Here's How Energizer (ENR) Is Placed Ahead of Q4 Earnings

Energizer Holdings, Inc. ENR is likely to witness top-and bottom-line growth when it reports fourth-quarter fiscal 2023 numbers on Nov 14, before the opening bell. The Zacks Consensus Estimate for revenues is pegged at $790.8 million, which suggests a marginal increase from the prior-year quarter’s reported figure.

The consensus mark for earnings is pinned at $1.14 per share, which has declined by a penny in the past 30 days. However, this indicates a jump of 39% from the figure reported in the prior-year quarter. The company’s bottom line missed the Zacks Consensus Estimate by 18.2% in the last reported quarter. It has a trailing four-quarter earnings surprise of 3.5%, on average.

Key Factors to Note

Energizer has been experiencing soft consumer demand stemming from a high inflationary environment, which might have affected its fiscal fourth-quarter results. The slowdown in the U.S. housing market is also expected to have affected the company’s performance in the to-be-reported quarter.

The company has been witnessing weakness across its battery and auto care businesses. The company exited certain low-margin profile battery customers and products, which is expected to adversely impact its organic sales in the fourth quarter of fiscal 2023.

For fiscal 2023, management expects low single-digit declines in organic revenues. We expect revenues from the company’s Batteries segment to decline by 4.1% to $2,327.8 million in fiscal 2023. The same for the Auto care segment is pegged at $610.1 million, suggesting a year-over-year decline of 2%.

Supply chain issues, higher labor and energy costs and geopolitical tensions are some other headwinds Energizer might have encountered during the fiscal fourth quarter. Given the company’s extensive geographic presence, a stronger U.S. dollar might have also hurt its overseas business in the quarter. It’s worth noting that the company experienced $48 million in currency headwinds in the first three quarters of fiscal 2023.

That said, the company’s efforts to drive productivity through improvement initiatives and optimization of its manufacturing footprint might have been proven beneficial. Energizer anticipates organic revenues to be roughly flat in the fourth quarter of fiscal 2023, with a solid gross margin expansion. For the quarter, it expects a gross margin of about 40%, in line with our estimate. The metric suggests a year-over-year increase of 200 basis points, backed by incremental Project Momentum savings.

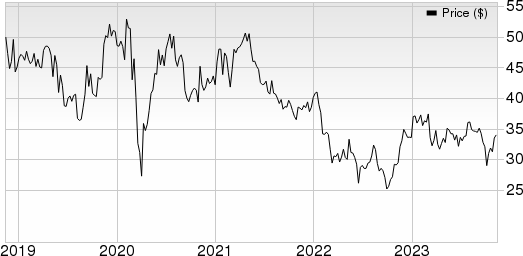

Energizer Holdings, Inc. Price and EPS Surprise

Energizer Holdings, Inc. price-eps-surprise | Energizer Holdings, Inc. Quote

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Energizer this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Energizer carries a Zacks Rank #4 (Sell) and has an Earnings ESP of -2.85%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are some companies that, according to our model, have the right combination of elements to post an earnings beat in the to-be-reported quarter.

Ollie's Bargain Outlet OLLI currently has an Earnings ESP of +3.75% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company is likely to register top-and-bottom-line growth when it reports third-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for Ollie's Bargain’s quarterly revenues is pegged at $468.8 million, indicating an increase of 12.1% from the figure reported in the prior-year quarter. The Zacks Consensus Estimate for Ollie's Bargain’s quarterly earnings per share of 43 cents suggests growth of 16.2% from the year-ago quarter’s levels. OLLI has a trailing four-quarter earnings surprise of 1.3%, on average.

The J. M. Smucker Co. SJM currently has an Earnings ESP of +0.27% and carries a Zacks Rank #3. The company is expected to register a bottom-line increase when it reports second-quarter fiscal 2024 results. The Zacks Consensus Estimate for earnings is pinned at $2.47 per share, indicating growth of 2.9% from the year-ago quarter’s reported number.

The company’s revenues are anticipated to have decreased year over year. The consensus mark for the same is pegged at $2 billion, indicating a fall of 11.3% from that reported in the year-ago quarter. SJM has a trailing four-quarter average earnings surprise of 7.3%.

Danimer Scientific DNMR has an Earnings ESP of +2.94% and a Zacks Rank #2. The company’s revenues are anticipated to have increased year over year. The consensus mark for the same is pegged at $14.3 million, indicating a rise of 36.8% from that reported in the year-ago quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Energizer Holdings, Inc. (ENR) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Danimer Scientific, Inc. (DNMR) : Free Stock Analysis Report