HealthEquity (HQY): A Comprehensive Analysis of Its Market Value

With a gain of 4.63% and a 3-month increase of 13.6%, HealthEquity (NASDAQ:HQY) has been making notable strides in the stock market. The company reported an Earnings Per Share (EPS) of 0.15, raising the question: is the stock fairly valued? This article presents an in-depth analysis of HealthEquity's valuation, providing valuable insights for potential investors.

Company Overview

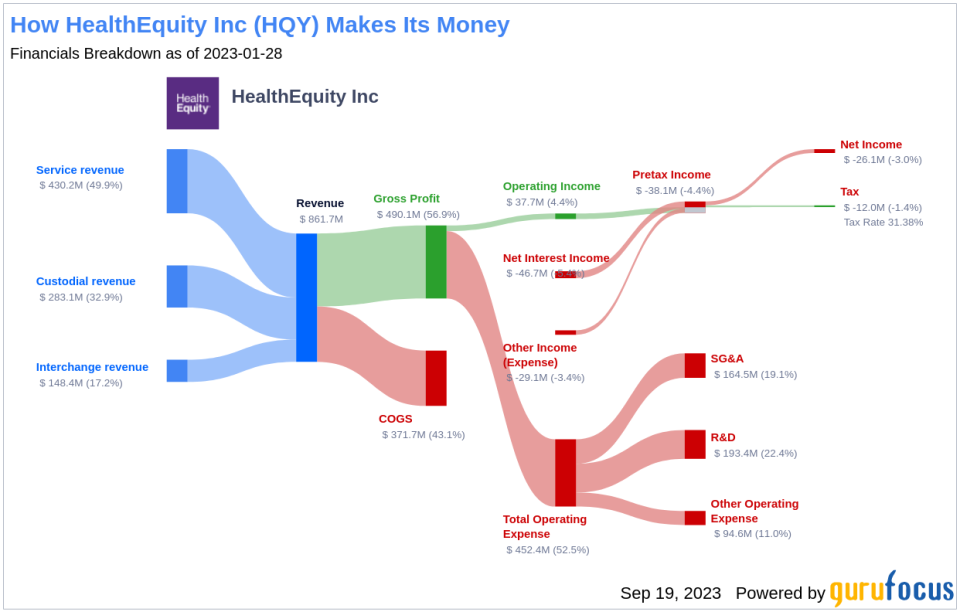

HealthEquity Inc is a leading provider of solutions that enable consumers to make informed healthcare saving and spending decisions. The company's innovative technology provides customers with visibility into their tax-advantaged healthcare savings, facilitates comparison of treatment options and pricing, and offers a platform for paying healthcare bills, receiving benefit information, and earning wellness incentives.

HealthEquity primarily partners with health plans and employers, serving as the custodian of its customers' health savings accounts (HSAs). The company also engages in reimbursement arrangements, offers healthcare incentives to its members, and provides investment advisory services to customers with account balances exceeding a certain threshold. HealthEquity generates its revenue in the United States.

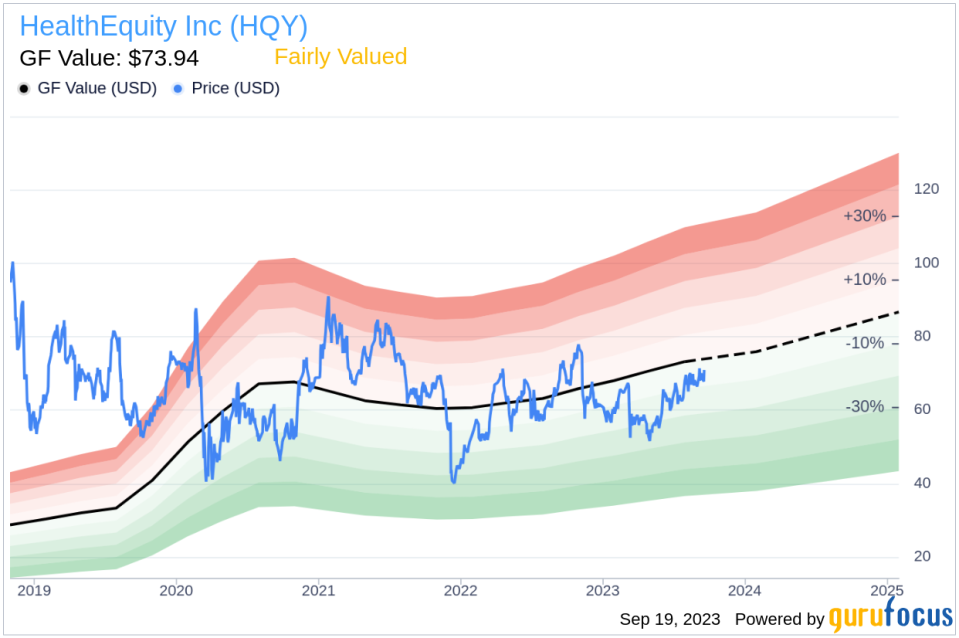

With a current stock price of $70.95, the question arises: how does this compare with the company's fair value? To answer this, we delve into the GF Value of HealthEquity.

