Health care costs are still a crushing problem

Andrew Luccock pays about $1,700 per month for health insurance for his family of 5—and still expects to pay more than $25,000 out-of-pocket this year for medical care. That will total around $45,000 for premiums and uncovered expenses in 2018–on top of a similar outlay last year.

“I’m angry. I feel trapped,” the 58-year-old insurance broker form Portland, Ore., tells Yahoo Finance. “I have enough cash flow coming in, but I keeping thinking, how does a normal person pay for this?”

Congress fought some epic battles over health care during the last year—and in the end did precisely nothing to help a slice of Americans struggling with soaring health insurance premiums and out-of-pocket expenses. The Trump administration, meanwhile, killed a subsidy associated with the Affordable Care Act, raising costs even more for those already facing the sharpest increases.

The most crushing price hikes are hitting people who don’t get insurance from an employer or government program, and purchase it individually on the so-called non-group market. These over-the-barrel consumers tend to be small-business owners or independent contractors, and the steepest premiums hit those between 50 and 64. For people getting insurance through an employer, premiums rose just 3% in 2017 on average, according to the Kaiser Family Foundation. But premiums for individual policies rose a whopping 20%, and premium increases in 2018 may very well surpass last year’s.

That’s happening for a couple of reasons. First, many insurers participating in the marketplaces set up under the Affordable Care Act set premiums too low when the law first went into effect in 2014. They’ve since adjusted upward, with sharp hikes in premiums for some customers. There are rules limiting premium increases under Obamacare itself, and big employers have negotiating leverage that helps keep a lid on the premiums their workers pay. But purchasers in the non-group market have hardly any leverage, so insurers have shifted the biggest price hikes there.

President Trump’s decision last October to end “cost-sharing reduction” payments to insurers probably pushed premiums up even more, since insurers had to find additional ways to offset rising costs. Again, raising premiums on individual policy purchasers is the path of least resistance. Complete data for 2018 isn’t available yet, but Kaiser found likely premium increases ranging from 17% for a low-cost plan offering modest coverage to 32% for a medium-priced plan that covers more.

Obamacare, as the ACA is known, provides subsidies for lower-income people buying insurance through an exchange, so they don’t feel the full sting of higher premiums. But people who earn too much to qualify for subsidies have no such protection, and end up bearing the full brunt of all the price hikes insurers are loading onto individual purchasers. There are about 10 million Americans covered by plans purchased on the individual market without ACA subsidies.

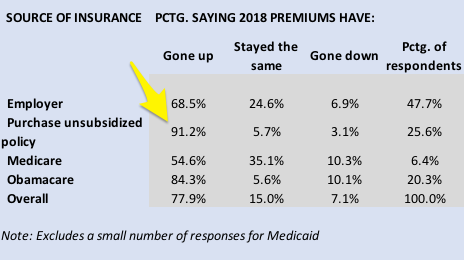

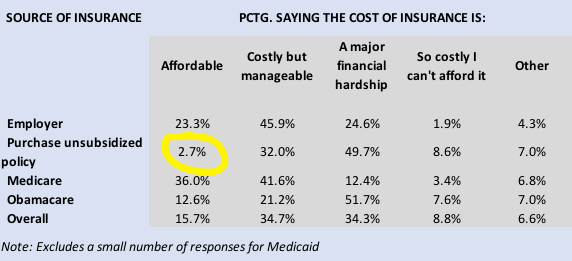

Yahoo Finance surveyed more than 1,400 readers on their insurance costs from Jan. 12 – 15, and found more pain among people purchasing individual policies than those covered by any other source. More than 58% of people buying individual coverage said the cost was unaffordable or a major hardship, compared with just 43% overall. And 91% of those purchasing an individual policy said premiums went up this year, compared with just 78% of all respondents.

