Hasbro's (HAS) Stock Declines 18% in a Year: Here's Why

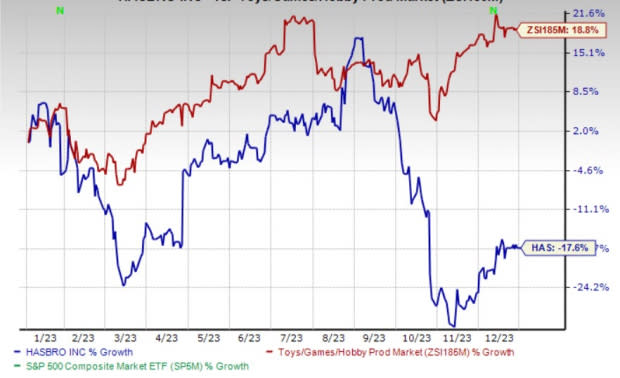

Hasbro, Inc. HAS stock fell 17.6% against the industry’s growth of 18.8% in 2023. The underperformance can be primarily attributed to higher costs and industry woes.

Estimates for this Zacks Rank #4 (Sell) company’s 2024 earnings have witnessed downward revision of 2.2% in the past 60 days.

Concerns

Tepid performances of the Consumer Products and Entertainment segments are hurting the company. A decrease in toy and game volume, and unfavorable pricing and mix remain headwinds. Furthermore, strikes by notable writers and actors, related to the Entertainment segment, added to the downtrend.

Hasbro's initiatives, including product launches and a shift toward more technology-driven toys for reviving its brands, and boosting sales, are likely to drive profits in the long term. However, costs related to these initiatives might prove detrimental in the near term. It has shouldered high expenses with respect to freight, product costs, sales allowances, and various toy and gaming products closeouts.

Toy manufacturers have to battle a broad array of alternative modes of entertainment including video games, MP3 players, tablets, smartphones and other electronic devices. HAS’ revenues have been under some pressure over the past few quarters due to lower demand for games as children are opting for electronic versions of games on smartphones and tablets.

Image Source: Zacks Investment Research

For fiscal 2023, the company now expects revenues to decline 13-15% year over year compared with the prior guidance of 3-6% fall. Segment wise, it envisions revenues in Consumer Products to record year-over-year decrease (at cc) in mid-to-high teens compared with the prior anticipation of mid-single digits. Hasbro still projects Entertainment revenues to plunge 25-30% year over year.

The adjusted operating margin for fiscal 2023 is expected to dip 13-13.5%. The metric was 15.8% in the prior year. Also, adjusted EBITDA is suggested to tumble $900-$950 million. In fiscal 2022, the metric was $1,173.1 million. Operating cash flow is now suggested to be between $500 million and $600 million, down from the prior expectation of $600-$700 million.

Key Picks

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector:

Live Nation Entertainment, Inc. LYV flaunts a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 37.5% on average. Shares of LYV have increased 34.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LYV’s 2023 sales and earnings per share (EPS) suggests growth of 29.5% and 132.8%, respectively, from the year-earlier levels.

Royal Caribbean Cruises Ltd. RCL carries a Zacks Rank #2 (Buy). RCL has a trailing four-quarter earnings surprise of 28.3% on average. RCL’s shares have surged 162.9% in the past year.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates a rise of 57.7% and 187.9%, respectively, from the year-ago levels.

Stride, Inc. LRN carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 44.3% on average. Shares of LRN have soared 89.8% in the past year.

The Zacks Consensus Estimate for LRN’s 2024 sales and EPS implies an improvement of 9.1% and 34.7%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report