Herbalife Ltd (HLF): A Comprehensive GF Score Analysis

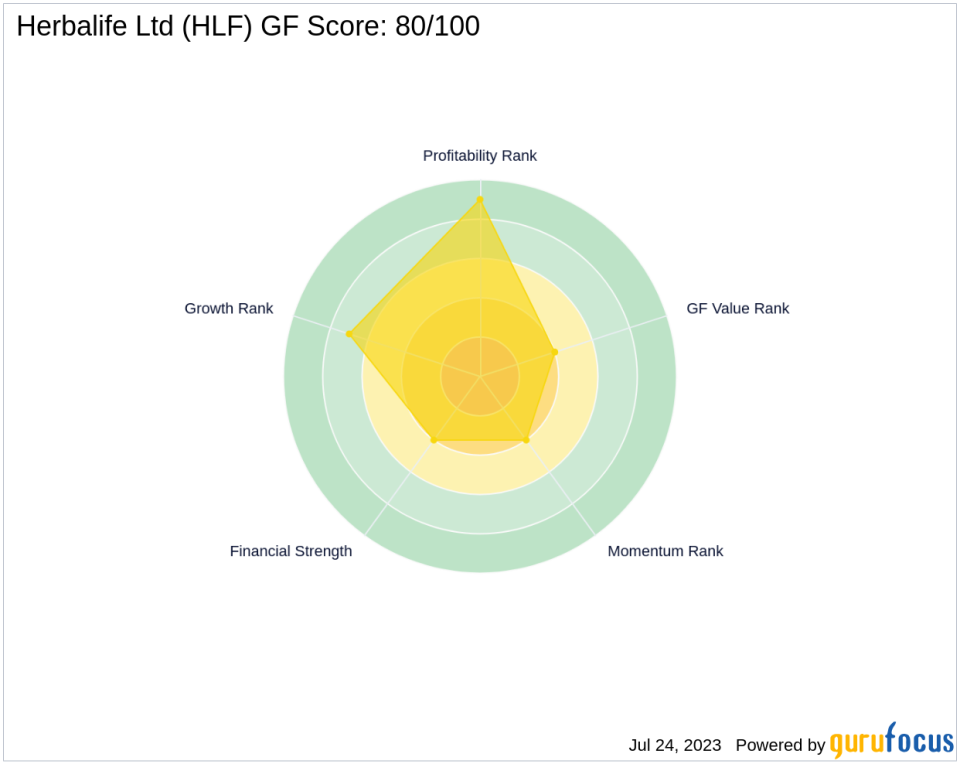

Herbalife Ltd (NYSE:HLF), a prominent player in the Consumer Packaged Goods industry, is currently trading at $15.37 with a market capitalization of $1.53 billion. The stock has seen a gain of 3.78% today and a significant increase of 20.35% over the past four weeks. In this article, we will delve into the company's GF Score of 80/100, which indicates a likelihood of average performance, and analyze its various components to provide a comprehensive understanding of the company's financial health and future prospects.

Financial Strength Analysis

Herbalife's Financial Strength Rank stands at 4/10. This score is derived from several factors, including the company's debt burden, debt to revenue ratio, and Altman Z-Score. Herbalife's interest coverage is 3.09, indicating its ability to cover interest expenses with its operating profit. The company's debt to revenue ratio is 0.56, suggesting a moderate level of debt relative to its revenue. The Altman Z-Score of 2.15 indicates that Herbalife is not in the distress zone, but there is room for improvement in its financial strength.

Profitability Rank Analysis

Herbalife's Profitability Rank is impressive at 9/10. The company's operating margin stands at 9.03%, and its Piotroski F-Score is 5, indicating a stable financial situation. However, the trend of the Operating Margin over the past five years shows a decrease of 4.80%. Despite this, the company has consistently been profitable over the past ten years, earning it a Predictability Rank of 3.5.

Growth Rank Analysis

The company's Growth Rank is 7/10, indicating a strong growth trajectory. Herbalife has demonstrated a 5-year revenue growth rate of 15.40% and a 3-year revenue growth rate of 14.90%. The 5-year EBITDA growth rate is also robust at 10.70%, suggesting that the company's business operations are expanding.

GF Value Rank Analysis

Herbalife's GF Value Rank is 4/10, indicating that the stock is fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth and future estimates of the business' performance.

Momentum Rank Analysis

The company's Momentum Rank is 4/10, suggesting that the stock's momentum is relatively weak. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its main competitors, Herbalife's GF Score of 80/100 is higher than Utz Brands Inc (GF Score: 59) and BRC Inc (GF Score: 21), but slightly lower than Usana Health Sciences Inc (GF Score: 83). This suggests that Herbalife is performing well within its industry, but there is still room for improvement.

In conclusion, Herbalife Ltd (NYSE:HLF) presents a mixed picture with strong profitability and growth but moderate financial strength and momentum. Investors should consider these factors in their decision-making process.

This article first appeared on GuruFocus.