HEICO (HEI) Q3 Earnings Beat Estimates, Sales Increase Y/Y

HEICO Corporation’s HEI third-quarter fiscal 2023 earnings per share (EPS) of 77 cents beat the Zacks Consensus Estimate of 74 cents by 4.1%. The bottom line also improved 28.3% from the prior-year period’s 60 cents.

Total Sales

The company’s net sales increased 27% year over year to $722.9 million in the reported quarter, primarily driven by an improvement in the commercial aerospace market. Total sales also beat the Zacks Consensus Estimate of $697 million by 3.7%.

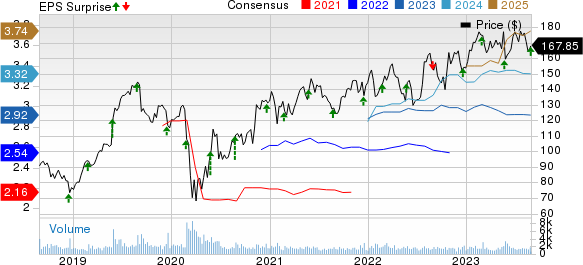

Heico Corporation Price, Consensus and EPS Surprise

Heico Corporation price-consensus-eps-surprise-chart | Heico Corporation Quote

Operational Update

HEICO’s total costs and expenses increased 29.4% year over year to $573.5 million in the quarter under review. The rise was due to the higher cost of sales and SG&A expenses.

Segmental Performance

Flight Support Group: Net sales surged 23% year over year to $405 million. This hike was driven by the increased demand for the majority of its commercial aerospace products and services, resulting from the continued recovery in global commercial air travel.

The operating income soared 26% year over year to $89.2 million. This increase was due to solid net sales growth and an improved gross profit margin. Further, its operating margin expanded by 60 basis points (bps) to 22% compared with 21.4% in the prior-year period.

Electronic Technologies Group: The segment’s net sales increased 33% to $325.9 million, primarily due to the increased demand for its products and net sales contributions from the acquisitions made by the company.

The segment’s operating income improved 9% year over year to $74.2 million, primarily driven by higher net sales volumes. The company’s operating margin contracted by 510 bps to 22.8%.

Financial Details

As of Jul 31, 2023, HEI’s cash and cash equivalents totaled $694.3 million compared with $139.5 million as of Oct 31, 2022.

Cash flow provided by operating activities was $300.4 million during the nine months preceding Jan 31, 2023, highlighting a 7.3% decline from the prior-year period.

HEICO reported long-term debt (net of current maturities) of $1,198.5 million as of Jul 31, 2023, up from $288.6 million as of Oct 31, 2022.

Zacks Rank

HEICO currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

General Dynamics Corporation GD reported a second-quarter 2023 EPS of $2.70, which beat the Zacks Consensus Estimate of $2.59 by 4.2%. However, the figure decreased 1.8% from $2.75 per share recorded in the year-ago quarter.

General Dynamics’ revenues of $10,152 million beat the Zacks Consensus Estimate of $9,413.3 million by 7.8%. The top line also improved 10.5% from that reported in the prior-year period.

Lockheed Martin LMT reported second-quarter 2023 adjusted earnings of $6.73 per share, which surpassed the Zacks Consensus Estimate of $6.43 by 4.7%. The bottom line also improved 6.5% from the year-ago quarter's figure.

Net sales amounted to $16.69 billion in the reported quarter, which surpassed the Zacks Consensus Estimate of $15.86 billion by 5.3%. The top line rose 8.1% from $15.45 billion in the year-ago quarter.

AAR Corp. AIR reported fourth-quarter fiscal 2023 adjusted earnings of 83 cents per share, which surpassed the Zacks Consensus Estimate of 77 cents by 7.8%. Earnings surged 15% from the year-ago quarter.

In the quarter under review, AAR generated net sales worth $553.3 million. The reported figure surpassed the Zacks Consensus Estimate by 4.5% and increased 16.5% from the $474.9 million recorded in the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

AAR Corp. (AIR) : Free Stock Analysis Report

Heico Corporation (HEI) : Free Stock Analysis Report