Hawkins (HWKN) Up 35% in 6 Months: Will the Trend Continue?

Hawkins, Inc.’s HWKN shares have rallied 35.1% in the last six months. Thanks to the upside, the stock outperformed its industry’s rise of 5.1% over the same time frame. The company has topped the S&P 500’s roughly 9.2% rise over the same period.

Image Source: Zacks Investment Research

Let’s look at the factors driving this Zacks Rank #1 (Strong Buy) stock.

What’s Going in Hawkins’ Favor?

In the first quarter of fiscal 2024, the company achieved remarkable results, with a noteworthy 101.8% increase in net income compared with the previous quarter’s levels. This outstanding performance was further underscored by a 10% growth in revenues from the preceding quarter.

A standout performer during this period was the Water Treatment segment, which exhibited exceptional growth. The segment recorded a substantial 19% year-over-year increase in revenues and an impressive 70% rise in operating income. This achievement reflects the company's strategic emphasis on the water treatment sector, including the successful integration of recent acquisitions, such as EcoTech Enterprises in July. These moves have solidified the company's position in the water treatment market.

An astute pricing strategy played a pivotal role in driving the expansion of the Water Treatment segment. In response to escalating raw material costs, the company adeptly adjusted its product pricing, resulting in increased sales.

Despite acknowledging potential challenges related to economic pressures impacting customer demand, the company maintains a positive outlook for the Industrial segment. It remains confident in its ability to navigate these challenges and sustain its growth trajectory.

The company is steadfast in its commitment to enhancing shareholders’ value. In fiscal 2023, Hawkins distributed dividends totaling $12 million and allocated $6.6 million to stock repurchases. To reaffirm this commitment, the company raised its quarterly dividend by 7% to 16 cents per share.

In the first quarter of fiscal 2024, the company exceeded expectations by reporting earnings of $1.12 per share, surpassing the Zacks Consensus Estimate of 61 cents. The company has consistently exceeded earnings projections for the past four quarters, with an average beat of 25.6%.

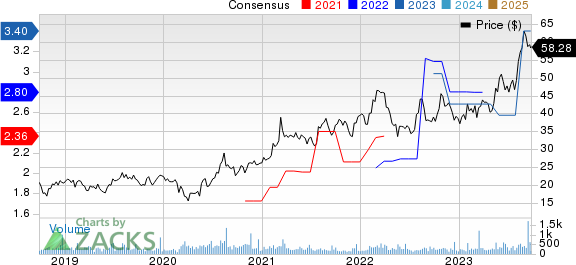

The consensus estimate for earnings for the current fiscal year has been revised upward by 32.3% in the past 60 days. The Zacks Consensus Estimate for fiscal 2024 earnings is pegged at $3.40 per share, reflecting an impressive 18.9% growth from the previous year’s levels.

The consensus estimate for the second quarter of fiscal 2024 has been revised upward by 42.9% over the same time frame. These favorable estimate revisions instill confidence among investors in the company's performance and prospects.

Hawkins, Inc. Price and Consensus

Hawkins, Inc. price-consensus-chart | Hawkins, Inc. Quote

Zacks Rank & Other Key Picks

Some other top-ranked stocks in the basic materials space are Carpenter Technology Corporation CRS and WestRock Company WRK, both sporting a Zacks Rank #1, and Alamos Gold Inc. AGI, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Carpenter Technology’s current year is pegged at $3.48, indicating a year-over-year growth of 205%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have surged 100.1% in the past year.

The earnings estimate for Westrock’s current year is pegged at $3.02. In the past 60 days, WRK’s current-year earnings estimate has been revised upward by 29%. WRK beat the Zacks Consensus Estimate in three of the last four quarters, with the average earnings surprise being 30.7%. The company’s shares have rallied 13.1% in the past year.

The earnings estimate for Alamos’ current year is pegged at 43 cents, indicating a year-over-year growth of 53.6%. The Zacks Consensus Estimate for AGI current-year earnings has been revised 7.5% upward in the past 60 days. The company’s shares have risen roughly 76.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report