HashiCorp's (NASDAQ:HCP) Q4: Beats On Revenue But Full-Year Guidance Underwhelms

Cloud infrastructure automation platform HashiCorp beat analysts' expectations in Q4 FY2024, with revenue up 14.7% year on year to $155.8 million. The company expects next quarter's revenue to be around $153 million, in line with analysts' estimates. It made a non-GAAP profit of $0.05 per share, improving from its loss of $0.07 per share in the same quarter last year.

Is now the time to buy HashiCorp? Find out by accessing our full research report, it's free.

HashiCorp (HCP) Q4 FY2024 Highlights:

Revenue: $155.8 million vs analyst estimates of $149.3 million (4.3% beat)

EPS (non-GAAP): $0.05 vs analyst estimates of $0.01 ($0.04 beat)

Revenue Guidance for Q1 2025 is $153 million at the midpoint, roughly in line with what analysts were expecting

Management's revenue guidance for the upcoming financial year 2025 is $645 million at the midpoint, missing analyst estimates by 1.6% and implying 10.6% growth (vs 23.5% in FY2024)

Free Cash Flow of $7.28 million, up 27.4% from the previous quarter

Net Revenue Retention Rate: 115%, down from 119% in the previous quarter

Customers: 4,423, up from 4,354 in the previous quarter

Gross Margin (GAAP): 82.7%, in line with the same quarter last year

Market Capitalization: $4.98 billion

Initially created as a research project at the University of Washington, HashiCorp (NASDAQ:HCP) provides software that helps companies operate their own applications in a multi-cloud environment.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

Sales Growth

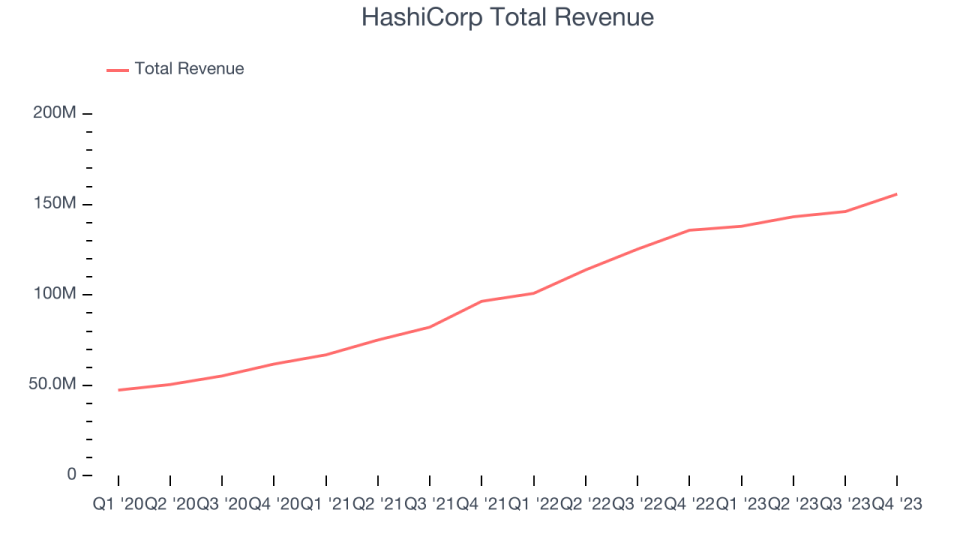

As you can see below, HashiCorp's revenue growth has been very strong over the last two years, growing from $96.52 million in Q4 FY2022 to $155.8 million this quarter.

This quarter, HashiCorp's quarterly revenue was once again up 14.7% year on year. We can see that HashiCorp's revenue increased by $9.66 million quarter on quarter, which is a solid improvement from the $2.88 million increase in Q3 2024. Shareholders should applaud the acceleration of growth.

Next quarter's guidance suggests that HashiCorp is expecting revenue to grow 10.9% year on year to $153 million, slowing down from the 36.8% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $645 million at the midpoint, growing 10.6% year on year compared to the 22.5% increase in FY2024.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Customer Growth

HashiCorp reported 4,423 customers at the end of the quarter, an increase of 69 from the previous quarter. , suggesting that the company's customer acquisition momentum is slowing.

Key Takeaways from HashiCorp's Q4 Results

It was great to see HashiCorp beat Wall Street's revenue and EPS estimates this quarter, driven by an increase in its customer base. On the other hand, its net revenue retention rate of 115% fell short of analysts' 119% forecast. Its full-year revenue guidance also came in below expectations, suggesting a slowdown in demand. With the results, HashiCorp announced a share repurchase program for up to $250 million of the company's common stock. Overall, this was a mediocre quarter for HashiCorp. The company is down 3.9% and currently trades at $23.02 per share.

So should you invest in HashiCorp right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.