal 2024, revenues were up 25% year over year to $1,681 million. Average gold prices received for the period rose nearly 10% year over year to $1,900 per ounce (oz).

Harmony Gold Mining Company Limited Price, Consensus and EPS Surprise

Harmony Gold Mining Company Limited price-consensus-eps-surprise-chart | Harmony Gold Mining Company Limited Quote

Production and Costs

Gold production was 832,349 oz for the reported period, up around 14% year over year.

Cash operating costs per oz fell 10% year over year to $1,191. All-in-sustaining costs fell 12% year over year to $1,403 per oz.

Financial Overview

As of Dec 31, 2023, cash and cash equivalents rose around 46% year over year to $188 million.

Operating free cash flow surged 237% year over year to $381 million during the period.

Long-term debt was $183 million at the end of first half of fiscal 2024, down around 55% year over year.

Outlook

Harmony Gold’s guidance to produce 1.38-1.48 million oz of gold in fiscal 2024 remains unchanged. Similarly, the AISC and underground grade guidance remains unchanged.

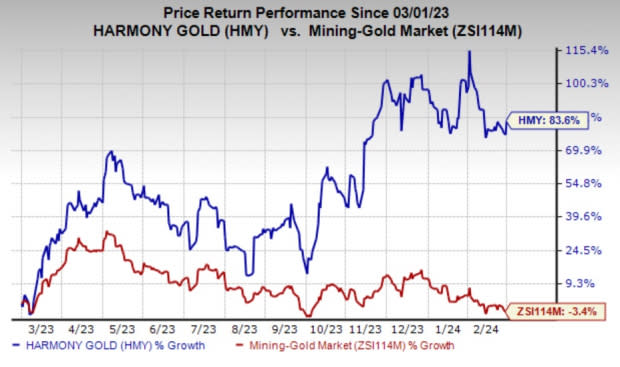

Price Performance

Shares of Harmony Gold are up 83.6% in the past year compared with a 3.4% fall of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Harmony currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS sporting a Zacks Rank #1 (Strong Buy), and Ecolab Inc. ECL and Hawkins, Inc. HWKN, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CRS’ current fiscal year earnings is pegged at $3.97 per share, indicating a year-over-year surge of 248.3%. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have rallied 28% in the past year.

Ecolab has a projected earnings growth rate of 22.65%% for the current year. The Zacks Consensus Estimate for ECL’s current-year earnings has been revised upward by 6.5% in the past 60 days. ECL topped the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.7%. The company’s shares have rallied 41.8% in the past year.

The consensus estimate for HWKN’s current fiscal year earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 4.3% in the past 30 days. HWKN beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 30.6%. The company’s shares have surged 69% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report