Is Havells India's (NSE:HAVELLS) 126% Share Price Increase Well Justified?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the Havells India Limited (NSE:HAVELLS) share price has soared 126% in the last half decade. Most would be very happy with that.

See our latest analysis for Havells India

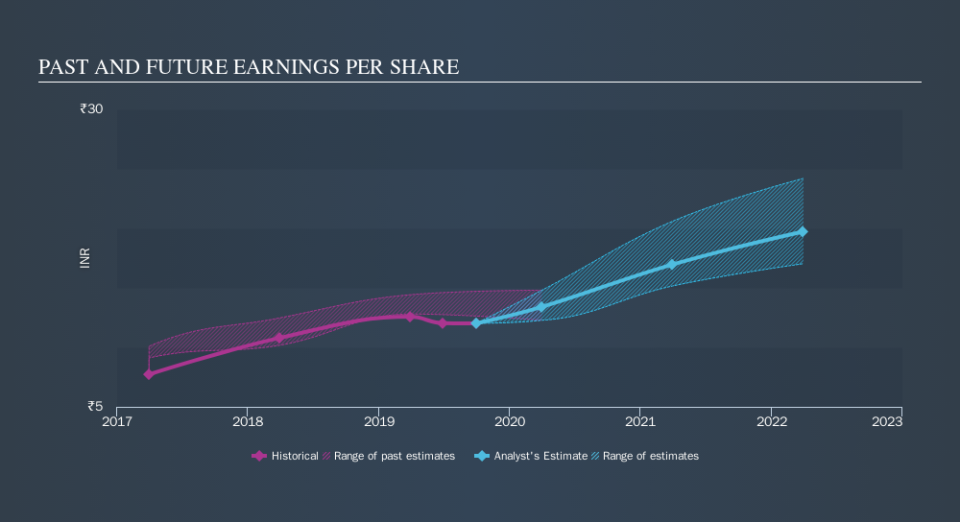

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Havells India became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Havells India's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Havells India's TSR for the last 5 years was 137%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Havells India provided a TSR of 4.6% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 19% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.