Here's How Booz Allen (BAH) Increased 16% in the Past 6 Months

Booz Allen Hamilton Holding Corporation BAH has had an impressive run on the bourse over the past six months. The stock gained 15.6%, outperforming 11.1% of the industry it belongs to and 8.2% growth of the Zacks S&P 500 composite. It has a long-term expected earnings per share growth rate of 12%.

The Zacks Consensus Estimate of BAH’s revenues for the fiscal second quarter is pegged at $2.53 billion, indicating 11.1% growth from the year-ago reported figure. The estimate for earnings is $1.13 per share, which is up 5.6% from the year-ago reported figure. The consensus mark for fiscal 2024 revenues indicates a 13% increase while earnings are expected to grow 10.1%.

Factors Moving the Stock

Booz Allen's Vision 2020 served as a transformative strategy aimed at fostering sustainable growth. This strategy emphasized aligning with clients' core missions, enhancing the technical depth of projects, attracting and retaining diverse talent, fostering innovation, building an extensive network of external partnerships, and expanding into commercial and international markets. The execution of this strategy has expedited the company's organic revenue growth, bolstered its profitability, and resulted in substantial increases in headcount and backlog.

The company is concentrating on key areas like artificial intelligence, advanced engineering, directed energy and modern digital platforms to foster innovation. It is constructing the mechanics and infrastructure for novel and groundbreaking business models to elevate service quality and meet client expectations. The transformative solutions emerging from these initiatives are anticipated to substantially boost the company's future revenue prospects.

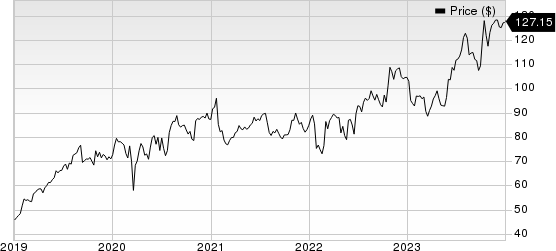

Booz Allen Hamilton Holding Corporation Price

Booz Allen Hamilton Holding Corporation price | Booz Allen Hamilton Holding Corporation Quote

Booz Allen strategically evolved its solutions business, crafting distinctive business models and sales channels to augment client acquisition and future revenue potential. The company also set itself apart in the talent market, ensuring the attraction and retention of high-quality professionals from diverse fields. These endeavors bolstered its capability to secure technically complex, mission-critical projects in the federal government sector, thus ensuring sustained long-term growth.

BAH holds a current Zacks Rank #3 (Hold).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector:

Gartner IT: The Zacks Consensus Estimate for Gartner’s 2023 revenues indicates 7.9% growth from the year-ago reported figure, while earnings are expected to decline 1.9%. The company has beaten the consensus estimate in each of the four quarters, with an average surprise of 34.4%.

IT currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DocuSign DOCU: The Zacks Consensus Estimate for DocuSign’s 2023 revenues indicates 9.2% growth from the year-ago reported figure, while earnings are expected to grow 41.4%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

DOCU presently flaunts a Zacks Rank of 1.

Broadridge Financial Solutions BR: The Zacks Consensus Estimate for Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago reported figure, while earnings are expected to grow 10.1%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR currently has a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report