Heartland Express Inc (HTLD) Reports Record Annual Operating Revenue Amidst Industry Challenges

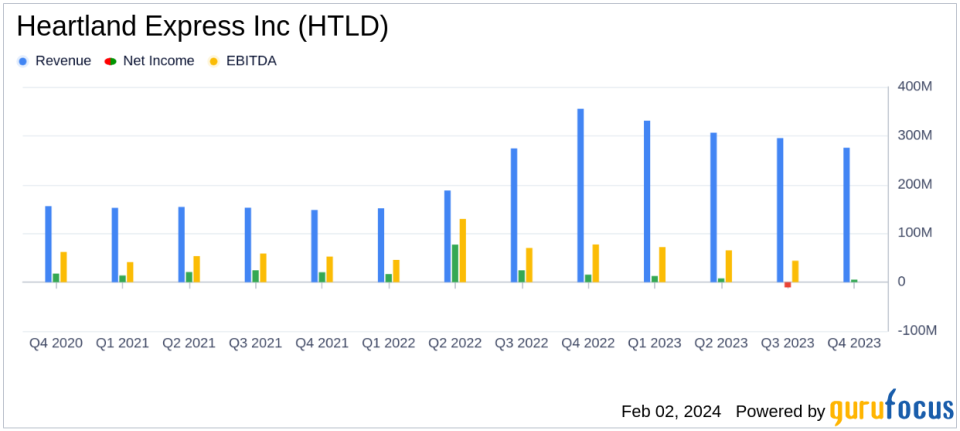

Annual Operating Revenue: Achieved an all-time high of $1.2 billion for the year ended December 31, 2023.

Net Income: Reported $14.8 million for the year, a decrease from the previous year's $133.6 million.

Basic Earnings per Share (EPS): Declined to $0.19 in 2023 from $1.69 in 2022.

Debt Reduction: Paid $114.1 million towards debt reduction in 2023, totaling $195.6 million since acquisitions in 2022.

Operating Ratio: Recorded 96.5% GAAP and 95.4% Non-GAAP Adjusted Operating Ratio for the year.

Cash Flow: Net cash flows from operations were $165.3 million, representing 13.7% of operating revenues.

On February 2, 2024, Heartland Express Inc (NASDAQ:HTLD) released its 8-K filing, announcing financial results for the fourth quarter and the full year ended December 31, 2023. The company, a prominent player in the asset-based truckload services across the United States and Canada, faced a challenging freight environment and excess industry capacity throughout the year. Despite these hurdles, HTLD achieved an all-time high annual operating revenue of $1.2 billion, a testament to its strategic positioning and recent acquisitions.

Financial Performance and Strategic Initiatives

HTLD's performance reflects the broader industry's cyclical nature and the impact of external market conditions. The company's CEO, Mike Gerdin, acknowledged the weaker freight environment and its pressure on financial results, which fell below historical results and management expectations. However, he emphasized the strategic benefits of the company's scale following its acquisitions of Smith Transport and Contract Freighter's, Inc. ("CFI").

These acquisitions not only contributed to the record operating revenues but also allowed HTLD to enhance its service offerings and customer base. The company's proactive approach included divesting certain real estate assets that no longer aligned with its freight patterns, as well as a commitment to reducing debt incurred from the acquisitions.

"Our consolidated operating results for the three and twelve months ended December 31, 2023 reflect the continued weak freight environment combined with excess industry capacity throughout the year... We believe this enhanced scale provides a better strategic position given the cyclical nature of the industry we operate in." - Mike Gerdin, CEO of Heartland Express Inc.

Income Statement and Balance Sheet Highlights

HTLD's net income for the fourth quarter was $5.1 million, with basic earnings per share of $0.06, compared to $15.5 million and $0.20, respectively, in the same quarter of the previous year. The annual net income saw a significant drop from $133.6 million in 2022 to $14.8 million in 2023, with basic earnings per share decreasing from $1.69 to $0.19. The operating ratio for the year was 96.5% GAAP and 95.4% Non-GAAP adjusted, indicating a decrease in operational efficiency compared to the previous year.

The balance sheet shows total assets of $1.5 billion and stockholders' equity of $865.3 million as of December 31, 2023. The company's liquidity position included $28.1 million in cash balances, a decrease from the previous year, and a maintained compliance with financial covenants.

Operational Readiness and Future Outlook

Despite the downturn in net income and EPS, HTLD's management remains focused on improving operational readiness and anticipates future freight demand growth. The company's operating brands, including Heartland Express and Millis Transfer, achieved a combined operating ratio of 86.9%, showcasing the potential for future operational improvements and cost reductions.

HTLD's commitment to shareholder value is evident through regular dividend payments and a robust share repurchase program. The company's strategic initiatives, including debt repayment and fleet management, are aimed at positioning it for long-term success in the transportation industry.

As a value investor or potential member of GuruFocus.com, understanding the intricacies of HTLD's financial health is crucial. The company's ability to navigate industry challenges and its strategic focus on operational efficiency and debt reduction are key factors to consider when evaluating its investment potential.

For a detailed view of Heartland Express Inc's financials, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Heartland Express Inc for further details.

This article first appeared on GuruFocus.