Helmerich & Payne Inc (HP) Reports Increased Rig Activity and Revenue Growth in Q1 FY2024

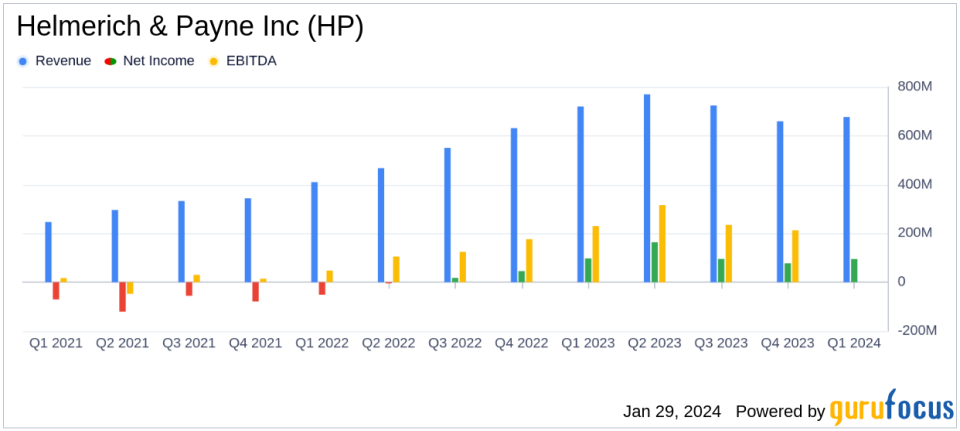

Net Income: Reported $95 million, or $0.94 per diluted share, for the fiscal first quarter of 2024.

Operating Revenues: Increased to $677 million compared to $660 million in the previous quarter.

North America Solutions Segment: Exited Q1 with 151 active rigs and a revenue per day increase to $38,300.

Capital Return to Shareholders: Approximately $90 million returned through dividends and share repurchases.

International Expansion: Preliminary notification of an award for seven super-spec rigs in the Middle East.

Operational Outlook: NAS direct margins expected to be between $255-$275 million in Q2 FY2024.

On January 29, 2024, Helmerich & Payne Inc (NYSE:HP) released its 8-K filing, announcing financial results for the first quarter of fiscal year 2024. The company, known for having the largest fleet of U.S. land drilling rigs and its leading FlexRig line, reported a net income of $95 million, or $0.94 per diluted share, from operating revenues of $677 million for the quarter ended December 31, 2023. This compares to a net income of $78 million, or $0.77 per diluted share, from operating revenues of $660 million for the previous quarter.

Helmerich & Payne's North America Solutions (NAS) segment showed a sequential increase in operating income and direct margins, with the segment exiting the first quarter with 151 active rigs. The company's performance is particularly noteworthy as it indicates resilience in the face of ongoing market volatility in crude oil and natural gas prices. The increase in revenue per day and direct margins per day in the NAS segment underscores the company's operational efficiency and ability to capitalize on market opportunities.

The company's financial achievements, including the return of approximately $90 million of capital to shareholders through dividends and share repurchases, reflect a strong commitment to shareholder returns. This is significant for a company in the Oil & Gas industry, where capital discipline and returns are closely monitored by investors.

Financial Performance Highlights

Helmerich & Payne's financial performance in the first quarter of fiscal 2024 was marked by several achievements:

"The Company performed well both operationally and financially during the first fiscal quarter of 2024 despite the persistent volatility in crude oil and natural gas prices," said President and CEO John Lindsay.

The company's NAS segment anticipates exiting the second quarter with between 154-159 active rigs, indicating a positive outlook for the near term. Additionally, the recent preliminary notification of an award for seven super-spec rigs in the Middle East is a testament to the company's international expansion strategy and its ability to secure new business in a competitive market.

Senior Vice President and CFO Mark Smith also highlighted the company's shareholder capital allocation strategy, emphasizing the return of capital to shareholders through dividends and share repurchases. This approach aligns with the company's goal of delivering superior returns for shareholders.

Analysis of Financial Statements

Key details from the financial statements reveal that Helmerich & Payne's net cash provided by operating activities was $175 million for the first quarter of fiscal year 2024, a decrease from $215 million in the previous quarter. The company's balance sheet remains robust, with cash and cash equivalents of $214 million as of December 31, 2023.

From the income statement, the company's drilling services revenue was $674.6 million for the quarter, while drilling services operating expenses, excluding depreciation and amortization, were $403.3 million. The balance sheet shows a healthy financial position, with total assets of $4.42 billion and total shareholders' equity of $2.76 billion as of December 31, 2023.

Helmerich & Payne's commitment to innovation and technology, as well as its focus on operational efficiency, are key drivers of its financial performance. The company's ability to maintain a strong balance sheet and return capital to shareholders, even amid market volatility, positions it favorably among its peers in the Oil & Gas industry.

For a more detailed analysis and to stay updated on Helmerich & Payne Inc's financial performance and strategic direction, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Helmerich & Payne Inc for further details.

This article first appeared on GuruFocus.