Herc Holdings Inc. Reports Mixed Results for Q4 and Full Year 2023

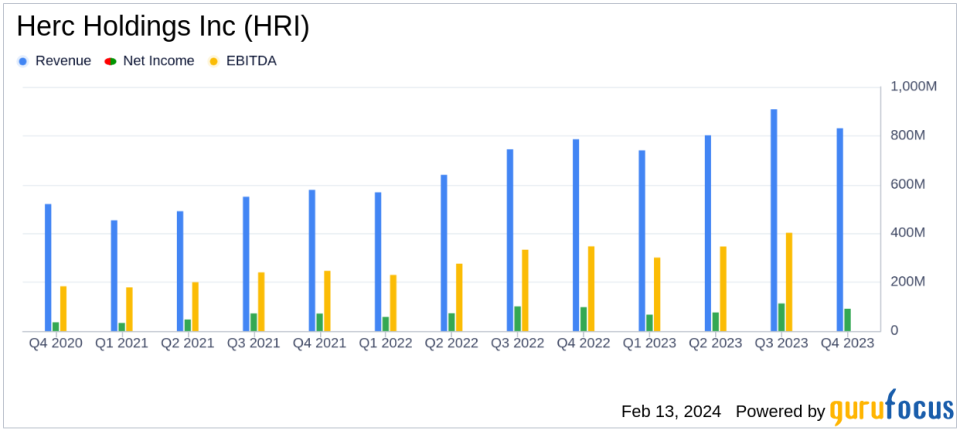

Q4 Total Revenues: Increased by 6% to $831 million.

Q4 Net Income: Decreased by 7% to $91 million, or $3.20 per diluted share.

Full Year Revenues: Grew by 20% to $3,282 million.

Full Year Net Income: Rose by 5% to $347 million, or $12.09 per diluted share.

Adjusted EBITDA: Increased by 18% to $1,452 million for the full year.

2024 Outlook: Expects 7% to 10% equipment rental revenue growth and adjusted EBITDA of $1.55 billion to $1.60 billion.

On February 13, 2024, Herc Holdings Inc (NYSE:HRI) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading equipment rental firm in North America, reported mixed results with record total revenues for both the quarter and the year, while facing a decline in net income for the fourth quarter.

Company Overview

Herc Holdings, a company spun out of Hertz Global in 2016, is the third-largest equipment rental company in North America, holding a 4% market share. With a fleet size valued at $6.2 billion, Herc Holdings serves a diverse range of sectors, including construction, environmental, industrial, and entertainment. Over its 50-year history, the company has expanded its offerings to include specialty items and long-term rentals, particularly for industrial customers.

Financial Performance and Challenges

The fourth quarter saw Herc Holdings achieve a 6% increase in total revenues, reaching $831 million, driven by a 5.8% year-over-year increase in rental pricing and a 9.4% increase in volume. However, net income for the quarter decreased by 7% to $91 million, or $3.20 per diluted share, impacted by a decline in the studio entertainment business and higher interest expenses. Adjusted EBITDA for the quarter grew by 6% to $382 million, maintaining a margin of 46.0%.

For the full year, Herc Holdings reported a 20% increase in total revenues to $3,282 million, with net income rising by 5% to $347 million, or $12.09 per diluted share. The adjusted EBITDA for the year increased by 18% to $1,452 million, though the adjusted EBITDA margin slightly decreased to 44.2% from 44.8% in the prior year. The company's performance reflects its ability to manage inflationary pressures and maintain cost discipline while investing in growth.

Financial Achievements and Importance

The company's financial achievements, particularly the growth in revenues and adjusted EBITDA, underscore its competitive position in the Business Services industry. Herc Holdings' focus on rental pricing strategies and expansion through mergers and acquisitions (M&A) and greenfield openings has contributed to its revenue growth. The company added 42 new locations in 2023 through these initiatives.

Moreover, Herc Holdings' disciplined capital management is evident in its share repurchase program, with approximately 1.1 million shares bought back in 2023, and a 5% increase in its quarterly dividend to $0.665 per share.

Key Financial Metrics

Important metrics from the financial statements include:

"Dollar utilization was 40.9% compared to 43.5% in the prior-year period... Direct operating expenses were $287 million, or 38.4% of equipment rental revenue... Net debt was $3.6 billion as of December 31, 2023, with net leverage of 2.5x compared to 2.4x in the same prior-year period."

These metrics are crucial as they provide insights into the company's operational efficiency, cost management, and financial leverage.

2024 Outlook and Analysis

Looking ahead to 2024, Herc Holdings expects to deliver 7-10% organic rental-revenue growth and 6-9% higher adjusted EBITDA year over year. The company's guidance excludes its Cinelease studio entertainment business, which is currently being held for sale. This outlook reflects the company's confidence in its strategic priorities and its ability to capitalize on forecasted higher construction spending.

In conclusion, Herc Holdings Inc's mixed financial results for the fourth quarter of 2023 highlight the company's resilience in a challenging environment. With a strong revenue performance and strategic growth initiatives, Herc Holdings is poised to continue its trajectory of value creation for its stakeholders.

Explore the complete 8-K earnings release (here) from Herc Holdings Inc for further details.

This article first appeared on GuruFocus.