Herbalife Ltd's Meteoric Rise: Unpacking the 32% Surge in Just 3 Months

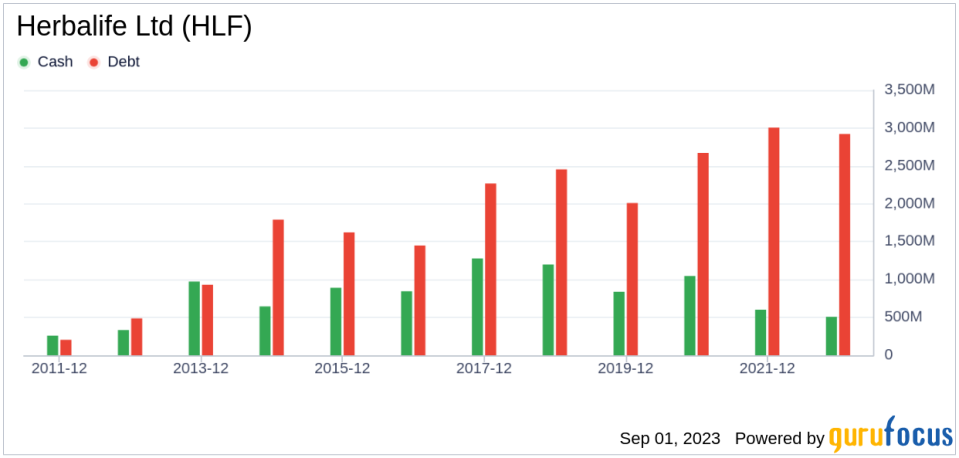

Herbalife Ltd (NYSE:HLF), a prominent player in the Consumer Packaged Goods industry, has been making waves in the stock market with its impressive performance. The company's stock price has seen a significant gain of 1.49% over the past week and a remarkable 31.82% surge over the past three months. Currently, the company boasts a market cap of $1.55 billion and a stock price of $15.62. Despite this upward trend, the company's GF Value stands at $37.31, down from $45.09 three months ago, indicating that the stock is significantly undervalued. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates.

Company Overview: Herbalife Ltd

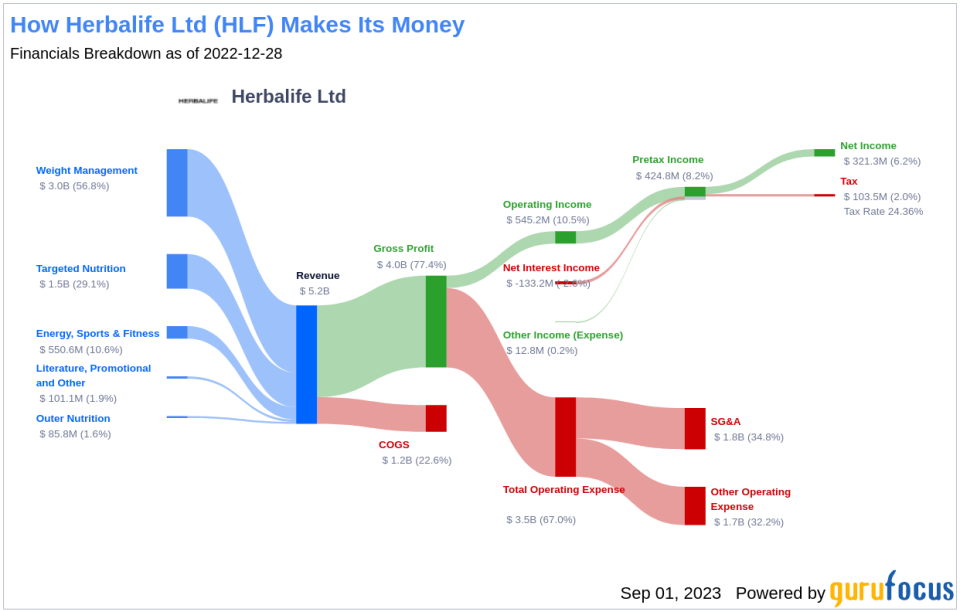

Herbalife Ltd is a global nutrition company that provides health and wellness products to consumers in 95 markets through a direct-selling business model. The company's product portfolio includes weight management products, targeted nutrition, energy, sports and fitness, outer nutrition, and literature, promotional, and other products. Geographically, the company operates in several segments, including North America, Mexico, South and Central America, EMEA, Asia-Pacific, and China.

