Hartford Financial (HIG) Q1 Earnings Beat on High Earned Premium

The Hartford Financial Services Group, Inc. HIG reported first-quarter 2022 adjusted operating earnings of $1.66 per share, which beat the Zacks Consensus Estimate by 6.4%. The bottom line increased to nearly three-fold year over year.

HIG’s quarterly results gained momentum from growth in property and casualty (P&C) earned premium, favorable P&C prior accident year development (PYD), lower P&C current accident year (CAY) catastrophe (CAT) losses and fall in P&C CAY COVID-19 incurred losses. Sound contributions by its Commercial Lines and Group Benefits segments provided a boost to the results.

However, the upside was partly offset by elevated group disability loss ratio and Personal Lines underlying loss ratio coupled with higher insurance operating costs and other expenses.

Hartford Financial’s operating revenues amounted to $3.6 billion, which improved 7.2% year over year in the first quarter. However, the top line missed the consensus mark by 1.6%.

Net investment income of $509 million remained unchanged year over year as the benefits stemming from higher income out of limited partnerships and other alternative investments as well as improved invested assets was offset by reduced yield on fixed maturities.

Total benefits and expenses of HIG decreased nearly 3% year over year to $4.9 billion in the quarter under review.

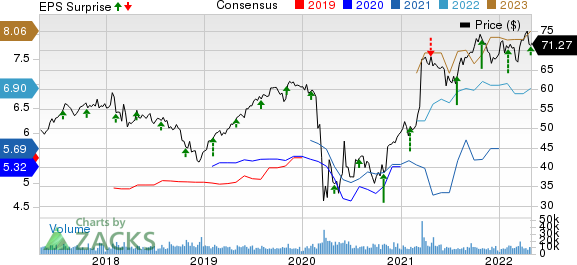

The Hartford Financial Services Group, Inc. Price, Consensus and EPS Surprise

The Hartford Financial Services Group, Inc. price-consensus-eps-surprise-chart | The Hartford Financial Services Group, Inc. Quote

Segmental Update

P&C

Commercial Lines

The segment reported total revenues of $2.7 billion, which advanced 4.5% year over year in the quarter under review.

Core earnings increased to more than four-fold year over year to $456 million. The improvement can be attributed to a rise of 11% in earned premium, favorable P&C PYD, reduced CAY CAT losses and lower underlying combined ratio before COVID-19 losses.

Underlying combined ratio of 88.3% improved 290 basis points (bps) year over year in the first quarter driven by lower COVID-19 losses and reduced underwriting expense ratio.

Personal Lines

Revenues of $769 million declined 4.2% year over year in the segment.

Core earnings tumbled 36% year over year to $84 million in the first quarter due to decline in net favorable PYD and lower underlying underwriting gain.

Underlying combined ratio deteriorated 500 bps year over year to 88.5% primarily due to elevated auto loss costs.

P&C Other Ops

The segment’s revenues of $12 million plunged 33.3% year over year.

Group Benefits

Revenues grew 2.1% year over year to $1.6 billion in the first quarter.

Core earnings amounted to $8 million against the prior-year quarter’s loss of $3 million, courtesy of decline in excess mortality losses within group life coupled with increased fully insured ongoing premiums’ effect.

Loss ratio improved 240 bps year over year to 81.9% on the back of a fall in excess mortality within group life.

Hartford Funds

The segment’s operating revenues amounted to $279 million, which fell 2.1% year over year in the quarter under review.

Core earnings totaled $50 million, which climbed 11% year over year driven by improved fee income.

Daily average assets under management (AUM) were $150.1 billion, up 5% year over year on account of higher market values and strong net inflows.

Corporate

Operating revenues of $1 million reduced to 13-fold on a year-over-year basis.

Core loss of $48 million was narrower than the year-ago quarter’s loss of $60 million, attributable to a higher tax benefit (related to stock-based compensation) during the 2022 period.

Financial Update (as of Mar 31, 2022)

Book value per diluted share came in at $46.36, down 3% year over year.

Core earnings’ return on equity during the trailing 12 months improved 390 bps year over year to 14.8%.

Share Repurchase and Dividend Update

During the first quarter, Hartford Financial rewarded its shareholders with $530 million via share buybacks of $400 million and common dividends worth $130 million.

Zacks Rank

Hartford Financial currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

Of the insurance industry players that have reported first-quarter results so far, the bottom line of RLI Corp. RLI, Chubb Limited CB and Cincinnati Financial Corporation CINF beat the Zacks Consensus Estimate.

RLI reported first-quarter 2022 operating earnings of $1.43 per share, beating the Zacks Consensus Estimate by 40.2%. The bottom line improved 64.4% from the prior-year quarter. Operating revenues of RLI for the reported quarter were $287 million, up 17.1% year over year. The top line beat the Zacks Consensus Estimate of $276 million by 0.8%. RLI’s gross premiums written increased 22% year over year to $359.2 million.

Chubb reported first-quarter 2022 core operating income of $3.82 per share, which outpaced the Zacks Consensus Estimate by 8.5%. The bottom line improved 51.6% from the year-ago quarter. Chubb’s net premiums written increased 6.2% year over year to $9.1 billion in the quarter. Net premiums earned rose 6.4% to $8.7 billion. Net investment income of CB was $822 million, down 4.8% year over year.

Cincinnati Financial reported first-quarter 2022 operating income of $1.58 per share, which outpaced the Zacks Consensus Estimate by 6.8%. The bottom line improved 15.3% year over year. Total operating revenues of Cincinnati Financial in the quarter under review were $1.9 billion, which improved 9.3% year over year. Also, the top line surpassed the consensus mark by 10.9% of $1.7 billion. CINF’s net written premiums climbed 12% year over year to $1.9 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research