Luccock, who buys insurance on the individual market, started seeing substantial price hikes in 2017, after his prior insurer pulled out of Oregon, unable to turn a sufficient profit. Monthly premiums rose from $1,050 per month to $1,350 under the new insurer, and then to $1,700 for 2018. Luccock’s 23-year-old son injured his back in 2016, requiring two medical procedures last year. But insurance would only pay for one, forcing Luccock to pay more than $40,000 out of pocket for the other. He paid half upfront last year, with the rest due this year.

Since Luccock is an insurance broker who understands how the market works, he’s contemplating alternatives to traditional insurance. “I’m thinking I could put $4,000 or $5,000 a month into an investment account and eventually be able to cover most medical expenses myself,” Luccock says. “In the worst case, if something terrible happened, I’d just go bankrupt. How crazy is it for somebody like me to even contemplate self-insuring?”

Going without

Others are giving up on insurance altogether. Mark Viator, a retired statistician living in Crofton, Md., had been buying insurance on the individual market since he left a government job in 2005. But with his premiums due to rise 40% from 2016 to 2017, he decided to go without. “That’s just an astonishing rate of growth,” he says. “That stunned me. For me, it’s the costs being out of control.” Viator, 61, has a condition that will require some orthopedic work on his hand, but he figures he’ll negotiate a cash price with doctors—and otherwise simply wait it out until he qualifies for Medicare in 4 years.

Brian, a 60-year-old business owner who lives near Ft. Lauderdale, is also looking ahead to the moment he qualifies for Medicare—but with a lot more trepidation. His wife suffers from multiple sclerosis and requires costly medication, so going without insurance isn’t an option. Monthly premiums for the two of them have risen from about $1,800 per month in 2014 to $3,140 per month this year—a 74% increase during that time, or 19% per year. Including deductibles, the cost of insurance is about $31,000 per year.

“That’s a crazy amount of money,” says Brian, who asked that we not use his last name. Paying that much for insurance leaves less to put into retirement funds or invest back in his business, and fellow business owners he knows face the same crunch. “We don’t have any buying power as a group,” Brian says. “We feel like we’re underheard and underrepresented. Nobody talks about it any more.”

Focus on killing Obamacare

The big fight in Congress last year wasn’t about solving the problem of runaway costs that millions of Americans face. That battle was strictly about killing Obamacare, which would have checked a Republican wish-list item but also would have axed insurance for millions, while doing little to rein in costs. Three Republican-led efforts to kill Obamcare failed.

Obamacare is, in fact, partly to blame for the predicament individual insurance buyers face. By establishing minimum coverage levels and phasing out subsidies at certain income levels, the 2010 law left an island of consumers in the individual market uniquely vulnerable to rising costs. But the law also did a lot of good, and repealing it outright would leave 20 million people or so without insurance.

The Trump administration made two changes last year that will probably affect insurance and medical costs in the future—but not favorably. The tax cuts President Trump signed in December included a repeal of the individual mandate requiring all Americans who can afford health insurance to purchase it. That will save money for people who choose not to buy insurance, provided they don’t get sick or hurt. But it will probably push premiums even higher for individual insurance purchasers, because there will be fewer healthy people in the insurance pool and a larger portion of sick people requiring costly care. Inevitably, those hikes in premiums and out-of-pocket costs will flow to the individual market.

Trump also plans to allow the sale of “association health plans,” which tend to offer stripped-down benefits at a lower cost than typical plans. That could lower costs for some, but these plans are controversial because they’ve been associated with fraud in the past. They could also siphon off healthy consumers from broader insurance pools, which, again, would push rates higher for those who remain.

There are better ways to address spiraling costs. The U.S. system is riddled with middlemen and incentives that reward the amount of care provided, rather than the effectiveness of care. There are many sound ideas for how to better control costs, if Congress were interested in real solutions. The government could even provide last-resort catastrophic care to those who can’t afford a traditional policy but want minimal coverage in case of disaster—an idea once backed by conservative icon Milton Friedman, but rejected now by conservatives seemingly opposed to any government role in anything. For the time being, meanwhile, health reform in the United States is more likely to go backward than forward.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available.

Read more:

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn