Heartland books Q3 loss, cuts unprofitable customers and lanes

Heartland Express booked a net loss for the 2023 third-quarter, saying the outcome was the result of a “weak freight environment” as well as “strategic operational changes implemented.”

The North Liberty, Iowa-based truckload carrier has run into difficulty integrating the operations of Contract Freighters Inc. (CFI) and Smith Transport during a freight recession. Heartland (NASDAQ: HTLD) acquired both fleets in a relatively short window last year and, like the rest of the industry, has seen freight fundamentals deteriorate since.

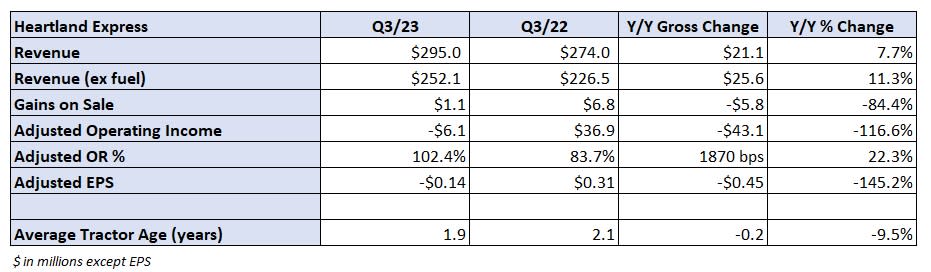

Heartland reported a net loss of 14 cents per share Thursday, which was worse than a consensus EPS estimate of 8 cents and well below the year-ago result of 31 cents. Gains on equipment sales were nearly $6 million lower year over year (y/y), which was a 5 cent headwind. Increased interest expense from debt used to fund the acquisitions was a 4 cent hurdle during the period.

The company expects very little benefit from gains on sale in the fourth quarter compared to gains of $4.1 million last year.

Heartland “targeted unprofitable customers and lanes of freight that were not acceptable for the long term profitability of our organization,” CEO Mike Gerdin said in a news release.

No time frame was provided as to when operations would improve.

“These decisions, while difficult, were made to set a course for the future to ensure that we are prepared to capitalize on stronger freight demand with more efficient operations in the future,” Gerdin continued. “We cannot continue to provide our premium level of service at unprofitable or unsustainable rates.”

Heartland reported an 8% y/y increase in revenue during the quarter to $295 million. Excluding fuel surcharges, revenue was 11% higher y/y but down 5% from the second quarter. The increases were tied to the acquisition of CFI, which only provided a one-month contribution to the year-ago result.

Heartland does not provide operating metrics for utilization and pricing.

The carrier recorded an adjusted operating ratio of 102.4%, which was 1,870 basis points worse y/y.

Most expense lines as a percentage of revenue increased. Salaries, wages and benefits as well as depreciation and amortization each increased by more than 450 bps. Rent and purchased transportation expenses were 280 bps higher.

Legacy operations and the Millis Transfer fleet, which was acquired four years ago, operated at an 89.9% OR through the first nine months of the year. Smith and CFI combined for a 101.6% OR over that period.

Prior to the transactions, it wasn’t uncommon to see Heartland post low-80s ORs.

“We will continue on our path for future operational improvements and cost reduction measures at all four operating brands and remain confident that we can improve our consolidated operating results over time to align with our historical operational expectations,” Gerdin said.

The company ended the quarter with $20 million in cash, a $26 million decline from the second quarter, and $344 million in debt and finance lease obligations, a $5 million reduction over that period. It has an untapped credit line with $88 million in borrowing capacity available.

Cash flow from operations was $125 million in the first nine months of 2023.

Shares of HTLD were off 6.7% at 3:33 p.m. EDT Thursday compared to the S&P 500, which was down 0.9%.

More FreightWaves articles by Todd Maiden

The post Heartland books Q3 loss, cuts unprofitable customers and lanes appeared first on FreightWaves.