Herbalife Ltd (HLF) Reports Mixed Results for Q4 and Full-Year 2023

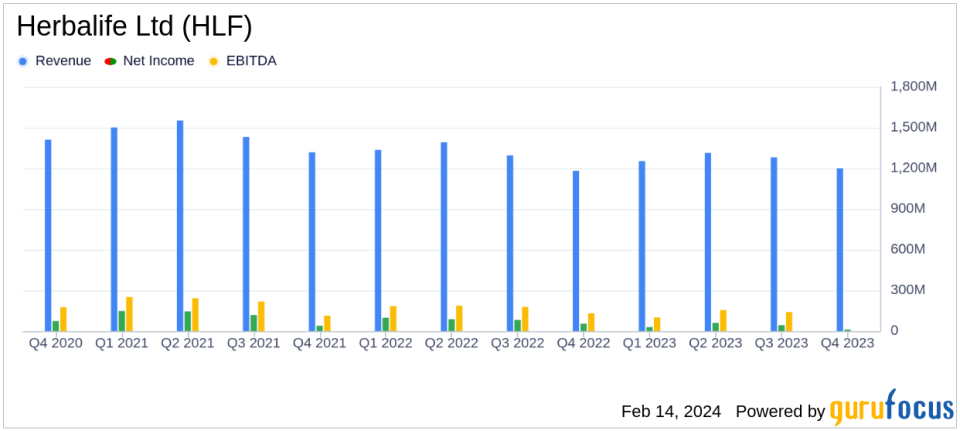

Net Sales: Q4 net sales increased by 2.9% year-over-year to $1.2 billion, while full-year net sales declined by 2.7% to $5.1 billion.

Net Income: Q4 net income was $10.2 million, a decrease from the same quarter last year. Full-year net income totaled $142.2 million.

Earnings Per Share (EPS): Q4 diluted EPS was $0.10, and adjusted diluted EPS was $0.28. Full-year diluted EPS was $1.42, with adjusted diluted EPS of $2.21.

Adjusted EBITDA: Q4 adjusted EBITDA reached $108.8 million, with a margin of 9.0%. Full-year adjusted EBITDA was $570.6 million, with a margin of 11.3%.

Free Cash Flow: Herbalife reported a free cash flow of $222.5 million for the full year.

Cost Savings: The company achieved approximately $70 million in cost savings in 2023 through its Transformation Program.

Capital Expenditures: For the year ended December 31, 2023, capital expenditures were approximately $135 million, with an expected increase for 2024.

On February 14, 2024, Herbalife Ltd (NYSE:HLF) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, known for its health and wellness products sold in over 90 markets, experienced a year-over-year net sales growth in the fourth quarter but saw a decline over the full year. Herbalife's direct-selling business model and product range, which includes weight management and nutrition products, faced challenges amidst a complex economic environment.

Financial Performance Overview

Herbalife's fourth quarter net sales rose to $1.2 billion, a 2.9% increase compared to the fourth quarter of 2022. This marks the fourth consecutive quarter of improved year-over-year net sales trends. However, the full-year net sales saw a decrease of 2.7% to $5.1 billion. The company's net income for the fourth quarter was $10.2 million, with a diluted EPS of $0.10 and an adjusted diluted EPS of $0.28. For the full year, net income stood at $142.2 million, with a diluted EPS of $1.42 and an adjusted diluted EPS of $2.21.

Herbalife's adjusted EBITDA for the fourth quarter was $108.8 million, while the full-year adjusted EBITDA reached $570.6 million. The adjusted EBITDA margin for the year was 11.3%. The company also reported a net cash provided by operating activities of $357.5 million and a free cash flow of $222.5 million for the full year.

Strategic and Operational Highlights

Herbalife's management highlighted the company's focus on top-line growth and margin expansion. The company's Transformation Program, initiated in 2021, delivered approximately $70 million of cost savings in 2023, with expectations to deliver total program run rate savings of at least $115 million in 2024 and beyond. The company also continued the rollout of its all-new Herbalife.com website, now live in markets representing approximately 70% of the company's sales.

Herbalife's capital expenditures for the year, including spending related to the Herbalife One digital technology platform, were approximately $135 million. The company expects to incur total capital expenditures of approximately $145 million to $195 million for the full year of 2024.

The company also reported a full return to in-person events, which have been positively received by distributors. The distributor sales leader retention rate improved slightly year-over-year, indicating a positive trend in engagement.

Regional Performance and Future Outlook

Regionally, Asia Pacific showed the strongest growth in net sales, while North America experienced a decline. The company is also in the process of refinancing its 2018 Term Loan A and 2018 Revolving Credit Facility, due in March 2025.

Herbalife's management remains committed to enhancing productivity and driving top-line growth, expanding margins, and securing the balance sheet. The company's strategic actions, including the expansion of its Transformation Program and the launch of innovative products, are aimed at optimizing cost structure and strengthening the financial position.

For more detailed information on Herbalife Ltd (NYSE:HLF)'s financial performance, please refer to the full 8-K filing.

Investors and interested parties can access the earnings webcast and conference call replay on the Investor Relations section of Herbalife's website, where additional financial and operational information is also available.

Explore the complete 8-K earnings release (here) from Herbalife Ltd for further details.

This article first appeared on GuruFocus.