HEICO Corp. (HEI) Q2 Earnings Top Estimates, Guidance Raised

HEICO Corporation HEI reported second-quarter fiscal 2019 earnings of 60 cents per share, surpassing the Zacks Consensus Estimate of 49 cents. The bottom line rose 36.4% from the prior-year quarter’s figure of 44 cents. The year-over-year improvement was driven by higher sales in the reported quarter and a 30% increase in operating income.

Total Sales

Quarterly net sales of $515.6 million outpaced the Zacks Consensus Estimate of $478 million by 7.9%. The top line also increased 19.7% from the year-ago quarter’s $430.6 million. The upside can be primarily attributed to the company’s organic growth and favorable impact from the company’s profitable acquisitions.

Operational Update

HEICO Corp’s total costs and expenses increased 17% year over year to $396.5 million in the reported quarter. The uptick was due to higher cost of sales, and increased selling, general and administrative expenses.

The company’s consolidated operating margin improved to 23.1% in the second quarter of fiscal 2019, up from 21.3% in the second quarter of fiscal 2018.

Segmental Performance

Flight Support Group: Net sales were up 15.1% year over year to $308.3 million, attributable to strong organic growth of 15% along with increased demand and new product offerings within the company’s aftermarket replacement parts and specialty products categories.

Operating income improved 20.7% year over year to $62.2 million, courtesy of net sales growth and improved gross profit margin, mainly reflecting a more favorable product mix within the specialty products category.

Segmental operating margin increased to 20.2% in the second quarter of fiscal 2019, up from 19.2% in the second quarter of fiscal 2018.

Electronic Technologies Group: Net sales rose 27.1% year over year to $214.5 million, majorly owing to increased demand for certain defense, aerospace and space products.

The segment’s operating margin improved to 31.4% in the second quarter of fiscal 2019, up from 28.5% in the second quarter of fiscal 2018.

Operating income increased 39.9% year over year to $67.4 million, largely on account of quarterly net sales growth, improved gross profit margin, and a favorable product mix for certain defense and aerospace products.

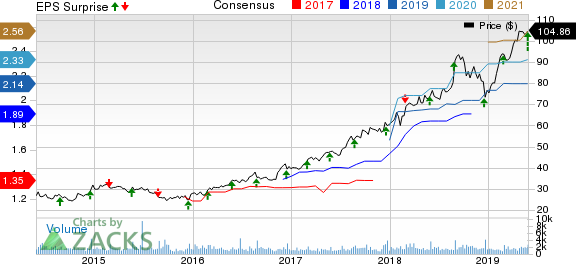

Heico Corporation Price, Consensus and EPS Surprise

Heico Corporation price-consensus-eps-surprise-chart | Heico Corporation Quote

Financial Details

As of Apr 30, 2019, cash and cash equivalents summed $64.1 million compared with $59.6 million as of Oct 31, 2018.

Long-term debt (net of current maturities) totaled $555.5 million as of Apr 30, 2019, up from $531.6 million as of Oct 31, 2018.

For the six months ended Apr 30, 2019, cash provided by operating activities was $178.3 million compared with $103.4 million in the year

ago period.

Fiscal 2019 Guidance

HEICO Corp estimates fiscal 2019 net sales to grow 12-13%, up from its prior growth estimates of 9-11%.

The company also anticipates net income growth of 17-18% for the fiscal, up from the prior growth estimates of 11-13%.

Zacks Rank

HEICO Corp. currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Defense Releases

Textron Inc. TXT reported first-quarter 2019 earnings from continuing operations of 76 cents per share, which surpassed the Zacks Consensus Estimate of 70 cents by 8.6%.

Lockheed Martin Corp. LMT reported first-quarter 2019 earnings of $5.99 per share, which surpassed the Zacks Consensus Estimate of $4.29 by 39.6%.

The Boeing Company BA reported adjusted earnings of $3.16 per share for first-quarter 2019, which outshined the Zacks Consensus Estimate of $3.11 by 1.6%.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Heico Corporation (HEI) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research