Hennessy Japan Fund Bolsters Position in Sompo Holdings Inc with a 2.06% Portfolio Impact

Insightful Moves in the Japanese Equity Market by Hennessy Japan Fund (Trades, Portfolio)

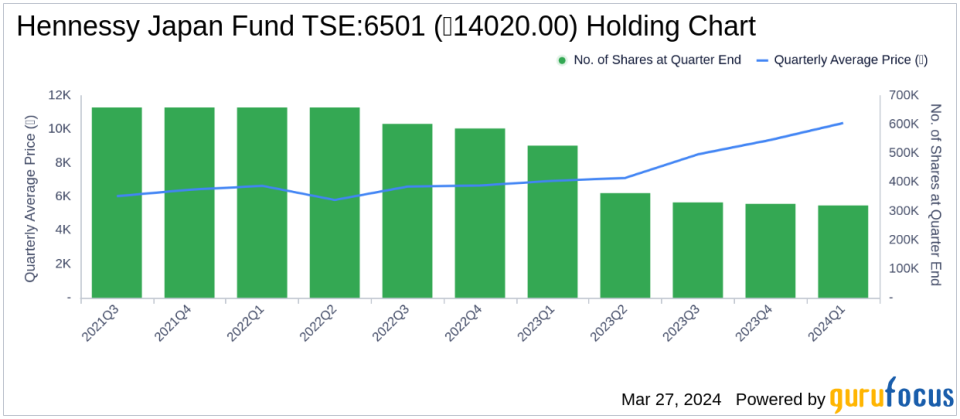

Hennessy Japan Fund (Trades, Portfolio), known for its strategic investments in Japanese equities, has revealed its N-PORT filing for the first quarter of 2024. Established on October 31, 2003, the Fund is dedicated to long-term capital appreciation, focusing on equity securities of Japanese companies. Hennessy's investment philosophy is rooted in a blend of quantitative stock selection and a disciplined, team-managed approach. The Fund targets businesses with strong management and attractive valuations, emphasizing market growth potential, earnings quality, and balance sheet strength. By identifying discrepancies between a company's market price and its fundamental value, the Fund aims to capitalize on arbitrage opportunities, maintaining a concentrated portfolio reflective of the managers' best ideas.

Key Position Increases

During the first quarter of 2024, Hennessy Japan Fund (Trades, Portfolio) augmented its stakes in a total of 12 stocks. Noteworthy increases include:

Sompo Holdings Inc (TSE:8630) saw an addition of 134,100 shares, bringing the total to 287,600 shares. This adjustment marks an 87.36% increase in share count and a 2.06% impact on the current portfolio, valued at ?14,912,480.

MS&AD Insurance Group Holdings Inc (TSE:8725) with an additional 160,400 shares, now totaling 361,300. This represents a 79.84% increase in share count, valued at ?14,919,800.

Summary of Sold Out Positions

The Fund also completely exited holdings in two companies:

MISUMI Group Inc (TSE:9962): All 99,600 shares were sold, impacting the portfolio by -0.54%.

Rohm Co Ltd (TSE:6963): The liquidation of all 29,400 shares caused a -0.17% impact on the portfolio.

Key Position Reductions

Hennessy Japan Fund (Trades, Portfolio) reduced its position in 13 stocks, with significant changes in:

Nippon Telegraph & Telephone Corp (TSE:9432) by 2,832,800 shares, resulting in a -39.72% decrease and a -1.2% portfolio impact. The stock traded at an average price of ?175.91 during the quarter and returned 7.23% over the past three months and 6.79% year-to-date.

Terumo Corp (TSE:4543) by 102,100 shares, marking a -73.56% reduction and a -1.01% portfolio impact. The stock's average trading price was ?4,696.11 during the quarter, with returns of -39.65% over the past three months and -39.08% year-to-date.

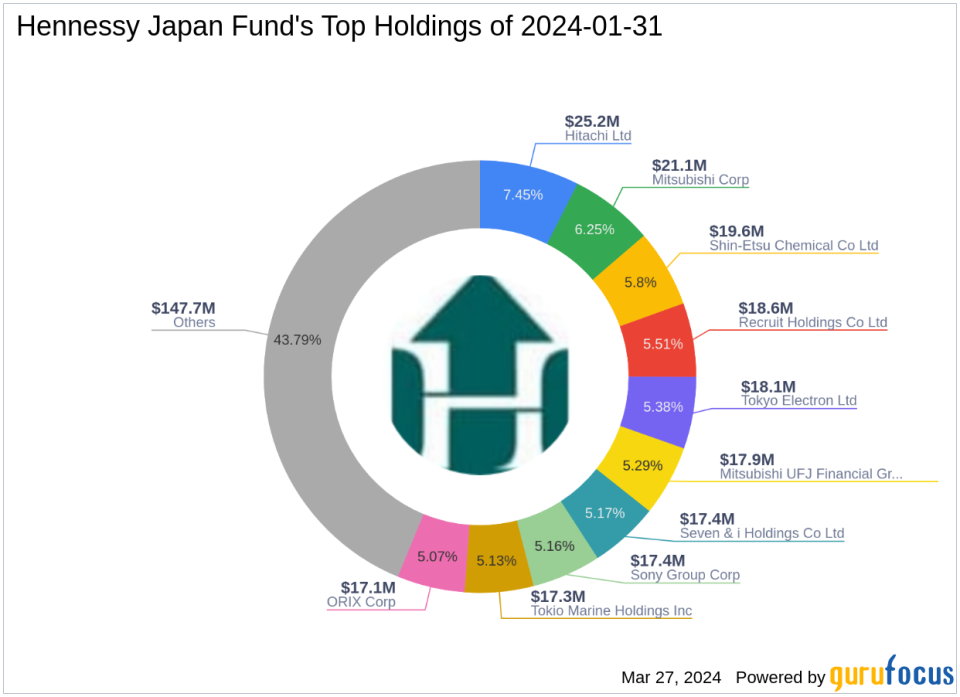

Portfolio Overview

As of the first quarter of 2024, Hennessy Japan Fund (Trades, Portfolio)'s portfolio comprised 27 stocks. The top holdings included 7.45% in Hitachi Ltd (TSE:6501), 6.25% in Mitsubishi Corp (TSE:8058), 5.8% in Shin-Etsu Chemical Co Ltd (TSE:4063), 5.51% in Recruit Holdings Co Ltd (TSE:6098), and 5.38% in Tokyo Electron Ltd (TSE:8035). The Fund's investments are primarily concentrated across eight industries: Financial Services, Industrials, Technology, Consumer Defensive, Basic Materials, Communication Services, Healthcare, and Consumer Cyclical.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.