Here’s What Hedge Funds Think About Comerica Incorporated (CMA)

At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Hedge fund interest in Comerica Incorporated (NYSE:CMA) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren't the only variables you need to analyze to decipher hedge funds' perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That's why at the end of this article we will examine companies such as Masco Corporation (NYSE:MAS), IDEX Corporation (NYSE:IEX), and Campbell Soup Company (NYSE:CPB) to gather more data points.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren't comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let's view the new hedge fund action regarding Comerica Incorporated (NYSE:CMA).

How have hedgies been trading Comerica Incorporated (NYSE:CMA)?

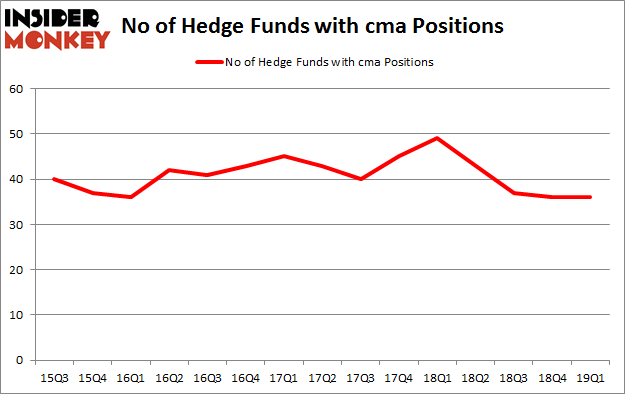

Heading into the second quarter of 2019, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CMA over the last 15 quarters. So, let's see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, John Overdeck and David Siegel's Two Sigma Advisors has the most valuable position in Comerica Incorporated (NYSE:CMA), worth close to $140.8 million, comprising 0.4% of its total 13F portfolio. Sitting at the No. 2 spot is Israel Englander of Millennium Management, with a $102.6 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions include Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital, D. E. Shaw's D E Shaw and Martin Whitman's Third Avenue Management.

Due to the fact that Comerica Incorporated (NYSE:CMA) has witnessed falling interest from hedge fund managers, logic holds that there is a sect of money managers who sold off their positions entirely in the third quarter. At the top of the heap, Gregg Moskowitz's Interval Partners dumped the biggest investment of all the hedgies monitored by Insider Monkey, comprising about $6.2 million in stock. David Costen Haley's fund, HBK Investments, also cut its stock, about $2.6 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let's also examine hedge fund activity in other stocks similar to Comerica Incorporated (NYSE:CMA). These stocks are Masco Corporation (NYSE:MAS), IDEX Corporation (NYSE:IEX), Campbell Soup Company (NYSE:CPB), and Apollo Global Management LLC (NYSE:APO). This group of stocks' market valuations are similar to CMA's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position MAS,40,1105245,6 IEX,16,321069,-3 CPB,28,1032966,-1 APO,18,1406351,-4 Average,25.5,966408,-0.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $966 million. That figure was $579 million in CMA's case. Masco Corporation (NYSE:MAS) is the most popular stock in this table. On the other hand IDEX Corporation (NYSE:IEX) is the least popular one with only 16 bullish hedge fund positions. Comerica Incorporated (NYSE:CMA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CMA wasn't nearly as popular as these 20 stocks and hedge funds that were betting on CMA were disappointed as the stock returned -3.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index