Hedge Your Bet With These Dividend Payers

A great investment for income investors with a long time horizon is in dividend-paying companies like Granite Real Estate Investment Trust. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. As a long term investor with a short term temperament, I highly recommend these top dividend stocks.

Granite Real Estate Investment Trust (TSX:GRT.UN)

Granite Real Estate Investment Trust owns and manages industrial, warehouse, and logistics properties in North America and Europe. Started in 1998, and currently run by Michael Forsayeth, the company provides employment to 48 people and with the stock’s market cap sitting at CAD CA$2.35B, it comes under the mid-cap stocks category.

GRT.UN has a substantial dividend yield of 5.21% and the company currently pays out 45.27% of its profits as dividends , with an expected payout of 68.42% in three years. Despite there being some hiccups, dividends per share have increased during the past 10 years. The company has a lower PE ratio than the CA Equity Real Estate Investment Trusts (REITs) industry, which interested investors would be happy to see. The company’s PE is currently 9.3 while the industry is sitting higher at 12.

Exchange Income Corporation (TSX:EIF)

Exchange Income Corporation engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide. The company size now stands at 3265 people and has a market cap of CAD CA$1.02B, putting it in the small-cap category.

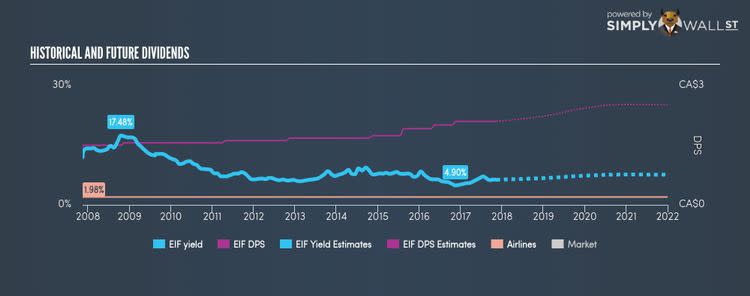

EIF has a large dividend yield of 6.33% and is paying out 87.81% of profits as dividends , with analysts expecting a 101.56% payout in three years. Over the past 10 years, EIF has increased its dividends from $1.44 to $2.1. They have been dependable too, not missing a single payment in this time. Exchange Income’s earnings growth over the past 12 months has exceeded the CA Airlines industry, with the company reporting an EPS growth of % while the industry totaled 0.055785%.

AGF Management Limited (TSX:AGF.B)

AGF Management Limited is a publicly owned asset management holding company. Started in 1957, and currently run by Blake Goldring, the company size now stands at 494 people and with the stock’s market cap sitting at CAD CA$664.75M, it comes under the small-cap group.

AGF.B has a solid dividend yield of 3.82% and is distributing 51.47% of earnings as dividends , with analysts expecting a 52.11% payout in the next three years. Even though dividends per share have dropped over the last 10, I’d argue that this is tolerable given the fact that they haven’t missed a payment in this time, and dividend hunters are after reliability. AGF Management’s earnings per share growth of % outpaced the CA Capital Markets industry’s -0.013% average growth rate over the last year.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.