HealthEquity Inc (HQY) Reports Strong Fiscal Year 2024 Earnings with Revenue Up 16%

Revenue: $999.6 million, a 16% increase from FY23.

Net Income: $55.7 million, a significant improvement from a net loss of $26.1 million in FY23.

Adjusted EBITDA: $369.2 million, up 36% from $272.3 million in FY23.

HSAs: 8.7 million, a 9% increase from FY23.

Total HSA Assets: $25.2 billion, a 14% increase from FY23.

Acquisition: Agreement to acquire BenefitWallet HSA portfolio.

Outlook FY25: Revenue projected to increase by approximately 15%, and Adjusted EBITDA by 20%.

On March 19, 2024, HealthEquity Inc (NASDAQ:HQY) released its 8-K filing, announcing financial results for the fourth quarter and fiscal year ended January 31, 2024. The company, a leading provider of health savings accounts (HSAs) and other consumer-directed benefits (CDBs), reported a nearly $1 billion revenue milestone and a significant turnaround to net income profitability.

HealthEquity Inc (NASDAQ:HQY) provides technology-driven solutions to simplify healthcare savings and spending for consumers. Its platform enables customers to manage their tax-advantaged healthcare savings, make informed treatment choices, settle healthcare bills, and earn wellness incentives. The company partners with health plans and employers, serving as the custodian for HSAs, and also offers investment advisory services for accounts exceeding certain thresholds. HealthEquity operates primarily in the United States and generates revenue through service, custodial, and interchange fees.

Fiscal Year Financial Highlights

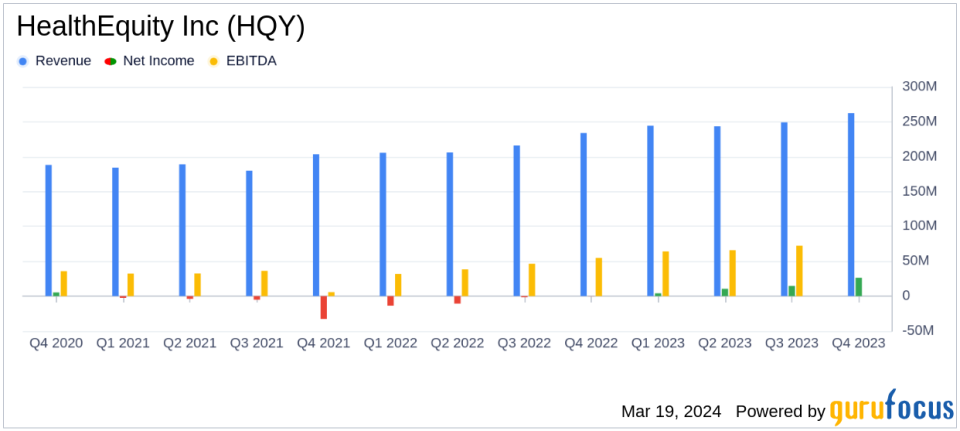

The fiscal year's revenue reached $999.6 million, a 16% increase from the previous year's $861.7 million. This growth was driven by service revenue of $455.7 million, custodial revenue of $386.6 million, and interchange revenue of $157.3 million. Net income saw a dramatic shift from a net loss of $26.1 million in FY23 to a net income of $55.7 million in FY24. Earnings per diluted share also reflected this positive change, with $0.64 per share compared to a net loss per diluted share of $0.31 in the prior year.

Adjusted EBITDA for the year stood at $369.2 million, marking a 36% increase from FY23's $272.3 million, and representing 37% of revenue. The company ended the fiscal year with $404.0 million in cash and cash equivalents and a reduced debt net of issuance costs to $875.0 million.

Fourth Quarter Financial Performance

The fourth quarter continued the upward trend with revenue of $262.4 million, a 12% increase from the same quarter in the previous year. Net income for the quarter was $26.4 million, a significant improvement from a net loss of $0.2 million in Q4 FY23. Adjusted EBITDA for the quarter was $98.8 million, up 34% from Q4 FY23.

HealthEquity's account and asset metrics also showed growth, with HSAs increasing by 9% to 8.7 million, including a 13% increase in HSAs with investments. Total HSA Assets grew by 14% to $25.2 billion. The company also announced the acquisition of the BenefitWallet HSA portfolio, which is expected to close in the first half of fiscal 2025.

For the fiscal year ending January 31, 2025, management expects revenues of $1.14 billion to $1.16 billion, net income between $73 and $88 million, and Adjusted EBITDA of $438 million to $458 million.

Analysis and Outlook

HealthEquity's fiscal year 2024 results demonstrate the company's robust growth trajectory and operational efficiency. The significant increase in revenue and the swing to net income profitability underscore the company's ability to scale effectively while managing costs. The growth in HSAs and total HSA assets reflects the company's competitive position in the market and its success in capitalizing on the increasing consumer demand for health savings solutions.

The acquisition of the BenefitWallet HSA portfolio aligns with HealthEquity's growth strategy and is expected to further enhance its market share. The positive business outlook for fiscal 2025, with anticipated revenue and Adjusted EBITDA growth, suggests continued confidence in the company's ability to deliver value to its customers and shareholders.

HealthEquity's President and CEO, Jon Kessler, expressed optimism about the company's direction, stating,

We delivered fiscal 2024 with a record of nearly $1 billion in revenue as well as over 500 bps expansion in Adjusted EBITDA margin,"

and indicating a strong position for continued growth in the upcoming fiscal year.

Investors and stakeholders can expect HealthEquity to continue its focus on technological investments and market share expansion, as it navigates the evolving healthcare and benefits administration landscape.

For a more detailed analysis of HealthEquity's financial results, including reconciliations of non-GAAP financial measures, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from HealthEquity Inc for further details.

This article first appeared on GuruFocus.