Profitability Analysis

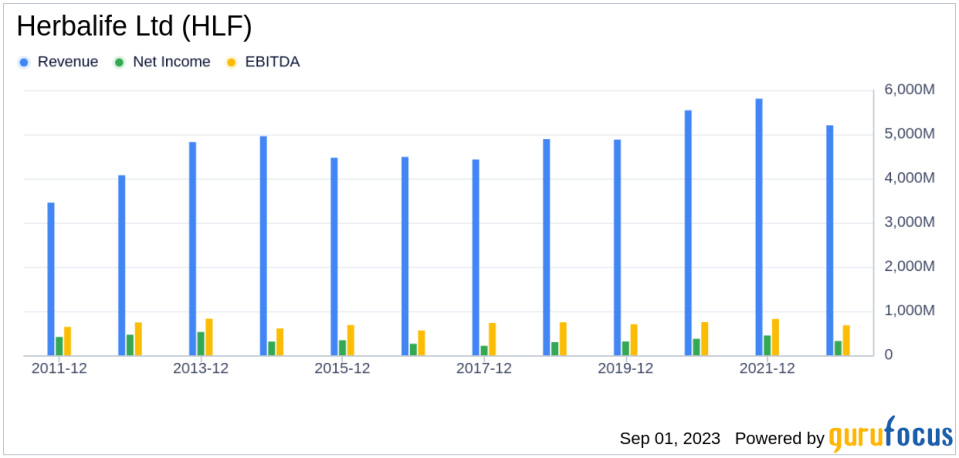

Herbalife Ltd's profitability is impressive, with a Profitability Rank of 9/10, indicating a high level of profitability. The company's Operating Margin stands at 8.53%, better than 67.84% of companies in the same industry. Furthermore, the company's ROE, ROA, and ROIC are all significantly higher than the industry average. Herbalife Ltd has also demonstrated consistent profitability over the past 10 years, further solidifying its financial strength.

Growth Prospects

Herbalife Ltd also shows strong growth potential, with a Growth Rank of 8/10. The company's 3-year and 5-year revenue growth rates per share are 14.90% and 15.40% respectively, outperforming 73.95% and 84.21% of companies in the same industry. Additionally, the company's 3-year and 5-year EPS without NRI growth rates stand at 13.70% and 22.20% respectively, indicating a promising future.

Top Holders of Herbalife Ltd Stock

Herbalife Ltd's stock is held by several prominent investors. Jim Simons (Trades, Portfolio) holds the largest number of shares, with 6,392,864 shares, accounting for 6.46% of the company's stock. Seth Klarman (Trades, Portfolio) holds 1,954,200 shares, representing 1.97% of the company's stock, while First Pacific Advisors (Trades, Portfolio) holds 1,839,085 shares, accounting for 1.86% of the company's stock.

Competitive Landscape

Herbalife Ltd faces competition from several companies in the Consumer Packaged Goods industry. Usana Health Sciences Inc (NYSE:USNA) has a market cap of $1.26 billion, Utz Brands Inc (NYSE:UTZ) has a market cap of $1.24 billion, and John B Sanfilippo & Son Inc (NASDAQ:JBSS) has a market cap of $1.17 billion. Despite the competition, Herbalife Ltd's recent performance and growth prospects position it favorably in the market.

Conclusion

In conclusion, Herbalife Ltd's impressive stock performance, high profitability, strong growth potential, and significant holdings by top investors make it a compelling option for investors. Despite facing competition in the Consumer Packaged Goods industry, the company's consistent profitability and growth prospects indicate a promising future. However, investors should note that the stock is currently significantly undervalued, suggesting potential for further gains.

This article first appeared on GuruFocus.