Helmerich & Payne Inc's Meteoric Rise: Unpacking the 32% Surge in Just 3 Months

Helmerich & Payne Inc (NYSE:HP), a leading player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 32.34% over the past quarter, marking a notable increase from its previous performance. Over the past week, the stock price has seen a gain of 2.84%, indicating a continued upward trend. The current market capitalization of the company stands at $4.14 billion, with a stock price of $41.64.

According to GuruFocus.com, the current GF Value of Helmerich & Payne Inc is $67.15, which is higher than its GF Value three months ago, which stood at $63.2. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Despite the increase in the stock price, the company remains significantly undervalued according to the GF Valuation, both currently and three months ago.

Helmerich & Payne Inc: A Brief Overview

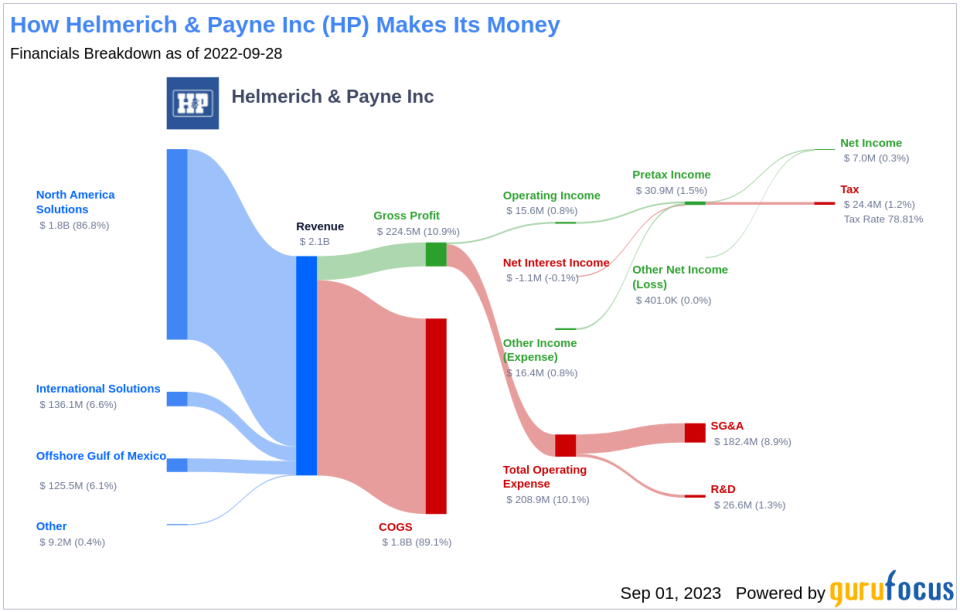

Helmerich & Payne Inc operates in the Oil & Gas industry and boasts the largest fleet of U.S. land drilling rigs. The company's FlexRig line is the leading choice for drilling horizontal wells for the production of U.S. tight oil and gas. With a presence in nearly every major U.S. shale play, H&P also has a small but growing international presence.

