Henry Schein (HSIC) Set to Post Q2 Earnings: What Awaits?

Henry Schein, Inc. HSIC is set to release second-quarter 2023 results on Aug 7 before the opening bell.

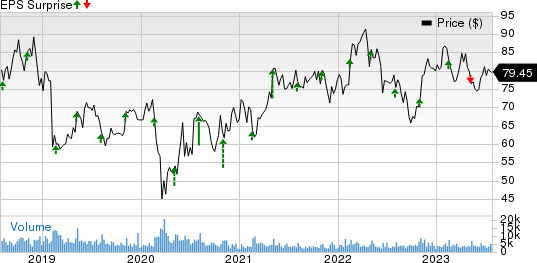

The company posted adjusted earnings per share (EPS) of $1.21 in the last reported quarter, which missed the Zacks Consensus Estimate by 2.42%. Henry Schein beat earnings estimates in two of the trailing four quarters, missed in one and was break-even in one quarter, the average surprise being 0.51%.

Let’s see how things have shaped up prior to this announcement.

Dental Business

Similar to the last reported quarter, HSIC’s dental distribution business is likely to have demonstrated underlying strength in end markets, backed by an aging global population, low unemployment levels and the growing global awareness of the healthcare benefits of preventative care and oral hygiene.

On the equipment side, the company is likely to have delivered solid sales from traditional equipment, with North America expected to have benefited from price increases and growth in the parts and service business. Although we anticipate increased unit sales of intraoral scanners, the declining average selling price per unit is likely to have dented revenues in the to-be-reported quarter.

Henry Schein, Inc. Price and EPS Surprise

Henry Schein, Inc. price-eps-surprise | Henry Schein, Inc. Quote

Internationally, Europe is likely to have posted good sales growth in dental equipment, supported by the equipment backlog and parts and service business. On the last earnings call, Henry Scheinnoted that its global equipment order book, comprising mainly traditional equipment, remains robust and up year over year. This is expected to have significantly benefited the company’s top line in the second quarter.

Within the Global Dental Specialty business, implant sales growth is likely to have been driven by the premium Camlog product line in Germany, Austria and Switzerland. Further, North America is likely to have witnessed the increased trend of dental specialty practices being acquired by larger DSOs (Dental Service Organizations).

Recent highlights across the business include the acquisition of a majority stake in Biotech Dental, one of the largest providers of end-to-end dental solutions. In addition, HSIC has signed a definitive agreement to acquire S.I.N. Implant System, one of Brazil's leading manufacturers of dental implants, pending regulatory approval. Both these transactions are expected to boost Henry Schein’s BOLD+1 strategic plan, which focuses on advancing high-growth, high-margin businesses through organic and acquisition growth.

In terms of the endodontic product offering, the company is likely to have seen growth in the second quarter, backed by Brasseler and Edge brands in North America. The positive development trend of HSIC’s Clear Aligner business, particularly with DSOs, is expected to have been sustained in the quarter under review.

Our model projects global Dental business revenues for the second quarter of 2023 to be $1.94 billion, suggesting a year-over-year improvement of 4.6%.

Medical

Similar to the last quarter, HSIC’s underlying medical business is expected to have witnessed internal sales growth. However, the pace is likely to have been slower than last year, given the prior-year comparison resulting from significant growth.

In May, the company announced the acquisition of Regional Health Care Group, a medical distributor serving the Australia and New Zealand region. The partnership will allow Henry Schein to leverage the countries’ infrastructure and expand its global medical product footprint.

Meanwhile, lower sales of COVID-19 test kits and PPE products are likely to have persisted this quarter also, affecting the top line. Out of the specific product categories, pharmaceutical and equipment sales are likely to have been strong, while point-of-care diagnostic product sales are expected to have dropped to some extent in the second quarter.

Per our model, projected global revenues from the Medical business for the second quarter of 2023 stand at $975.5 million, a decline of 2.1% from the prior-year reported figure.

Technology and Value-Added Services

The business is likely to have gained from the continued strength of the largest segment, Henry Schein One, which provides one of the broadest product offerings of dental practice management, and related software and services.

Growth in North America is likely to have been driven by Dentrix and Dentrix Ascend cloud-based solutions and customers’ upgradation from the Easy Dental product to Dentrix Ascend. International growth is expected to have been supported entirely by cloud-based solutions for customers, particularly in Australia and New Zealand, where it was recently launched.

On the last earnings call, management noted that the total number of customers for cloud-based solutions is up 30% over the last year. We anticipate HSIC to have demonstrated momentum within this part of the business in the second quarter also.

Further, Henry Schein is likely to have witnessed growth in the revenue cycle management insurance claim product in the second quarter, driven by the number of e-claims reprocessed and enhanced functionality by electronic invoicing and reimbursement solutions.

Toward the end of the first quarter, HSIC announced the full integration of Detect AI, powered by Video Health and Bola AI, into Dentrix Ascend. The initial customer uptake of this AI product offering has been well received and is likely to have aided the growth of the business.

Our model projects global Technology and Value-Added Services business revenues for the second quarter of 2023 to be $192.2 million, suggesting a year-over-year improvement of 6.2%.

Q2 Estimates

The Zacks Consensus Estimate for HSIC’s second quarter fiscal 2023 revenues is pegged at $3.11 billion. This suggests an increase of 2.7% from the year-ago reported figure.

The Zacks Consensus Estimate for its second-quarter 2023 EPS of $1.25 indicates a year-over-year rise of 7.8%

What Our Model Suggests

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), along with a positive Earnings ESP, has a higher chance of beating estimates, which is the case here.

Earnings ESP: Henry Schein has an Earnings ESP of +0.62%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Other Stocks Worth a Look

Here are some other medical stocks worth considering as these also have the right combination of elements to post an earnings beat this time:

Mckesson MCK has an Earnings ESP of +1.93% and a Zacks Rank #2. The company will release first-quarter fiscal 2024 results on Aug 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

MCK’s earnings surpassed estimates in three of the trailing four quarters and missed the same once, with the average surprise being 4.48%. The Zacks Consensus Estimate for Mckesson’s fiscal 2024 first-quarter EPS is expected to rise 0.5% from the year-ago reported figure.

Zimmer Biomet ZBH has an Earnings ESP of +2.34% and a Zacks Rank #2. The company is scheduled to release second-quarter 2023 results on Aug 1.

ZBH’s earnings surpassed estimates in all the trailing four quarters, with the average surprise being 7.38%. The Zacks Consensus Estimate for Zimmer Biomet’s second-quarter EPS is expected to be in line with the year-ago reported figure.

AmerisourceBergen ABC currently has an Earnings ESP of +0.59% and a Zacks Rank #2. ABC is scheduled to release third-quarter fiscal 2023 results on Aug 2.

The company’s earnings surpassed estimates in all the trailing four quarters, with the average surprise being 3.14%. The Zacks Consensus Estimate for ABC’s fiscal 2023 third-quarter EPS is expected to improve 5.6% from the year-ago reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report