Here's How Booz Allen (BAH) Gains 19.7% in the Past 6 Months

Booz Allen Hamilton Holding Corp. BAH has gained 19.7% in the past six months, outperforming 9.2% and 5.1% growth of the industry and S&P 500 composite, respectively.

Reasons Behind the Rally

Booz Allen's Vision 2020 strategy, geared toward sustainable expansion, has led to substantial growth in headcount and backlog. By aligning closely with clients' core missions, enhancing technical work, diversifying talent, fostering innovation and forming strategic partnerships, the company has seen rapid organic revenue growth and improved profitability.

Booz Allen strategically developed its solutions business to create unique business models and sales channels, bolster client acquisition and expand future revenue opportunities. It also set itself apart in the talent market, ensuring the attraction and retention of high-quality professionals from diverse backgrounds. These initiatives have greatly enhanced its capacity to secure technically advanced and mission-critical projects within the federal government sector, ensuring long-term sustainable growth.

BAH is prioritizing innovation in artificial intelligence, advanced engineering, directed energy and digital platforms. This focus aims to create new business models, improve service quality and boost client satisfaction, ultimately leading to substantial revenue growth.

Booz Allen enjoys a vast market, catering to the technology and consulting needs of the government, one of the world's largest consumers. Additionally, the U.S. intelligence agencies provide another substantial market. The company also sees significant potential for growth in global commercial markets where it has limited presence.

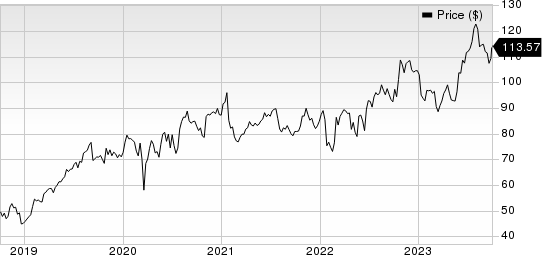

Booz Allen Hamilton Holding Corporation Price

Booz Allen Hamilton Holding Corporation price | Booz Allen Hamilton Holding Corporation Quote

Zacks Rank & Stocks to Consider

BAH currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Business Services sector:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the last four quarters and matched on one instance, with an average surprise of 9.9% The consensus mark for 2023 revenues is pegged at $2.66 billion, suggesting a decrease of 8.2% from the year-ago figure. The consensus estimate for 2023 earnings is pegged at $5.71 per share, indicating 14% rise from the year-ago figure. VRSK currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP currently has a Zacks Rank of 2. It outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 6.3% and 11.1%, respectively.

Broadridge BR currently carries a Zacks Rank of 2. It surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average surprise being 0.5%. The consensus estimate for fiscal 2024 revenues and earnings predicts jumps of 7.2% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report