Profitability Analysis of Helmerich & Payne Inc

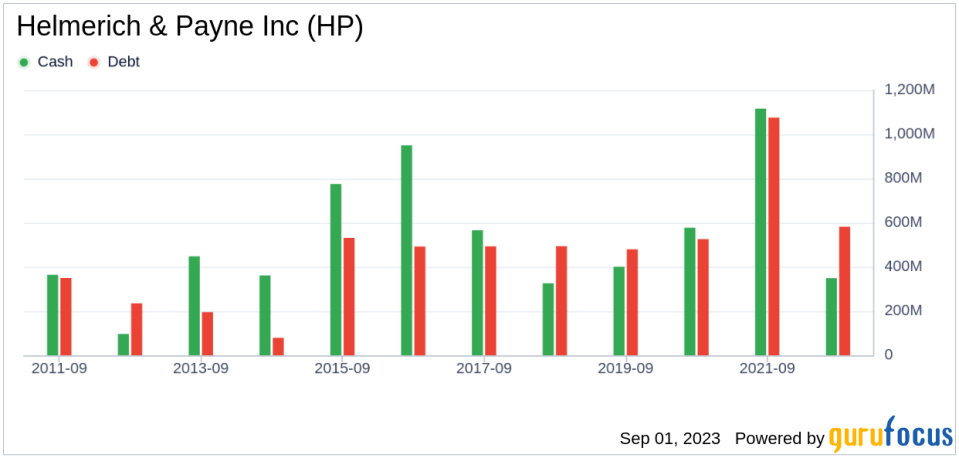

Helmerich & Payne Inc has a Profitability Rank of 5/10, indicating a moderate level of profitability. The company's operating margin stands at 17.87%, better than 64.74% of 967 companies in the same industry. The ROE and ROA are 14.66% and 9.22% respectively, both better than the majority of companies in the industry. The ROIC of 10.13% is also higher than 68.28% of 1075 companies. Over the past decade, the company has had 5 years of profitability, better than 51.58% of 948 companies.

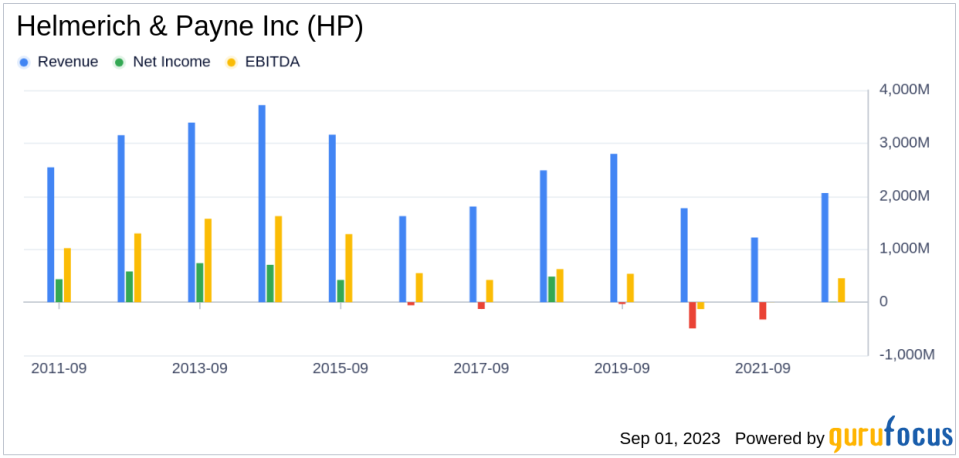

Growth Analysis of Helmerich & Payne Inc

The company's Growth Rank is 1/10, indicating a low growth rate. The 3-year and 5-year revenue growth rate per share are -9.00% and -5.00% respectively. However, the company's total revenue growth rate for the next 3 to 5 years is estimated at 12.81%, better than 82.51% of 263 companies. The EPS without NRI growth rate for the same period is projected at a whopping 165.28%, better than 98.48% of 66 companies.

Major Holders of Helmerich & Payne Inc's Stock

Ken Fisher (Trades, Portfolio), Prem Watsa (Trades, Portfolio), and First Eagle Investment (Trades, Portfolio) are the top three holders of Helmerich & Payne Inc's stock. Ken Fisher (Trades, Portfolio) holds 809965 shares, representing 0.81% of the total shares. Prem Watsa (Trades, Portfolio) holds 555105 shares, accounting for 0.56% of the total shares. First Eagle Investment (Trades, Portfolio) holds a smaller stake of 61012 shares, representing 0.06% of the total shares.

Competitors of Helmerich & Payne Inc

Helmerich & Payne Inc faces competition from Seadrill Ltd(NYSE:SDRL), Patterson-UTI Energy Inc(NASDAQ:PTEN), and Transocean Ltd(NYSE:RIG). Seadrill Ltd has a market capitalization of $4 billion, Patterson-UTI Energy Inc has a market capitalization of $3.64 billion, and Transocean Ltd has a market capitalization of $6.58 billion.

Conclusion

In conclusion, Helmerich & Payne Inc has shown a significant surge in its stock price over the past three months. Despite this, the company remains significantly undervalued according to the GF Valuation. The company has a moderate level of profitability and a low growth rate. However, the projected total revenue growth rate and EPS without NRI growth rate for the next 3 to 5 years are promising. The company faces competition from Seadrill Ltd, Patterson-UTI Energy Inc, and Transocean Ltd. Based on this analysis, Helmerich & Payne Inc presents an interesting investment opportunity for value investors.

This article first appeared on GuruFocus.