HashiCorp Inc (HCP) Insider Sells Shares

Ledger St., President, Worldwide Field Operations, has executed a sale of 17,895 shares of HashiCorp Inc (NASDAQ:HCP) on March 21, 2024, according to a recent SEC Filing.

HashiCorp Inc is a software company that provides multi-cloud infrastructure automation solutions. The company's suite of tools includes infrastructure as code, secrets management, and network automation. These tools are designed to help organizations provision, secure, connect, and run any infrastructure for any application.

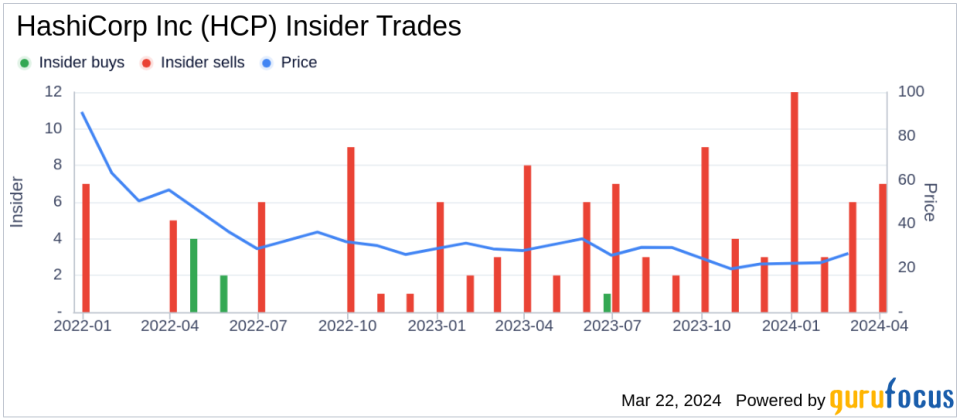

Over the past year, the insider has sold a total of 72,840 shares and has not made any purchases of the company's stock. The recent transaction is part of a series of sales by the insider, indicating a consistent pattern of share disposals over the period.

The insider transaction history for HashiCorp Inc shows a trend of more insider sales than purchases. There has been only 1 insider buy in the past year, compared to 67 insider sells in the same timeframe, suggesting a general disposition of shares by insiders.

On the date of the insider's recent sale, shares of HashiCorp Inc were trading at $27.39 each, giving the company a market capitalization of approximately $5.41 billion.

Investors and stakeholders often monitor insider transactions as they can provide insights into how the company's executives and directors view the stock's value and potential. However, insider transactions are not necessarily indicative of future stock performance and may be influenced by various factors, including personal financial requirements or portfolio diversification strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.