Hasbro (NASDAQ:HAS) Misses Q4 Sales Targets, Stock Drops 10.7%

Toy and entertainment company Hasbro (NASDAQ:HAS) missed analysts' expectations in Q4 FY2023, with revenue down 23.2% year on year to $1.29 billion. It made a non-GAAP profit of $0.38 per share, down from its profit of $1.31 per share in the same quarter last year.

Is now the time to buy Hasbro? Find out by accessing our full research report, it's free.

Hasbro (HAS) Q4 FY2023 Highlights:

Revenue: $1.29 billion vs analyst estimates of $1.36 billion (4.9% miss)

EPS (non-GAAP): $0.38 vs analyst expectations of $0.64 (40.3% miss)

Free Cash Flow of $341.8 million, up from $4.49 million in the previous quarter

Gross Margin (GAAP): 55.5%, up from 45.6% in the same quarter last year

Market Capitalization: $7.12 billion

“2023 was a productive year for Hasbro, although not without some challenges. As we navigated the current environment, we took aggressive steps to optimize our inventory, reset the cost structure, and sharpen our portfolio focus on play with the eOne film and TV divestiture," said Gina Goetter, Hasbro Chief Financial Officer.

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ:HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

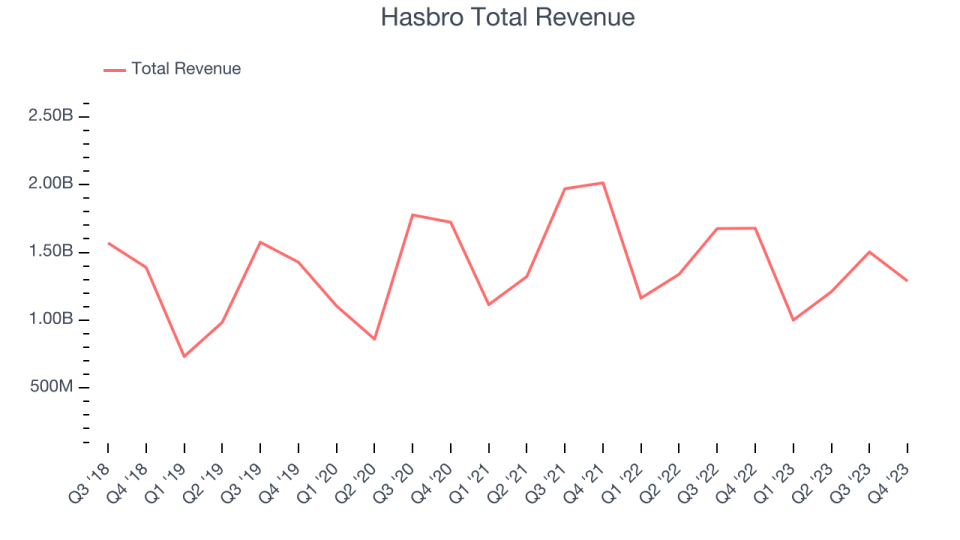

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Hasbro's annualized revenue growth rate of 1.8% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Hasbro's recent history shows a reversal from its already weak five-year trend, as its revenue has shown annualized declines of 11.7% over the last two years.

This quarter, Hasbro missed Wall Street's estimates and reported a rather uninspiring 23.2% year-on-year revenue decline, generating $1.29 billion of revenue. Looking ahead, Wall Street expects revenue to decline 11.6% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Hasbro has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 5.3%, subpar for a consumer discretionary business.

Hasbro's free cash flow came in at $341.8 million in Q4, equivalent to a 26.5% margin and up 409% year on year.

Key Takeaways from Hasbro's Q4 Results

We struggled to find many strong positives in these results. Its revenue missed analysts' expectations as its consumer products and entertainment segments declined 25% and 49% year on year. Its Wizards of the Coast and Digital Gaming segment was a silver lining (7% growth) but not enough to move the needle on company-level performance. The company's full-year 2024 EBITDA guidance also missed Wall Street's forecast.

On the bright side, Hasbro initiated a quarterly dividend of $0.70 per share, payable on May 15, 2024 to shareholders at the close of business on May 1, 2024.

Overall, the results could have been better. The company is down 10.7% on the results and currently trades at $45.82 per share.

Hasbro may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.