HashiCorp Inc (HCP) CMO Marc Holmes Sells 8,009 Shares

Marc Holmes, Chief Marketing Officer of HashiCorp Inc (NASDAQ:HCP), has sold 8,009 shares of the company on March 21, 2024, according to a recent SEC filing. The transaction was executed at an average price of $27.38 per share, resulting in a total value of $219,246.42.

HashiCorp Inc is a software company that provides open-source tools and commercial products for developers to provision, secure, run, and connect cloud-computing infrastructure. Its products include Vagrant, Packer, Terraform, Vault, Consul, Nomad, and Boundary, which are designed to manage modern dynamic infrastructures.

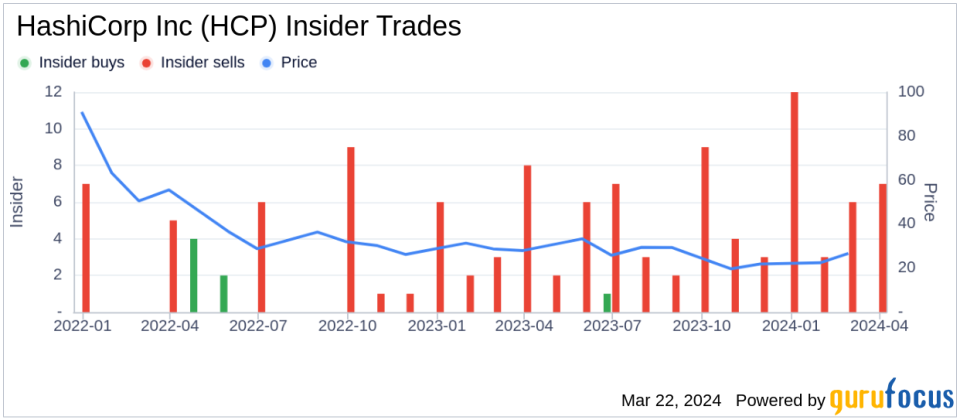

Over the past year, Marc Holmes has engaged in significant insider trading activity, selling a total of 244,447 shares and making no purchases. The insider's recent sale on March 21 represents a continuation of this selling trend.

The insider transaction history for HashiCorp Inc indicates a pattern of insider selling, with 67 insider sells recorded over the past year compared to only 1 insider buy.

On the date of the insider's most recent transaction, shares of HashiCorp Inc were trading at $27.38, giving the company a market capitalization of $5.409 billion.

Investors and analysts often monitor insider trading activities as an indicator of a company's internal perspective. The consistent selling by the insider could suggest their individual financial decisions or portfolio rebalancing and does not necessarily provide a complete picture of the company's potential performance or stock valuation.

It is important for investors to consider the broader market conditions, company performance, and other factors alongside insider trading patterns when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.