Heavily Shorted Energy Stock Poised to Surge

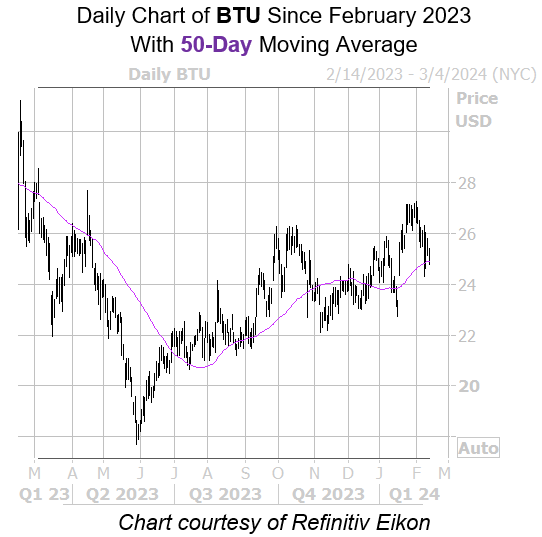

The shares of Peabody Energy Corp (NYSE:BTU) are down 1.4% at $24.78 at last check, but sport a 16.4% nine-month lead, despite struggling with a ceiling at the $27.50 level for much of the past year. The equity is today on track for its third consecutive daily loss, but this pullback may soon have bullish implications, as it has placed BTU near a trendline that has served as a catapult before.

Digging deeper, Peabody Energy stock is within one standard deviation of its 50-day trendline. Per Schaeffer's Senior Quantitative Analyst Rocky White's data, shares saw five similar signals in the past three years, defined for this study as having traded north of this trendline 80% of the time over the last two months, and in eight of the past 10 trading days.

The equity moved higher one month later after each of those instances, with an average 5.4% gain. A comparable move from its current perch would place BTU just below $26.

A short squeeze could power up those gains to set Peabody Energy stock above that aforementioned ceiling. Short interest rose 22.2% in the most recent reporting period, and the 19.55 million shares sold short account for 15% of the equity's available float.

Puts have been more popular than usual, suggesting a sentiment shift in the options pits could bode well for BTU, too. Over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the security's 10-day put/call volume ratio of 2.14 stands higher than 96% of readings from the past year.

Options are affordably priced at the moment, making now an excellent time to weigh in on Peabody Energy stock's next moves. This is per its Schaeffer's Volatility Index (SVI) of 34% that sits higher than 8% of annual readings, indicating traders are now pricing relatively low volatility expectations.