Hecla Mining (HL) Halts Lucky Friday Operations Until 2023 End

Hecla Mining Company HL announced that fire at its Lucky Friday mine has been extinguished and normal ventilation has been established. It is creating a secondary egress that will bypass the damaged section of the shaft and has decided to suspend production from the mine for the remainder of 2023.

The new egress will be 1,600 feet longer than the existing ramp and include a 290-foot manway rise.

On Aug 21, 2023, the company experienced a fall of ground incident in one of the shafts at the mine. The accident occurred roughly 500 feet from the bottom of the shaft's active portion. The failure is likely to have been caused by fire. There were no personnel in the mine at the time of the incident since the mine damage occurred at an unused station under repair.

Hecla Mining has property insurance with a $50-million underground sub-limit. It believes, less the deductible, this policy will cover the majority of the property damage and business interruption.

In the second quarter of 2023, the Lucky Friday mine reported a silver production of 1.3 million ounces, attaining its highest level since the first quarter of 2000. The company stated that, as of the end of July 2023, the Lucky Friday mine produced 3 million ounces of silver.

The company does not anticipate a major change in its consolidated silver production projection for 2024. After the end of second-quarter 2023, Hecla Mining projected a silver production of 17.5-18.5.5 million ounces for 2024

It is targeting to reach the 20-million-ounce mark in 2025. The company already produces 45% of the U.S. silver and is gearing up to be Canada’s largest silver producer by 2024.

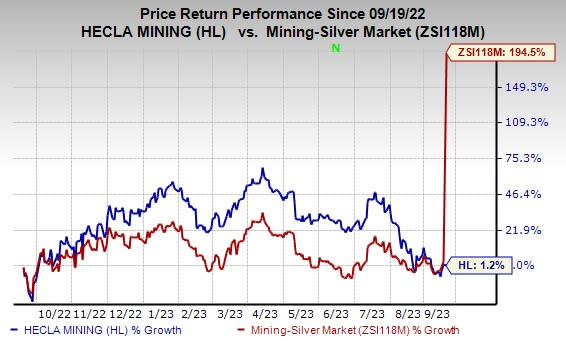

Price Performance

Shares of Hecla Mining have gained 1.2% in the past year compared with the industry's 194.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Hecla Mining currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Hawkins, Inc. HWKN, Carpenter Technology Corporation CRS and L.B. Foster Company FSTR. HWKN and CRS sport a Zacks Rank #1 (Strong Buy) at present, and FSTR carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has an average trailing four-quarter earnings surprise of 25.5%. The Zacks Consensus Estimate for HWKN’s fiscal 2024 earnings is pegged at $3.40 per share. The consensus estimate for 2024 earnings has moved 38% north in the past 60 days. Its shares gained 62.7% in the last year.

Carpenter Technology has an average trailing four-quarter earnings surprise of 10%. The Zacks Consensus Estimate for CRS’s fiscal 2024 earnings is pegged at $3.48 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. Its shares gained 72.9% in the last year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares gained 50.4% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Hecla Mining Company (HL) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report