HCI Group (HCI) Affiliate TypTap Surpasses $1B In-Force Premium

HCI Group, Inc. HCI recently declared the successful assumption of the initial of its two transfers from Florida's Citizens Property Insurance Corporation by its subsidiary, TypTap Insurance Company. This strategic step has resulted in the acquisition of approximately $30 million in in-force premiums for the company.

On Dec 19, 2023, TypTap assumed around 6,800 policies, in accordance with the approval granted by the Florida Office of Insurance Regulation in October 2023, which had authorized up to 25,000 policies. HCI expects its subsidiary to conclude the second assumption from Citizens Property Insurance in the first month of 2024.

The first assumption has helped TypTap to surpass writing $1 billion in in-force premiums. At the beginning of 2023, the company had in-force premiums of less than $740 million. This move underscores TypTap's expanding capabilities and the efficacy of its internally developed technology.

During the 2018-2022 period, TypTap recorded a gross written premium CAGR of 121%. It was launched in 2016 and now is operating in 13 states. As of Jun 30, 2023, it had invested assets of $306 million, 79% of which was in fixed income to enhance stability. Refining risk evaluation and improving efficiency are expanding its profit levels.

Last month, HCI Group’s subsidiary, HCPCI, assumed around 53,750 policies from the state-backed insurer in Florida, with an acceptance rate of 74%. The assumed policies represented an in-force premium of around $196 million.

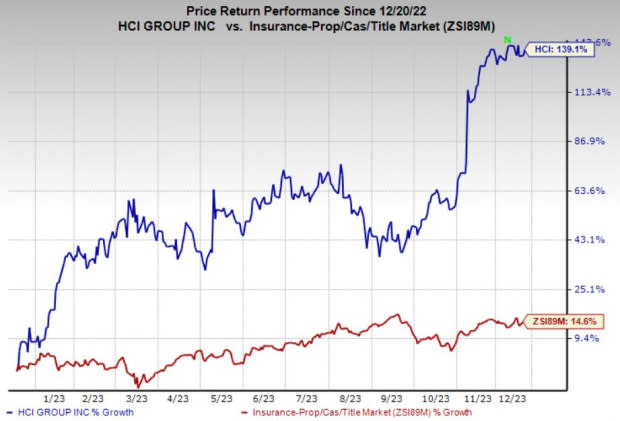

Price Performance

Over the past year, shares of HCI have jumped 139.1%, outperforming the industry’s 14.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

HCI Group currently sports a Zacks Rank #1 (Strong Buy). Some other top-ranked stocks in the broader Finance space are Assurant, Inc. AIZ, Brown & Brown, Inc. BRO and Chubb Limited CB. While Assurant sports a Zacks Rank #1 at present, Brown & Brown and Chubb carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Assurant’s current-year earnings indicates a 31% year-over-year increase. It beat earnings estimates in all the past four quarters, with an average surprise of 42.4%. Also, the consensus mark for AIZ’s 2023 revenues suggests 5.4% year-over-year growth.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $2.76 per share, which indicates 21.1% year-over-year growth. It has witnessed five upward estimate revisions against none in the opposite direction during the past 60 days. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 12.3%.

The consensus mark for Chubb’s current-year earnings indicates a 25.9% year-over-year increase. It beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 6.5%. Furthermore, the consensus estimate for CB’s 2023 revenues suggests 10.6% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report