Hedge Your Bet With These Transport Dividend Payers

The professional services sector tends to be highly cyclical, impacting companies operating in areas ranging from airlines to auto parts and equipment to infrastructure. As such, the position a company has relative to the economic cycle drives its level of profitability. Cash flow availability also drives dividend payout, so in times of growth, these transport companies could provide hefty dividend income for your portfolio. Here are my top dividend stocks in the transport and automobile industry that could be valuable additions to your current holdings.

Kwoon Chung Bus Holdings Limited (SEHK:306)

306 has a substantial dividend yield of 5.52% and the company currently pays out 41.13% of its profits as dividends . Despite some volatility in the yield, DPS has risen in the last 10 years from HK$0.025 to HK$0.24. Kwoon Chung Bus Holdings is also reasonably priced, with a PE ratio of 7.5 that compares favorably with the HK Transportation average of 15.3. More on Kwoon Chung Bus Holdings here.

Guangdong Yueyun Transportation Company Limited (SEHK:3399)

3399 has a great dividend yield of 4.47% and the company has a payout ratio of 30.67% . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from CN¥0.084 to CN¥0.20. Guangdong Yueyun Transportation’s earnings per share growth of 23.96% over the past 12 months outpaced the hk logistics industry’s average growth rate of 13.32%. More detail on Guangdong Yueyun Transportation here.

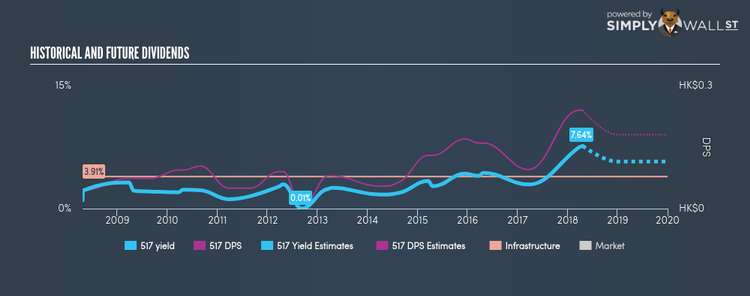

COSCO SHIPPING International (Hong Kong) Co., Ltd. (SEHK:517)

517 has a substantial dividend yield of 7.64% and is paying out 77.37% of profits as dividends . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from HK$0.045 to HK$0.24. More on COSCO SHIPPING International (Hong Kong) here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.