Helmerich & Payne (HP)'s Hidden Bargain: An In-Depth Look at the 25% Margin of Safety Based ...

Helmerich & Payne Inc (NYSE:HP) experienced a daily loss of -3.87%, with a 3-month gain of 23.24%. The company's Earnings Per Share (EPS) stand at 3.81. Despite these figures, the question remains: is the stock significantly undervalued? In this article, we will delve into the company's valuation analysis, providing insights into its intrinsic value.

Company Introduction

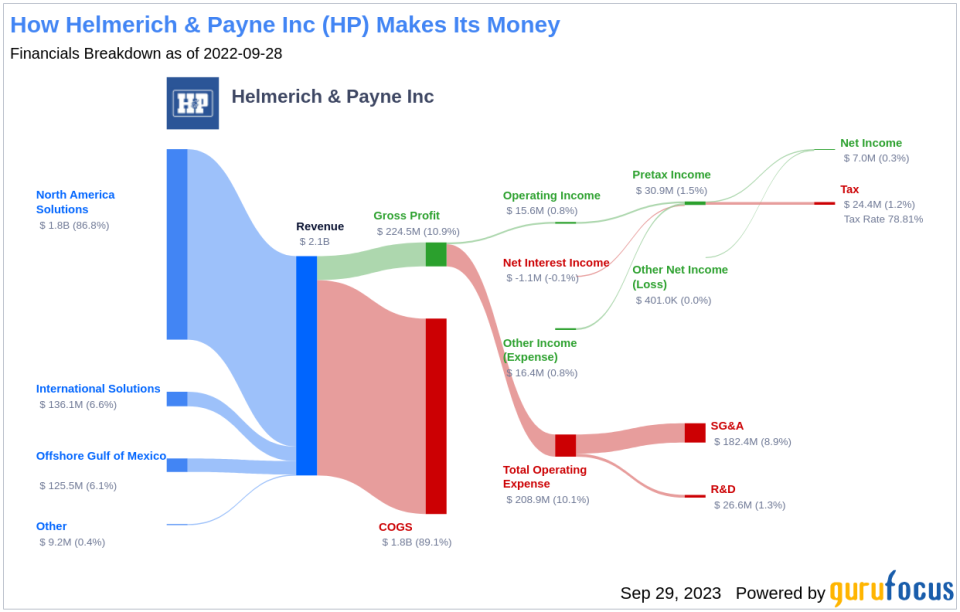

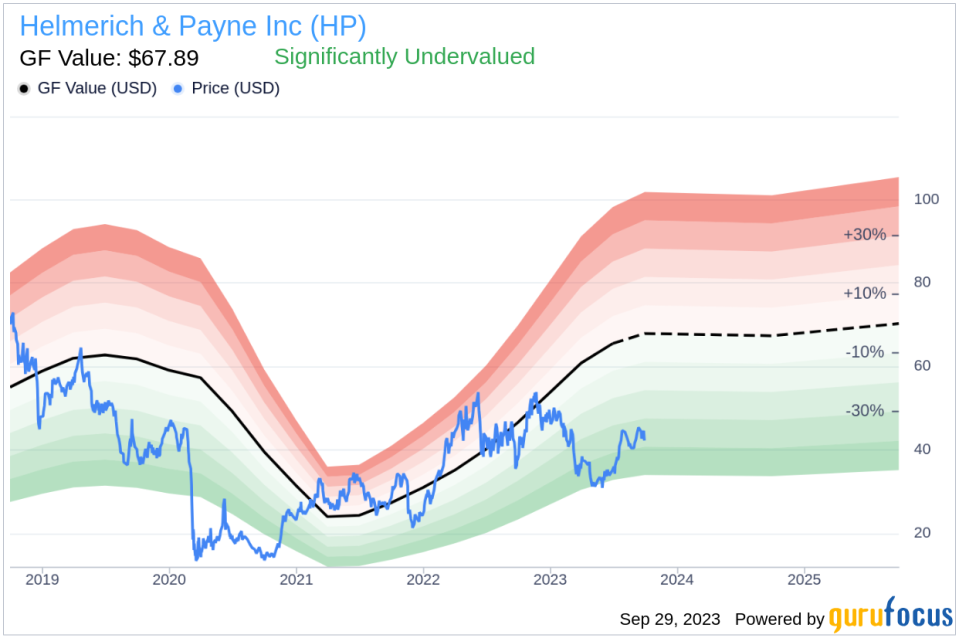

Helmerich & Payne Inc (NYSE:HP) boasts the largest fleet of U.S. land drilling rigs. Its FlexRig line is the leading choice for drilling horizontal wells for U.S. tight oil and gas production. The company has a presence in almost every major U.S. shale play and a growing international presence. With a stock price of $42.34 and a GF Value of $67.89, we see a significant gap, suggesting that the stock might be undervalued.