Understanding GF Value

The GF Value is a unique measure that represents the intrinsic value of a stock, calculated based on historical multiples, an adjustment factor from GuruFocus based on past returns and growth, and future business performance estimates. The GF Value Line on our summary page offers an overview of the fair value at which the stock should ideally be traded.

According to the GF Value, HealthEquity (NASDAQ:HQY) appears to be fairly valued. The stock's current price of $70.95 per share aligns closely with the GF Value estimate, indicating a balanced valuation. Because HealthEquity is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

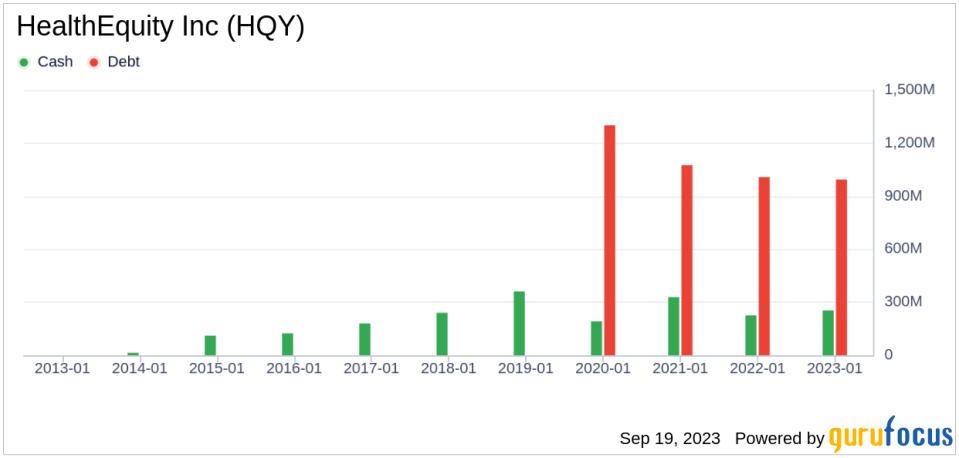

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to assess a company's financial strength before deciding to invest. HealthEquity has a cash-to-debt ratio of 0.31, ranking it lower than 65.24% of 656 companies in the Healthcare Providers & Services industry. GuruFocus ranks HealthEquity's financial strength as 6 out of 10, suggesting a fair balance sheet.

Profitability and Growth

Investing in profitable companies, especially those consistently profitable over the long term, poses less risk. HealthEquity has been profitable 8 out of the past 10 years. Over the past twelve months, the company had a revenue of $937.90 million and Earnings Per Share (EPS) of $0.15. Its operating margin is 8.93%, ranking better than 69.62% of companies in the Healthcare Providers & Services industry. GuruFocus ranks HealthEquity's profitability at 9 out of 10, indicating strong profitability.

Another crucial factor in a company's valuation is growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. HealthEquity's average annual revenue growth is 9.5%, ranking better than 53.05% of companies in the Healthcare Providers & Services industry. However, the 3-year average EBITDA growth is 4.1%, ranking worse than 59.85% of companies in the same industry.

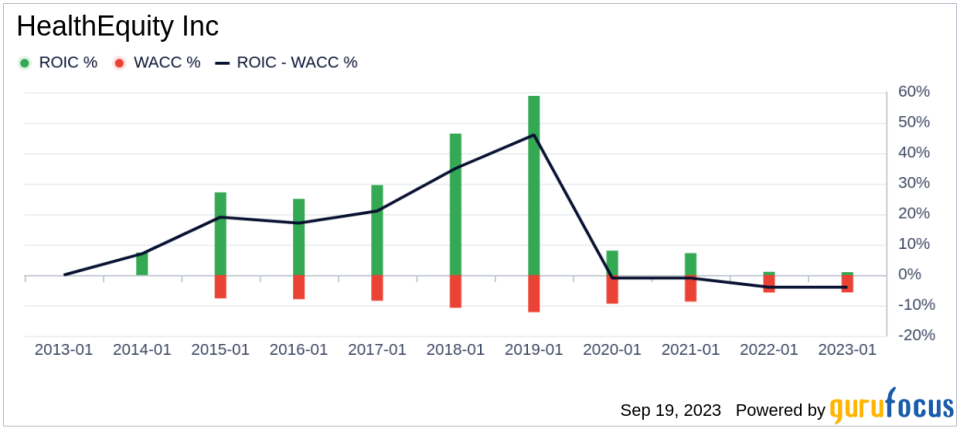

ROIC vs WACC

Profitability can also be evaluated by comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC). ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Over the past 12 months, HealthEquity's ROIC was 2.14, while its WACC was 5.83.

Conclusion

In conclusion, the stock of HealthEquity (NASDAQ:HQY) appears to be fairly valued. The company's financial condition is fair, and its profitability is strong. However, its growth ranks lower than 59.85% of companies in the Healthcare Providers & Services industry. To learn more about HealthEquity stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.