Haynes International Inc (HAYN) Reports Steady Earnings Amidst Market Challenges

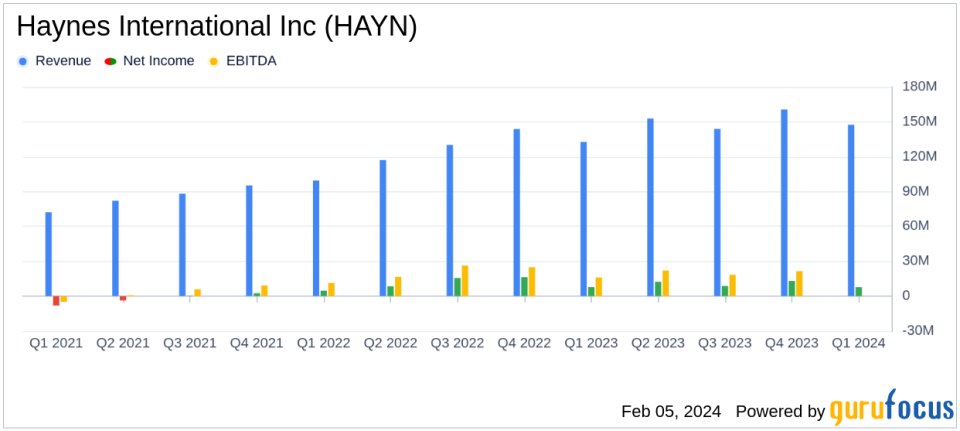

Revenue: Increased by 11.1% to $147.4 million in Q1 FY2024.

Net Income: Remained stable at $7.7 million, unchanged from Q1 FY2023.

Gross Profit: Grew to $24.7 million, up from $23.0 million in Q1 FY2023.

Dividend: Quarterly cash dividend declared at $0.22 per share.

Backlog: Increased to $448.8 million, up 9.9% from Q1 FY2023.

Liquidity: Improved with cash and equivalents of $14.0 million and total liquidity at $105.1 million.

Capital Spending: $4.3 million in Q1 FY2024 with a full-year forecast of $25 to $35 million.

On February 5, 2024, Haynes International Inc (NASDAQ:HAYN), a leading developer and manufacturer of high-performance alloys, released its 8-K filing, detailing the financial results for the first quarter of fiscal year 2024. The company, which specializes in nickel and cobalt-based alloys for aerospace, industrial gas turbine, and chemical processing industries, reported an 11.1% increase in net revenues to $147.4 million compared to the same period last year. This growth was attributed to a rise in product average selling price per pound and an increase in pounds sold.

Performance Highlights and Challenges

Despite an unplanned three-week outage at the Kokomo hot rolling mill, Haynes International managed to minimize the impact on revenue, demonstrating operational resilience. The company's gross profit increased to $24.7 million, up from $23.0 million in the first quarter of fiscal 2023, driven by higher volumes sold. However, gross profit as a percentage of net revenues declined slightly due to the outage.

Operating income remained steady at $11.1 million, mirroring the performance of the first quarter of fiscal 2023. The company faced challenges from falling nickel prices, which are expected to impact the second quarter but remains optimistic about strong demand and improving operational momentum throughout the year.

Financial Achievements and Importance

The company's financial achievements, including a stable net income of $7.7 million and a robust backlog of $448.8 million, underscore its ability to navigate market volatility and maintain a strong order book. The declared dividend of $0.22 per share reflects confidence in the company's financial health and commitment to shareholder returns.

Key Financial Metrics

Haynes International's balance sheet shows a solid liquidity position, with cash and cash equivalents increasing to $14.0 million. The company's working capital management resulted in a decrease of $2.3 million from the previous quarter, highlighting efficient operations. Net cash provided by operating activities showed a significant improvement, with $17.0 million generated in the first three months of fiscal 2024 compared to a cash use of $7.1 million in the same period of fiscal 2023.

"The continued strength of our aerospace and industrial gas turbine markets resulted in record first quarter revenue. We are proud of our teams actions in the quarter to minimize the revenue impact of an unplanned three-week outage at our Kokomo hot rolling mill," said Michael L. Shor, President and Chief Executive Officer.

Analysis of Company's Performance

Haynes International's performance in the first quarter of fiscal 2024 reflects a company adept at managing industry-specific challenges while capitalizing on market opportunities. The steady net income and increased backlog, coupled with a disciplined approach to capital spending and working capital management, position the company well for future growth. The focus on high-value, differentiated products and services, as well as strategic price increases, has helped to mitigate the impact of raw material price volatility.

The company's outlook remains positive, with expectations of higher revenue and earnings in the second quarter despite ongoing raw material headwinds. Haynes International's strategic efforts to improve gross margins and reduce the volume breakeven point have enhanced its profitability and resilience in a competitive market.

For more detailed financial information and to view the full earnings release, please visit Haynes International's 8-K filing.

Explore the complete 8-K earnings release (here) from Haynes International Inc for further details.

This article first appeared on GuruFocus.