Understanding GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Currently, Helmerich & Payne (NYSE:HP) is believed to be significantly undervalued. The stock is trading at $42.34 per share, significantly below the GF Value Line, suggesting that the stock may have higher future returns. As a result, the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

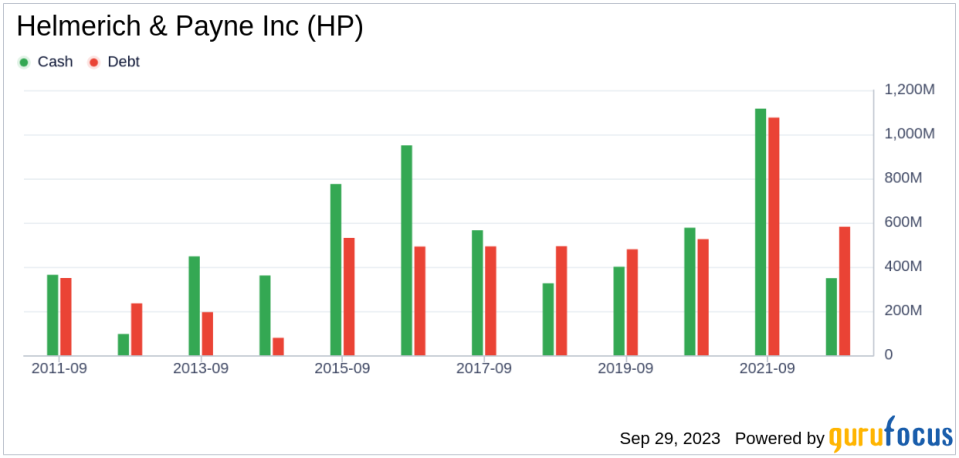

Investing in companies with poor financial strength can lead to a higher risk of permanent loss of capital. Therefore, it's essential to carefully review a company's financial strength before deciding to buy its stock. Helmerich & Payne's cash-to-debt ratio stands at 0.54, better than 50.68% of companies in the Oil & Gas industry. The company's overall financial strength is ranked 8 out of 10 by GuruFocus, indicating strong financial health.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, usually poses less risk. Helmerich & Payne has been profitable 5 times over the past 10 years. With an operating margin of 17.87%, it ranks better than 65.04% of companies in the Oil & Gas industry. However, the company's growth ranks worse than 74.34% of 830 companies in the Oil & Gas industry, with a 3-year average annual revenue growth of -9%.

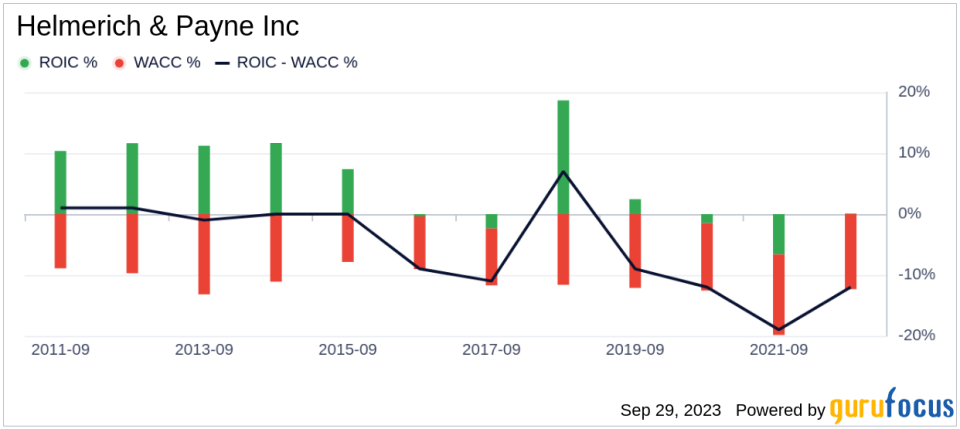

ROIC vs WACC

Another way to evaluate a company's profitability is to compare its return on invested capital (ROIC) and the weighted cost of capital (WACC). For the past 12 months, Helmerich & Payne's ROIC is 10.13, and its cost of capital is 10.84. This comparison offers insights into how well a company generates cash flow relative to the capital it has invested in its business.

Conclusion

In conclusion, Helmerich & Payne's stock appears to be significantly undervalued. The company boasts strong financial health and fair profitability. Despite its lower-than-average growth in the Oil & Gas industry, the stock's current price suggests a promising future return. For more detailed financial information about Helmerich & Payne, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.