Hecla Mining Company's (NYSE:HL) Share Price Not Quite Adding Up

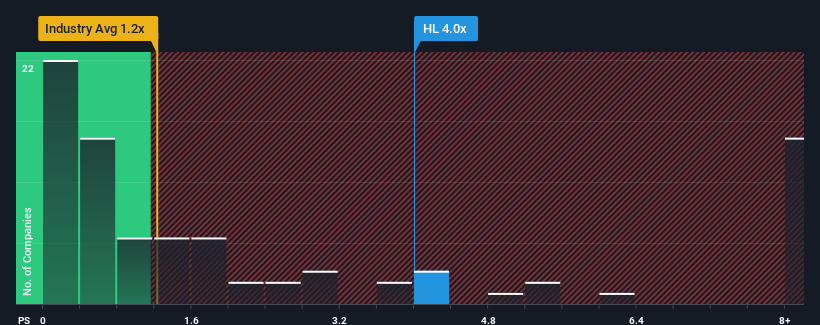

When you see that almost half of the companies in the Metals and Mining industry in the United States have price-to-sales ratios (or "P/S") below 1.2x, Hecla Mining Company (NYSE:HL) looks to be giving off strong sell signals with its 4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hecla Mining

What Does Hecla Mining's P/S Mean For Shareholders?

Recent times have been pleasing for Hecla Mining as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Hecla Mining's future stacks up against the industry? In that case, our free report is a great place to start.

How Is Hecla Mining's Revenue Growth Trending?

In order to justify its P/S ratio, Hecla Mining would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 6.4% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 2.2% per annum over the next three years. With the industry predicted to deliver 533% growth per annum, that's a disappointing outcome.

In light of this, it's alarming that Hecla Mining's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Hecla Mining's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Hecla Mining that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.