Hecla Mining (HL) Q2 Silver Production Up 10% Sequentially

Hecla Mining HL reported silver production of 3.6 million ounces in the second quarter of 2022, up 10% on a sequential basis, primarily driven by solid performance at the Lucky Friday mine that surpassed the 1 million ounce mark. Compared with the second quarter of 2021, production was up 3%. Apart from Lucky Friday, the company’s other two operating mines —Casa Berardi and Greens Creek — delivered solid performances as well.

Gold production was up 10% to 45,718 ounces compared with the first quarter of 2022, aided by improved performance at the Casa Berardi mine. However, compared with the last year’s comparable quarter, gold production was down 23%. Lead production was 13,331 tons, up 23% on a sequential basis and 16% year over year, backed by higher production at Lucky Friday. Zinc output went up 12% to 16,766 tons from the first quarter of 2022. Compared with the last year’s quarter, zinc production went down 3%.

Mine Performances

The Lucky Friday mine reported silver production of 1.2 million ounces in the second quarter. This marked a 38% surge from the first quarter of 2022 attributable to 25% higher throughput at the mill and a 9% increase in grades.

Silver production at the Greens Creek mine dipped 1% sequentially to 2.41 million ounces in the quarter. Gold production was up 9% from the first quarter of 2022 to 12,413 ounces due to higher grades.

At the Casa Berardi mine, gold production was up 10% year over year to 33,306 ounces on higher throughput, recoveries, and grades. The mill operated at an average of 4,413 tons per day, compared with an average of 4,291 tons per day in the first quarter of 2022. The mine achieved a record monthly production of 4,533 tons per day in May.

Hecla Mining recently announced that it would acquire all of the remaining outstanding common shares in Alexco Resource Corp. AXU. Alexco is a Canadian primary silver company that owns and operates the majority of the historic Keno Hill Silver District in Canada's Yukon Territory — one of the highest-grade silver districts in the world.

With this buyout, Hecla gains access to a fully permitted property in a premier mining jurisdiction with infrastructure that includes a 400-ton per day mill, on-site camp facility, all-season highway access, and connection to the hydropower grid. It adds to Hecla's significant silver reserves. HL is currently the largest primary silver producer in the United States and the third-largest in the world. Following this buyout, there's a possibility of it becoming Canada's largest silver producer as well.

HL’s Peer Performances in Q2

Endeavour Silver Corporation EXK recently announced that it produced 2.1 million silver equivalent ounces in the second quarter of 2022, which was 7% higher year on year. Consolidated silver production was up 27% year over year to 1,359,207 ounces, courtesy of higher silver production at the Guanacevi mine.

Endeavour Silver’s production for the six months period ended Jun 30, 2022, came in ahead of the anticipated amount at 4.1 million silver equivalent ounces on the back of higher ore grades at Guanacevi, which continues to exceed expectations for both silver and gold. Supported by this outperformance, EXK anticipates surpassing its guidance of 6.7-7.6 million silver equivalent ounces for the year.

Fortuna Silver Mines Inc. FSM reported silver production of 1,652,895 ounces in the second quarter of 2022, reflecting a 13% drop from last year's quarter. This was due to a 9% decline in head grade at the San Jose mine, which was in line with the Mineral Reserve average grade for the second quarter. FSM’s silver’s gold output soared 100% year on year to 62,171 ounces, driven by higher contributions from the Lindero and Yaramoko mines. Gold-equivalent ounces (GEOs) came in at 96,712 in the quarter.

For 2022, FSM expects silver production between 6.2 and 6.9 million ounces and gold production between 244 and 280 thousand ounces. GEOs for 2022 are anticipated to be 369,000-420,000 ounces.

Price Performance

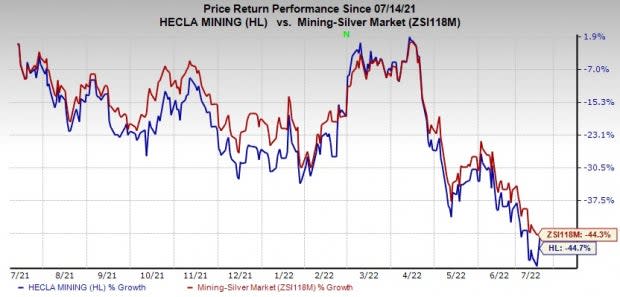

Image Source: Zacks Investment Research

Shares of Hecla Mining have fallen 44.7% in a year’s time compared with the industry's decline of 44.3%.

Zacks Rank

Hecla Mining currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hecla Mining Company (HL) : Free Stock Analysis Report

Alexco Resource Corp (AXU) : Free Stock Analysis Report

Endeavour Silver Corporation (EXK) : Free Stock Analysis Report

Fortuna Silver Mines Inc. (FSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research