HBT Financial (HBT) Rewards Shareholders With New Buyback Plan

HBT Financial, Inc.’s HBT board of directors has approved a new share repurchase plan, which authorizes the company to repurchase shares worth up to $15 million. The program will commence upon the expiration of the current repurchase program on Jan 1, 2024, and will be in effect until Jan 1, 2025.

HBT is not obligated to purchase any shares under the new program and this can be suspended or discontinued at any time without prior notice.

The company’s current share buyback program was announced on Dec 20, 2022. Under this program, HBT is authorized to repurchase shares worth up to $15 million till Jan 1, 2024.

As of Sep 30, 2023, $7.6 million worth of shares were left to be repurchased under this program.

In addition to share buybacks, HBT has been boosting shareholder confidence in the stock by paying regular dividends.

On Jan 24, 2023, HBT Financial announced a dividend hike of 6.3% to 17 cents per share. The dividend was paid out on Feb 14, 2023.

Moreover, the latest dividend of 17 cents per share was paid out on Nov 14, 2023, to shareholders of record as of Nov 6.

HBT has announced dividend hikes twice in the last five years. It has a payout ratio of 28% of earnings.

Also, it has a five-year annualized dividend growth rate of 4.23%.

Supported by its earnings strength and solid balance sheet, HBT Financial is expected to continue with efficient capital distribution activities. Through this, it will keep enhancing shareholders’ value.

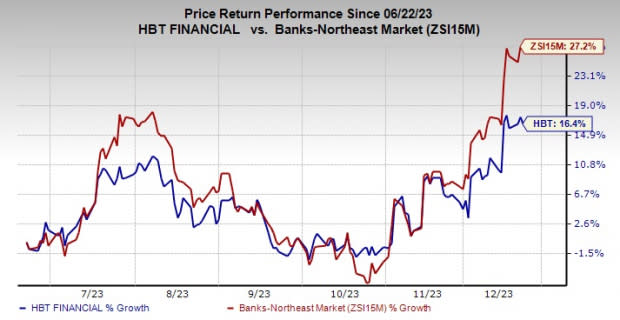

Over the past six months, shares of HBT have gained 16.4%, underperforming 27.2% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Currently, HBT carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Capital Distribution Announcements by Other Finance Companies

A couple of days ago, SEI Investments Company’s SEIC board of directors announced a dividend hike. The company announced a semi-annual cash dividend of 46 cents per share, representing an increase of 7% from the prior payout. The dividend will be paid out on Jan 9, 2024, to shareholders of record as of Dec 28, 2023.

Also, SEIC announced an increase in the share buyback authorization by $250 million. This brings SEIC’s available authorization under the program to nearly $289 million.

Earlier this month, Byline Bancorp, Inc. BY announced a new share repurchase plan. The company’s board of directors authorized the repurchase of up to 1.25 million shares. The program will commence on Jan 1, 2024, and expire on Dec 31, 2024.

The repurchase authorization represents 2.9% of Byline’s outstanding common stock.

Roberto R. Herencia, executive chairman and CEO of BY, stated, “The new share buyback authorization, which we believe is consistent with our disciplined approach, demonstrates our continued commitment to using this tool as part of our capital management strategy.”

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SEI Investments Company (SEIC) : Free Stock Analysis Report

Byline Bancorp, Inc. (BY) : Free Stock Analysis Report

HBT Financial, Inc. (HBT) : Free Stock Analysis Report