Henry Schein (HSIC) Sales Hurt by Cyber Attack, Macro Woes

Henry Schein HSIC is currently entangled in a major cyber-attack incident. Headwinds like unfavorable currency movement and global economic uncertainties continue to affect the company. The stock carries a Zacks Rank #4 (Sell).

In October 2023, Henry Schein stated that a portion of its manufacturing and distribution businesses experienced a cybersecurity incident. Henry Schein took precautionary action, including taking certain systems offline, to contain the incident. This led to a temporary disruption of some of Henry Schein’s business operations.

Accordingly, on the third-quarter earnings call, the company stated that 2023 sales growth will be negatively impacted by low to mid-single digits. Henry Schein also estimated 55 cents to 75 cents per share of business interruption impact of the cybersecurity incident in the fourth quarter.

Added to this, the current macroeconomic environment is affecting Henry Schein’s financial operations. Particularly, the exchange rate fluctuations, inflation and recession are adversely impacting the company’s results. Accordingly, governments and insurance companies continue to look for ways to contain the rising cost of healthcare. With sustained macroeconomic pressure, the company may struggle to keep in check its cost of revenues and operating expenses. In the third quarter, Henry Schein’s SG&A expenses rose 11.9% year over year.

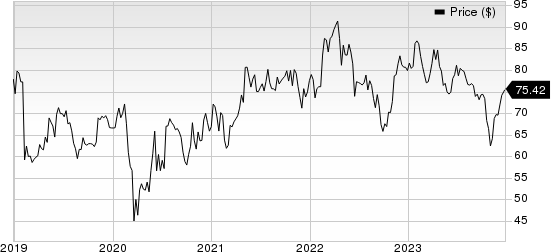

Henry Schein, Inc. Price

Henry Schein, Inc. price | Henry Schein, Inc. Quote

Moreover, fluctuating currency rates also hampered Henry Schein’s growth, given that it derives a substantial amount of its revenues from international markets.

Meanwhile, the U.S. healthcare products and service distribution industry is highly competitive and consists principally of national, regional and local distributors. In the North American dental products market, the company faces stiff competition from Patterson Dental business of Patterson Companies Inc. and Benco Dental Supply.

The competition in the fast-growing animal health market is also fierce, with Patterson Veterinary Supply under Patterson Companies and IDEXX Laboratories gaining traction. Henry Schein operates in a highly competitive medical product distribution market with larger players like McKesson Corp. Moreover, the presence of specialized players like Quality Systems, eClinicalWorks and athenahealth in the electronic medical records market puts Henry Schein in a tight spot. Moreover, the competitive landscape in the overseas market is also tough. The tussle for market share might be a drag on results.

Shares of HSIC have declined 5.1% in the past year against the industry’s 12.6% growth.

On a positive note, Henry Schein’s distribution business boasts a wide global footprint with 61 distribution centers. Apart from North America, the company has a presence in Australia and New Zealand as well as in emerging nations like China, Brazil, Israel, Czech Republic and Poland. The dental distribution business was fueled by an aging global population and a growing awareness of the benefits of preventative care and oral hygiene. We believe Henry Schein’s worldwide reach is a major competitive advantage over other players in the healthcare distribution industry.

In terms of the latest developments in global markets, in the third quarter, Henry Schein’s Global Dental consumable merchandise (LCI) sales increased by 0.3%, excluding PPE products. Global Technology and Value-Added service sales LCI increased 9.6% from the prior-year quarter. The global implant business grew 40%, predominantly through acquisitions during the third quarter.

Henry Schein seems to be upbeat about its dental technology joint venture, Henry Schein One. The dental software business has been progressing well despite a challenging business environment. Henry Schein One’s global growth is driven by the ongoing migration to its cloud-based practice management software solutions, Dentrix Ascend and Dentally, and revenue cycle management business growth, resulting from increased patient traffic, which drives e-claims.

Key Picks

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. Insulet sports a Zacks Rank #1 (Strong Buy), while Haemonetics and DexCom each presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have moved up from $1.90 to $1.91 in the past 30 days. Shares of the company have plunged 26% in the past year compared with the industry’s decline of 2.6%.

PODD’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Haemonetics’ stock has risen 12.3% in the past year. Earnings estimates for Haemonetics have increased from $3.86 per share to $3.89 per share for 2023 and from $4.11 per share to $4.15 per share for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it came up with an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.43 to $1.44 in the past 30 days. Shares of the company have increased 11.2% in the past year compared with the industry’s growth of 2.1%.

DXCM’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report