HBT Financial Inc (HBT) Reports Mixed Fourth Quarter Results; Strong Asset Quality Amidst ...

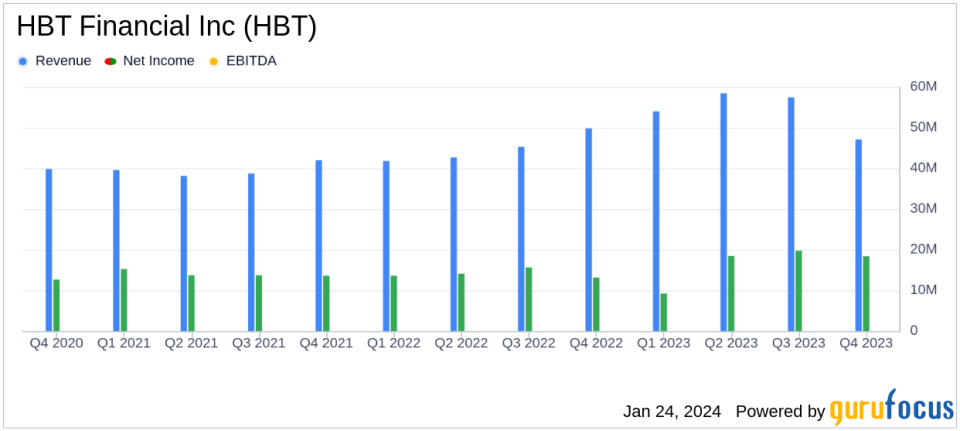

Net Income: $18.4 million for Q4 2023, down from $19.7 million in Q3 2023 but up from $13.1 million in Q4 2022.

Diluted Earnings Per Share (EPS): $0.58, compared to $0.62 in Q3 2023 and $0.46 in Q4 2022.

Net Interest Margin: Declined to 3.93% in Q4 2023 from 4.07% in Q3 2023.

Asset Quality: Nonperforming assets to total assets stood at 0.17%.

Dividend: Quarterly cash dividend increased to $0.19 per share, up from $0.17 per share.

Loan Growth: Total loans before allowance for credit losses reached $3.40 billion, a 1.8% increase over the quarter.

Deposits: Total deposits grew to $4.40 billion, a significant increase from $4.20 billion in Q3 2023.

On January 24, 2024, HBT Financial Inc (NASDAQ:HBT) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. HBT Financial Inc provides a comprehensive suite of business, commercial, wealth management, and retail banking products and services to individuals, businesses, and municipal entities throughout Central and Northeastern Illinois and Eastern Iowa. It operates through one reportable segment: community banking.

The company reported a net income of $18.4 million, or $0.58 per diluted share, for the fourth quarter of 2023, which represents a decrease from the third quarter of 2023 but an increase from the fourth quarter of 2022. The adjusted net income, which accounts for certain non-recurring items, stood at $19.3 million, or $0.60 per diluted share. HBT's asset quality remained robust with nonperforming assets to total assets at a mere 0.17%, reflecting the strength of the loan portfolio.

Financial Performance and Challenges

HBT Financial's net interest margin experienced compression, decreasing to 3.93% in the fourth quarter from 4.07% in the previous quarter, primarily due to higher funding costs. This margin pressure is a key challenge for the bank, as it can impact profitability. However, the company's management believes that the pace of net interest margin decreases will moderate in the first quarter of 2024.

Despite these challenges, HBT Financial's financial achievements include a solid loan growth of 1.8% for the quarter and a significant increase in deposits, excluding brokered deposits, by 4.2%. The increase in deposits was partly due to the successful integration of wealth management customers' deposits onto the bank's balance sheet. These achievements are important as they reflect the company's ability to grow its core business and maintain a strong balance sheet, which is crucial for stability and future growth in the banking industry.

Income Statement and Balance Sheet Highlights

The company's net interest income for the fourth quarter was $47.1 million, a slight decrease from the third quarter but an 11.6% increase from the fourth quarter of the previous year. Noninterest income decreased by 3.0% from the third quarter to $9.2 million, while noninterest expense saw a marginal decrease to $30.4 million. The efficiency ratio, a measure of the bank's overhead as a percentage of revenue, stood at 52.70%.

On the balance sheet, total assets were reported at $5.1 billion, with loans, before allowance for credit losses, at $3.40 billion. Total deposits grew significantly to $4.40 billion, reflecting the bank's strong deposit-gathering capabilities.

"We had a very good fourth quarter to complete an excellent year. We continued to produce strong profitability... We were able to improve liquidity and increase deposits... Loan growth remained solid at 1.8% for the quarter while we maintained strong credit quality with non-performing assets at only 0.17% of total assets," said J. Lance Carter, President and Chief Executive Officer of HBT Financial.

Analysis of Company's Performance

HBT Financial's performance in the fourth quarter demonstrates resilience in its core operations, with strong asset quality and growth in loans and deposits. The increase in the quarterly dividend signals confidence in the company's financial health and commitment to shareholder returns. However, the bank will need to navigate the challenges posed by margin pressures and a potentially changing interest rate environment.

For a detailed analysis of HBT Financial Inc's fourth quarter earnings and to stay updated on the company's performance, visit GuruFocus.com for comprehensive financial news and investment insights.

Explore the complete 8-K earnings release (here) from HBT Financial Inc for further details.

This article first appeared on GuruFocus.